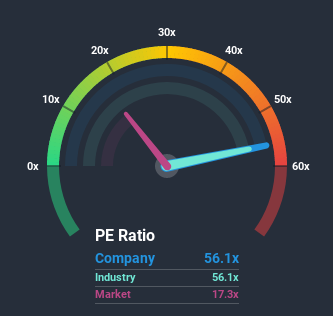

With a price-to-earnings (or "P/E") ratio of 56.1x Coloplast A/S (CPH:COLO B) may be sending very bearish signals at the moment, given that almost half of all companies in Denmark have P/E ratios under 17x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Coloplast's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Coloplast

How Is Coloplast's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Coloplast's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 22% overall rise in EPS. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 17% per annum growth forecast for the broader market.

With this information, we find it concerning that Coloplast is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Coloplast's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Coloplast's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Coloplast with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Coloplast. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you’re looking to trade Coloplast, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CPSE:COLO B

Coloplast

Engages in the development and sale of intimate healthcare products and services in Denmark, the United States, the United Kingdom, France, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion

AMC will prove to be BBBY 2.0 before it's all done. Life has become too expensive for people (especially those with children) to afford movie theater experiences regularly. If you add for the even higher ticket prices of "specialty" theaters with the luxury seating and XL/3D screens, it becomes even MORE unaffordable. This becomes just plain comical when additionally factoring in the unreasonably high priced snacks & drinks. The average family has been priced out of "movie nights". More and more people have instead, saved up to buy ever larger TVs, (which have become much more affordable in resent years) in order to stretch their money and remain on budget throughout their movie watching. With a substantially larger TV, it feels a bit more similar to the "big screen" experience of a movie theater. As time goes on, the theater ONLY experience will be reserved for those special releases that have been anxiously waited on and are expected to be EXTREME and INTENSE! The mere lack of affordability will make movie going, a growingly rare occasion for an increasing number of people. Although the theater is a favorite pastime, facts ARE facts. This particular source of entertainment, has become too budget busting, year over year for the average consumer. I, quite frankly, see this problem only growing worse in the future.