- Singapore

- /

- Transportation

- /

- SGX:C52

ComfortDelGro Corporation Limited Just Missed EPS By 9.6%: Here's What Analysts Think Will Happen Next

ComfortDelGro Corporation Limited (SGX:C52) shares fell 3.7% to S$2.09 in the week since its latest yearly results. It looks like the results were a bit of a negative overall. While revenues of S$3.9b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 9.6% to hit S$0.12 per share. Earnings are an important time for investors, as they can track a company's performance, look at what top analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for ComfortDelGro

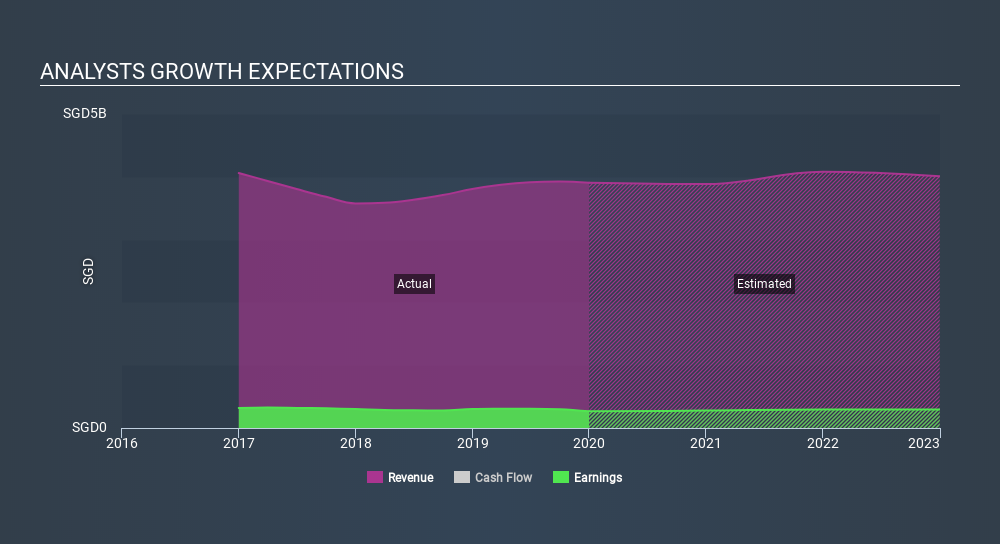

Taking into account the latest results, ComfortDelGro's twelve analysts currently expect revenues in 2020 to be S$3.88b, approximately in line with the last 12 months. Statutory earnings per share are expected to increase 4.6% to S$0.13. In the lead-up to this report, analysts had been modelling revenues of S$4.04b and earnings per share (EPS) of S$0.14 in 2020. Analysts are less bullish than they were before these results, given the reduced revenue forecasts and the minor downgrade to earnings per share expectations.

Despite the cuts to forecast earnings, there was no real change to the S$2.43 price target, showing that analysts don't think the changes have a meaningful impact on the stock's intrinsic value. The consensus price target just an average of individual analyst targets, so - considering that the price target changed, it would be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values ComfortDelGro at S$2.81 per share, while the most bearish prices it at S$2.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await ComfortDelGro shareholders.

It can be useful to take a broader overview by seeing how analyst forecasts compare, both to the ComfortDelGro's past performance and to peers in the same market. Over the past five years, revenues have declined around 1.9% annually. On the bright side, analysts expect the decline to level off somewhat, with the forecast for a 0.6% decline in revenue next year. By contrast, our data suggests that other companies (with analyst coverage) in the market are forecast to see their revenue decline 3.3% per year. So while it's not great to see that analysts are expecting a decline, at least ComfortDelGro is forecast to shrink at a slower rate than the wider market.

The Bottom Line

The most important thing to take away is that analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, analysts also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider market. Even so, earnings per share are more important to the intrinsic value of the business. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for ComfortDelGro going out to 2022, and you can see them free on our platform here..

We also provide an overview of the ComfortDelGro Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:C52

ComfortDelGro

Provides public transportation services in Singapore, the United Kingdom, Australia, China, and Malaysia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives