Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Capita plc (LON:CPI) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Capita

How Much Debt Does Capita Carry?

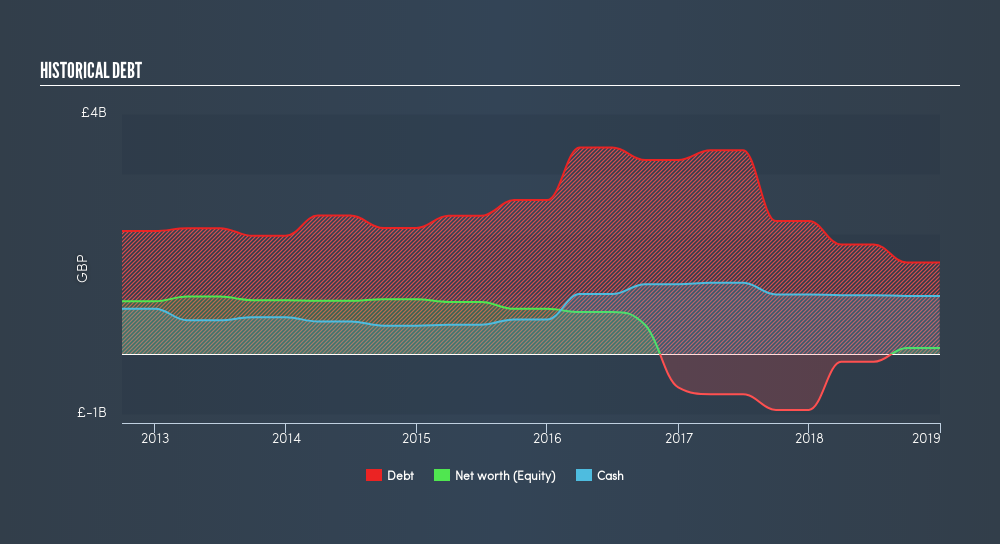

As you can see below, Capita had UK£1.53b of debt at December 2018, down from UK£2.22b a year prior. However, it also had UK£967.3m in cash, and so its net debt is UK£559.3m.

How Strong Is Capita's Balance Sheet?

The latest balance sheet data shows that Capita had liabilities of UK£2.36b due within a year, and liabilities of UK£1.63b falling due after that. On the other hand, it had cash of UK£967.3m and UK£650.1m worth of receivables due within a year. So it has liabilities totalling UK£2.37b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's UK£1.86b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Since Capita does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Capita's net debt is sitting at a very reasonable 2.06 times its EBITDA, while its EBIT covered its interest expense just 2.53 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. Shareholders should be aware that Capita's EBIT was down 70% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Capita can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Capita created free cash flow amounting to 16% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks some a little paranoia about is ability to extinguish debt.

Our View

Mulling over Capita's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. After considering the datapoints discussed, we think Capita has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Given the risks around Capita's use of debt, the sensible thing to do is to check if insiders have been unloading the stock.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:CPI

Capita

Operates an outsourcer that supports clients across the public and private sectors in the United Kingdom and rest of Europe.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives