- United States

- /

- Household Products

- /

- NYSE:CHD

Church & Dwight (CHD) Declares 498th Consecutive Quarterly Dividend of US$0.30 Per Share

Reviewed by Simply Wall St

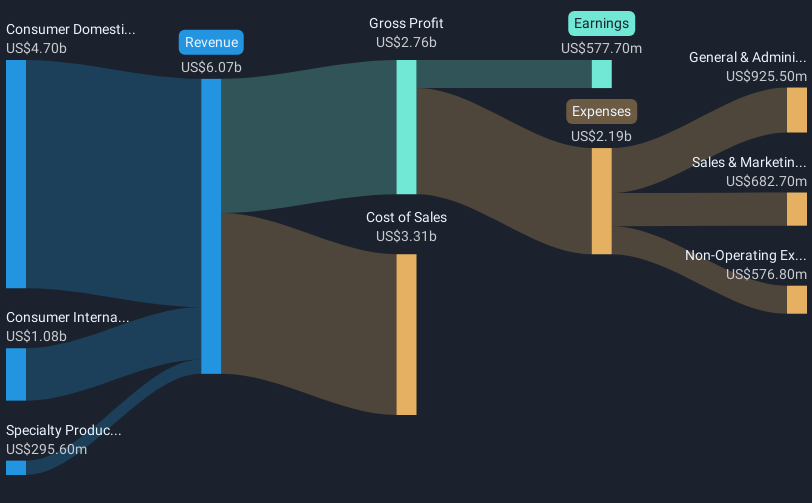

Church & Dwight (CHD) recently affirmed its quarterly dividend of $0.30 per share, marking its 498th consecutive dividend payment. This announcement might have lent some resilience to its share price, which rose 2% over the past month. During this period, the company also entered into a new credit agreement, enhancing its financial flexibility with a $2 billion facility. Broader market trends, including stable movements and investor focus on tech earnings and Fed rate decisions, suggest that Church & Dwight's performance was in line with market behavior, reflecting both its strategic financial moves and current economic conditions.

The recent dividend affirmation and new credit agreement are pivotal in boosting Church & Dwight's financial stability and stock resilience, as seen with its share price rising by 2% over the past month. Over a longer three-year period, the company's total return, including share price and dividends, was 15.15%, indicating solid performance in an increasingly complex market environment. In the past year, however, the company underperformed the US market, which returned 17.7%, while it surpassed the US Household Products industry's negative return of 8%.

The company's strategic focus on optimizing its brand portfolio and launching innovative products like BATISTE Light aligns with pursuits to boost margins and revenue. However, potential risks such as declining U.S. sales and tariff challenges still loom, possibly affecting revenue and earnings forecasts. Analysts forecast a revenue growth of 3.2% annually and predict earnings will climb to US$1 billion by July 2028, assuming continued adaptation to market conditions and strategic moves in brand management.

Regarding valuation, Church & Dwight's current share price of US$96.76 is close to the consensus analyst price target of US$101.70, indicating limited upside potential, with a nominal share price discount. This suggests analysts believe the stock is nearing its fair value based on expected financial growth. Investors should carefully consider the company's ongoing strategic developments and market positioning relative to broader economic factors and industry trends.

Explore Church & Dwight's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives