- United States

- /

- Household Products

- /

- NYSE:CHD

Church & Dwight (NYSE:CHD) Recalls Zicam and Orajel Products Over Microbial Contamination Concerns

Reviewed by Simply Wall St

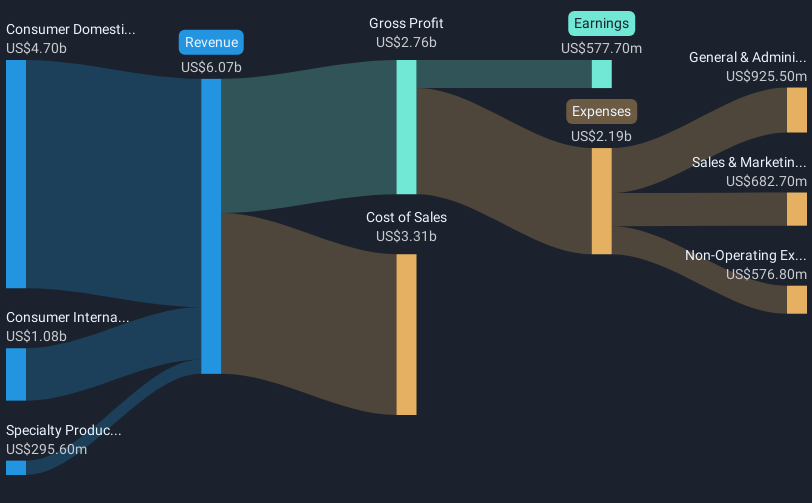

Church & Dwight (NYSE:CHD) recently announced a voluntary recall of several products, including Zicam Cold Remedy Nasal Swabs and Orajel Baby Teething Swabs, due to potential fungal contamination risk, notably posing health threats to children and people with compromised immune systems. While no adverse events have been reported, this recall coincided with a 7.7% rise in the company's stock over the last month, reflecting broader market movements. The broader market rose by 1.8% over the past seven days and 13% over the last year, suggesting the recall might have temporarily added counterweight against the positive market trend.

We've discovered 1 weakness for Church & Dwight that you should be aware of before investing here.

The voluntary recall of Church & Dwight's products, such as Zicam Cold Remedy Nasal Swabs, highlights challenges the company may face in its efforts to optimize its brand portfolio and stabilize earnings. This event, coupled with the company's rise in share price, mirrors broader market trends despite the recall's potential temporary impact. Over the past five years, the company's total shareholder return, including both share price growth and dividends, was 43.63%, showing a commendable performance in a challenging market environment.

For context, during the past year, Church & Dwight's performance lagged behind not only the US Household Products industry, which experienced a 3.8% decline, but also the wider US market, which climbed 11%. Looking ahead, potential impacts on revenue and earnings forecasts from the recall include the continuation of U.S. sales declines or a slower recovery in earnings growth projections. Analysts anticipate a 2.7% annual revenue growth over the next three years, potentially hindered by ongoing consumer demand issues and macroeconomic pressures.

Despite the recent share price movement and recall news, the company's current share price of US$92.07 trades at a small discount to analysts' consensus price target of US$99.6. This indicates expectations of moderate upside potential. Prospective investors might weigh these dynamics against the ongoing brand optimization and potential tariff impacts as Church & Dwight seeks to enhance its market position and financial health.

Understand Church & Dwight's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives