Just because a business does not make any money, does not mean that the stock will go down. By way of example, Optizen Labs (WSE:OPT) has seen its share price rise 146% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Optizen Labs's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Optizen Labs

Does Optizen Labs Have A Long Cash Runway?

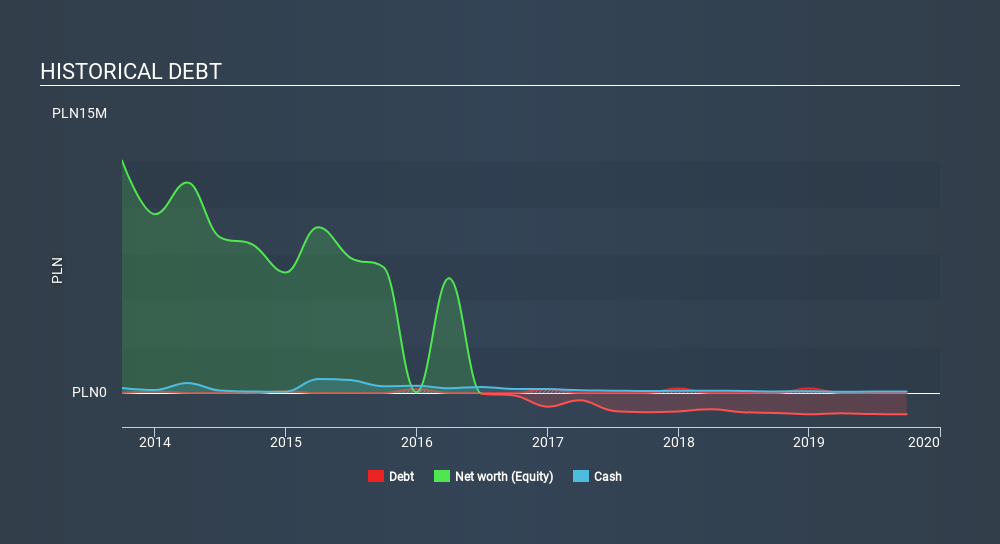

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Optizen Labs last reported its balance sheet in September 2019, it had zero debt and cash worth zł81k. In the last year, its cash burn was zł13k. That means it had a cash runway of about 6.4 years as of September 2019. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Is Optizen Labs's Cash Burn Changing Over Time?

Whilst it's great to see that Optizen Labs has already begun generating revenue from operations, last year it only produced zł1.1m, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. From a cash flow perspective, it's great to see the company's cash burn dropped by 93% over the last year. That might not be promising when it comes to business development, but it's good for the companies cash preservation. Admittedly, we're a bit cautious of Optizen Labs due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Optizen Labs To Raise More Cash For Growth?

There's no doubt Optizen Labs's rapidly reducing cash burn brings comfort, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash to drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of zł2.6m, Optizen Labs's zł13k in cash burn equates to about 0.5% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Optizen Labs's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Optizen Labs is burning through its cash. For example, we think its cash burn reduction suggests that the company is on a good path. But it's fair to say that its cash burn relative to its market cap was also very reassuring. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash. While we always like to monitor cash burn for early stage companies, qualitative factors such as the CEO pay can also shed light on the situation. Click here to see free what the Optizen Labs CEO is paid..

Of course Optizen Labs may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:FTL

Medium-low with weak fundamentals.

Market Insights

Community Narratives