- United States

- /

- Healthcare Services

- /

- NYSE:CI

Cigna Group (CI) Reports Q2 Revenue Surge To US$67,178 Million, Net Income Flat

Reviewed by Simply Wall St

Cigna Group (CI) reported their Q2 and H1 2025 earnings, highlighting significant growth in both sales and revenue year-over-year, although Q2 net income saw a slight dip. Over the past week, Cigna's stock experienced a 2% decline, possibly impacted by the mixed earnings results. Despite strong earnings from other companies like Microsoft and Meta boosting the tech-heavy indices, Cigna's performance diverged from the broader market's flat trend. The market's general resilience, supported by strong corporate earnings, dominated sentiment, with Cigna's financial results perhaps exerting a more company-specific influence on its recent share price movement.

You should learn about the 1 weakness we've spotted with Cigna Group.

The recent dip in Cigna Group's share price following their earnings report may influence the market's perception of the company's ongoing operations and future growth potential. While the Q2 net income decline introduces some concerns, the company demonstrated significant revenue and sales growth, suggesting operational strengths that support the narrative of enhanced efficiency and expansion through initiatives like Evernorth Care. Such strategic improvements, if sustained, could boost future revenues and margins, though the initial investor response reflects caution.

Over the longer term, Cigna's shares have delivered an 84.22% total return over the past five years. This performance reflects the company's ability to weather past challenges and capitalize on growth opportunities. Comparing the past year's performance, Cigna exceeded the US Healthcare industry, which had a negative return, though it lagged behind the broader US market's positive return.

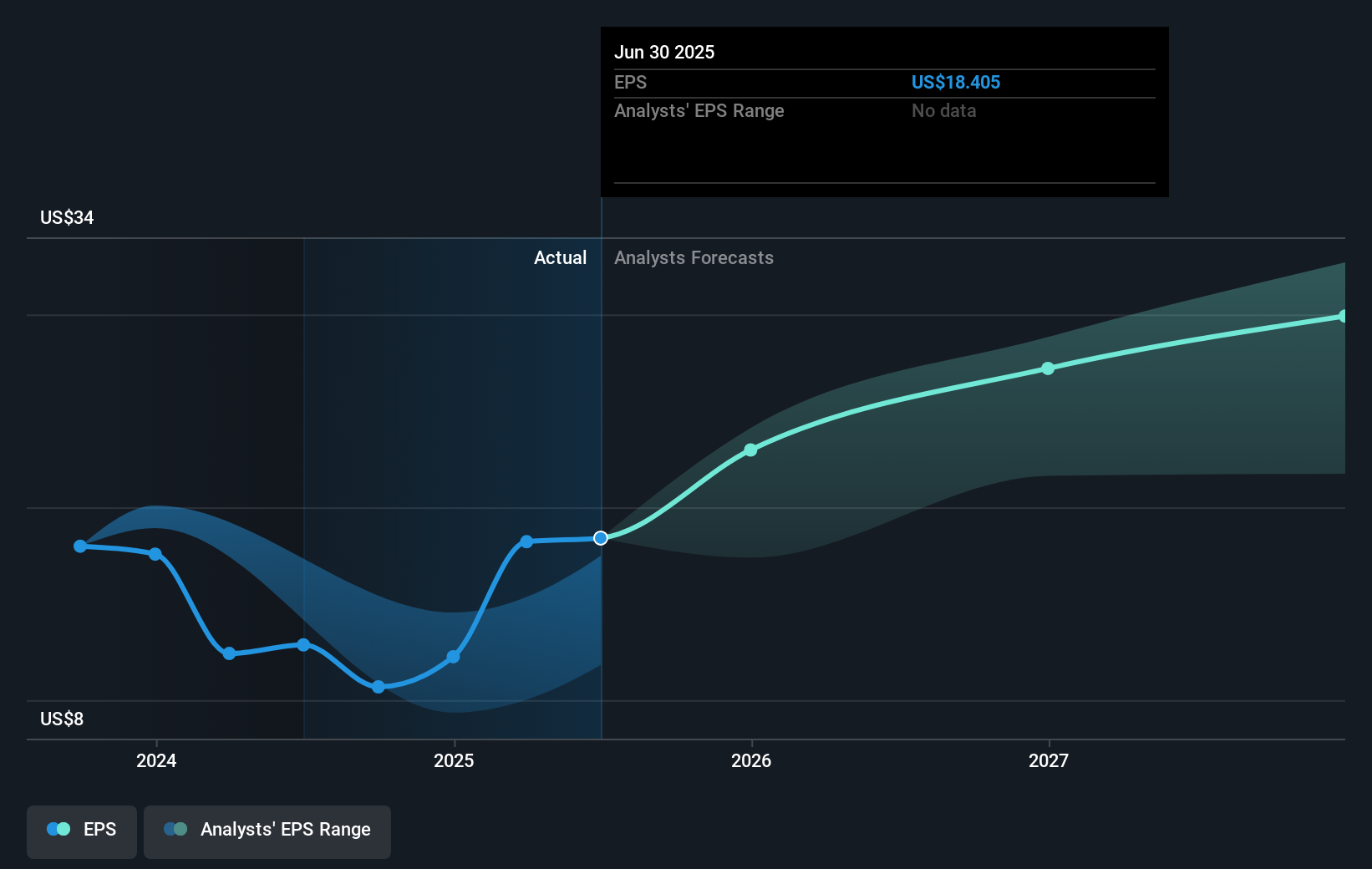

The recent earnings announcement may impact revenue and earnings forecasts, adding layers to analyst assumptions. The anticipated 4.1% annual revenue growth and profit margin improvements suggest positive future momentum. However, investor sentiment will depend on how effectively the company meets these expectations amidst operational challenges and regulatory changes.

Currently, with a share price of US$297.86, Cigna trades at a discount to the analyst price target of US$374.92. This gap highlights potential upside if the company's strategic initiatives effectively translate into the projected growth. Nevertheless, investors should closely monitor operational developments and regulatory impacts that could influence these projections.

Examine Cigna Group's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CI

Cigna Group

Provides insurance and related products and services in the United States.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives