- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Centrus Energy (NYSEAM:LEU) Reports US$27 Million Turnaround In Financial Results

Reviewed by Simply Wall St

Centrus Energy (NYSEAM:LEU) saw a remarkable price move of 171% over the last quarter, bolstered by several key developments. The U.S. Department of Energy's decision to extend Centrus's contract for High-Assay, Low-Enriched Uranium production through mid-2026 was a significant factor, showcasing strengthened commitments in the nuclear energy sector. This news, paired with a notable turnaround in financial results—reporting a net income of $27 million from a previous loss—contributed positively. While executive changes marked a transitional phase, broader market trends, particularly the rally in major indexes, provided further support to Centrus's upward momentum.

Find companies with promising cash flow potential yet trading below their fair value.

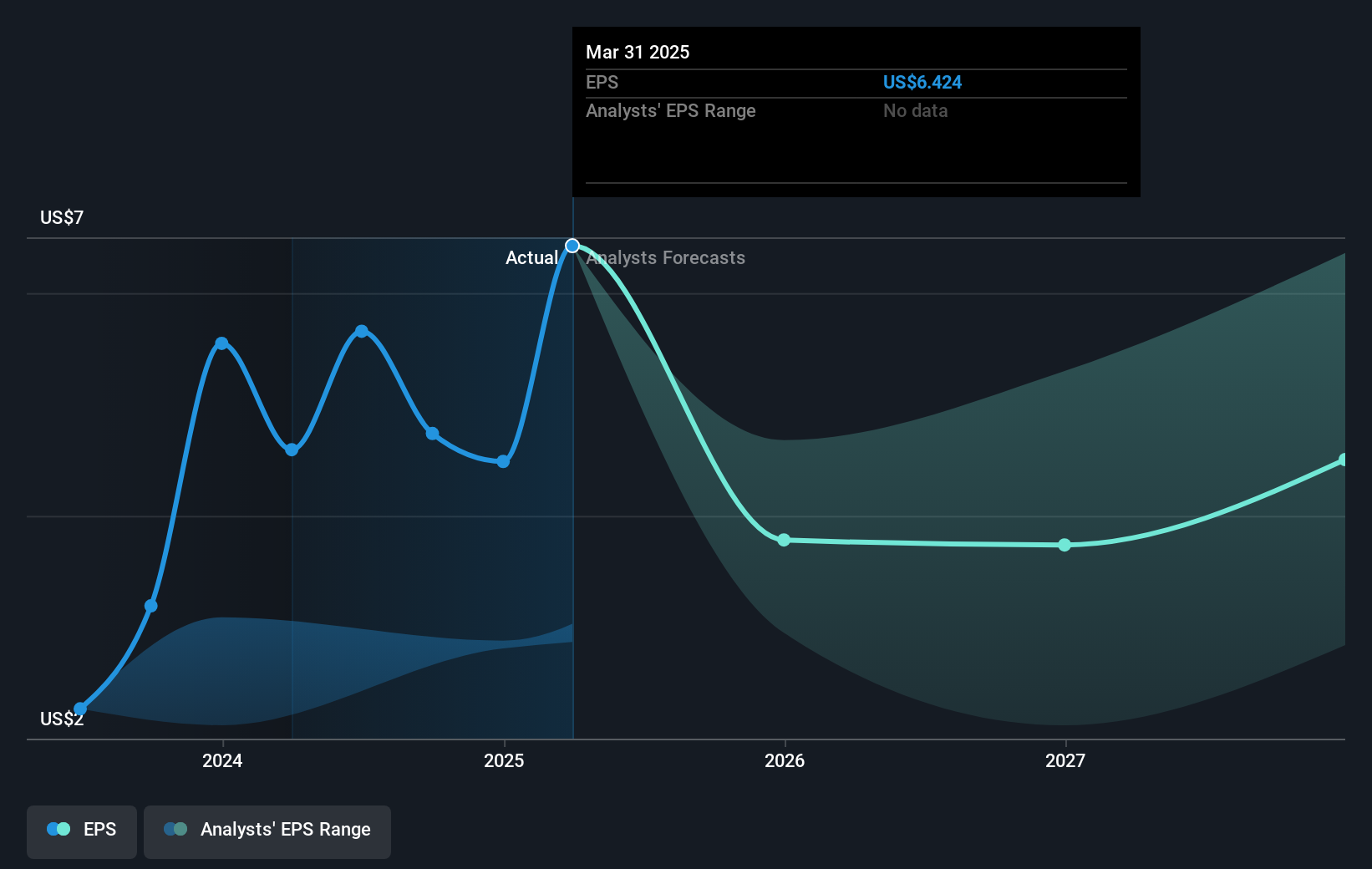

The recent developments regarding Centrus Energy's extended contract with the U.S. Department of Energy could significantly influence its revenue and earnings forecasts. With federal support extending through mid-2026, Centrus is positioned to enhance its role in nuclear enrichment, potentially leading to increased revenue streams and elevated earnings potential. The $2 billion in legally binding customer commitments supports this upward revenue trajectory.

Over the past five years, Centrus Energy's total shareholder return, including share price and dividends, has increased by a very large percentage. In contrast, over the past year, Centrus has outperformed the U.S. market's 13.7% return, indicating the company's strong performance relative to market trends. This reflects a substantial period of growth, with recent price movements supported by both internal financial improvement and external market conditions.

The share price's large increase over the past quarter reflects partly these positive developments. However, it is important to consider this movement in the context of the consensus analyst price target of US$166.84, which implies the stock is currently trading slightly below this target. The price movement provides some context for potential future gains, should the company continue to execute on its growth strategies.

Learn about Centrus Energy's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives