- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (CMCSA) Invests Nearly US$600 Million Expanding Fiber Network In Indiana

Reviewed by Simply Wall St

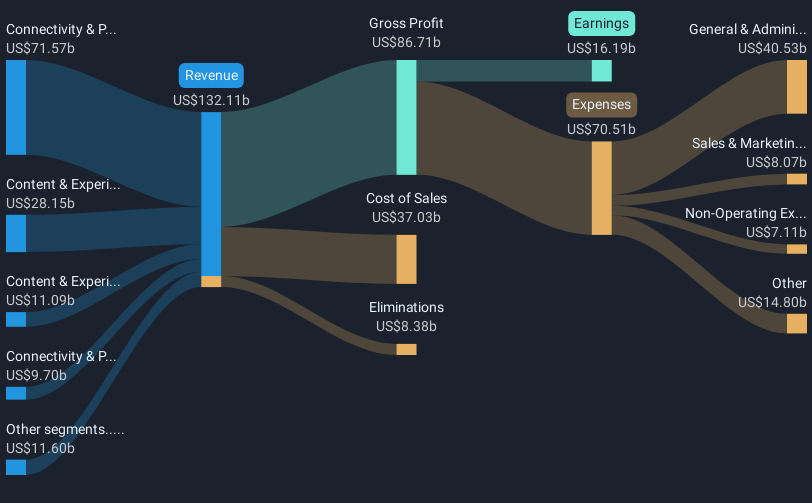

Comcast (CMCSA) recently announced the completion of its next-generation fiber network in Indiana, marking a significant move in its business expansion strategy and partnership with state programs. Despite these advances and a robust approach to community engagement, the company's share price fell by 4.01% over the last quarter. Market trends during the period showed broad strength, with indexes like the S&P 500 and Nasdaq reaching record highs. The company's network achievements and community initiatives are impactful, but broader market trends of rising investor interest in major technology stocks could have overshadowed individual gains.

The completion of Comcast's next-generation fiber network in Indiana may bolster long-term revenue potential, aligning with their strategic investments in broadband expansion. However, increased competitive intensity in the broadband and wireless segments may offset some benefits, challenging revenue and profit growth. Over a longer three-year period, Comcast’s total shareholder return, including dividends, was a 4.29% decline, amidst a backdrop of evolving market dynamics.

While recent market activity saw Comcast shares dip by 4.01% over the last quarter, broader indices like the S&P 500 and Nasdaq hit record highs. In the past year, Comcast underperformed the US Market, which achieved a 17.5% return, providing context for its need to address both industry challenges and investor expectations. The company's current share price of US$32.83 represents a 21.81% discount to the consensus analyst price target of US$39.99, suggesting potential for recovery as it navigates these operational complexities.

Looking ahead, the newly announced fiber network could present revenue opportunities, yet competition may exert pressure, potentially hindering earnings growth in the short term. The bearish analyst cohort forecasts Comcast's revenue to decrease incrementally over the next three years, leading to expected earnings of US$12.8 billion by 2028 from the current US$15.71 billion. Maintaining the balance between improving network infrastructure and managing competitive threats will be crucial for Comcast as it seeks to align its valuation with market expectations.

Click to explore a detailed breakdown of our findings in Comcast's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives