- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (NasdaqGS:CTAS) Removed From Three Russell Value Indexes

Reviewed by Simply Wall St

Cintas (NasdaqGS:CTAS) recently experienced significant index removals from the Russell 3000 Value Index, the Russell 1000 Value Index, and others, marking key shifts in market perception. Despite a 6% price increase over the last quarter, mirroring broader market trends, recent dividend affirmations and executive changes seemingly added stability amid these index exclusion pressures. The S&P 500 and Nasdaq reaching new highs likely provided additional support to Cintas's stock performance. Therefore, while index removals posed potential challenges, the overall bullish market sentiment may have helped counterbalance any negative impacts on Cintas’s returns.

Be aware that Cintas is showing 1 risk in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent index removals may influence Cintas’s narrative by shifting investor focus toward its operational strategies and technology investments as drivers of long-term growth. Despite these changes, Cintas has shown resilience with a remarkable total return of approximately 239.87% over the past five years, indicating robust long-term performance. This return is noteworthy against its recent one-year return, which surpassed the US Commercial Services industry’s 10.8% return. Such performance highlights Cintas's ability to outperform its peers in a competitive market.

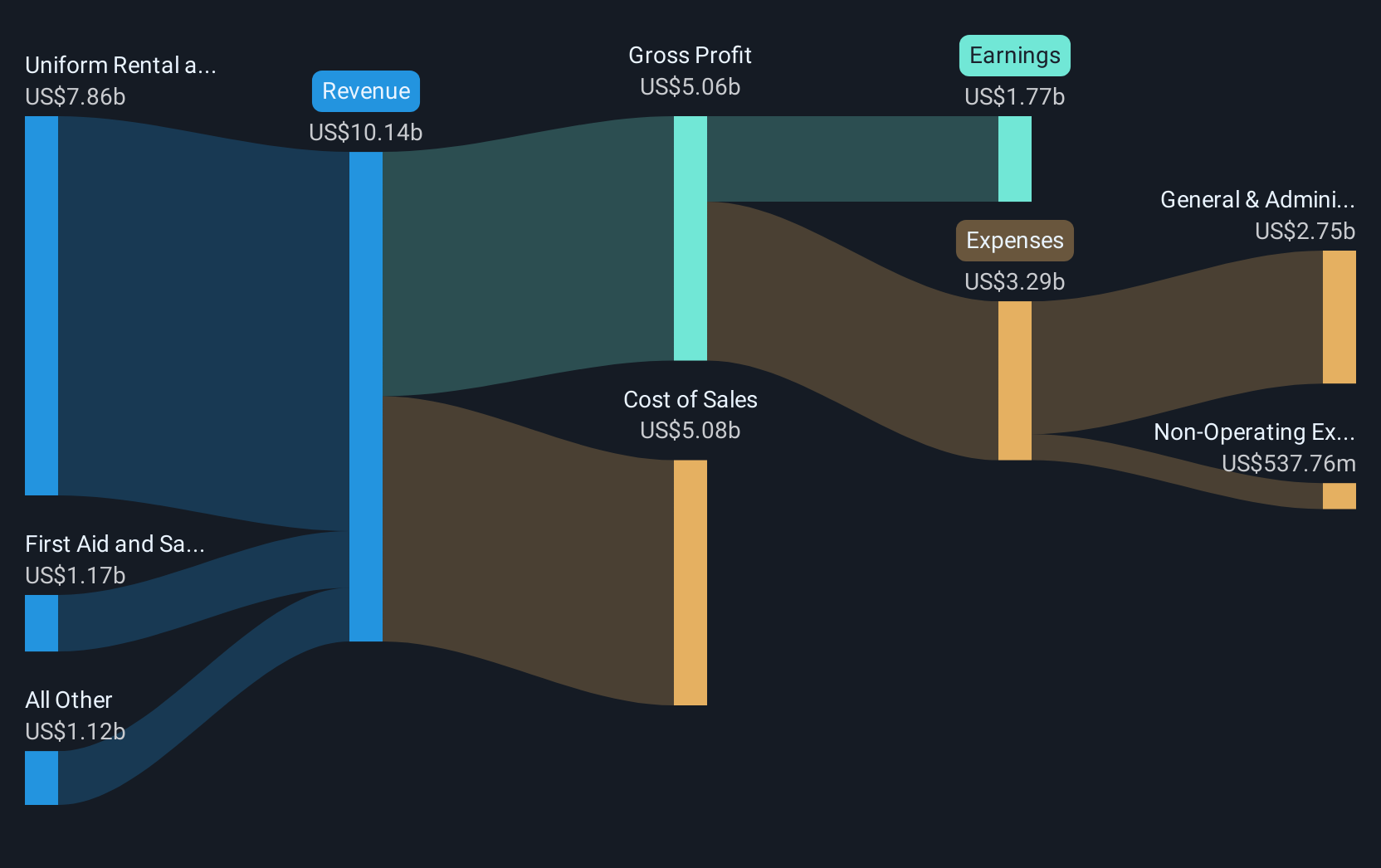

The longer-term returns underpin investor confidence, but index removals could potentially pose short-term challenges in market visibility and institutional interest. Meanwhile, the company's revenue and earnings forecasts remain optimistic due to ongoing efficiency improvements and technology enhancements. Analysts anticipate a revenue increase of 7.1% annually over the next three years, with profit margins expected to rise from 17.5% to 18.5% by 2028. Cintas’s innovative initiatives, such as SmartTruck and the SAP system, are integral to these expectations, though disruptions like foreign exchange fluctuations and tariffs could pose risks.

Currently, Cintas shares are trading at US$213.31, slightly above the consensus analyst price target of US$211.10, implying a small 1.8% discount from the target. This close pricing proximity suggests that analysts view Cintas as fairly priced, balancing its growth prospects with existing market pressures. Investors should consider how these elements interplay with their own expectations to form a complete picture of Cintas’s potential trajectory.

Assess Cintas' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives