Canadian Imperial Bank of Commerce (TSX:CM) To Redeem C$1 Billion Debentures

Reviewed by Simply Wall St

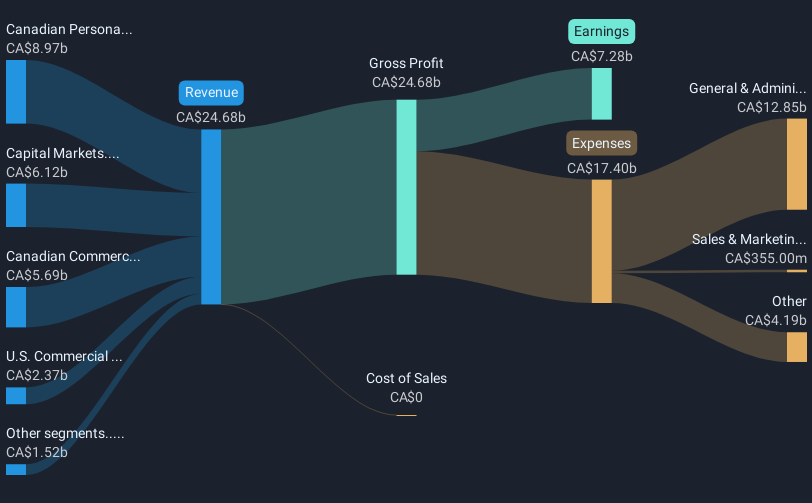

Canadian Imperial Bank of Commerce (TSX:CM) recently announced its intention to redeem $1 billion of its debentures, signaling a strategic financial move. This, alongside a strong second-quarter earnings report, may have positively influenced its 15% price increase over the last quarter, reflecting robust net income growth and active share repurchase activities. Additionally, the market's broader rally, evidenced by the S&P 500's upward trajectory, may have provided further tailwinds for the company's performance. Notably, the launch of innovative products like the CIBC Adapta Mastercard and an AI platform showcased its focus on evolving customer needs, likely bolstering investor confidence.

The recent redemption of A$1 billion in debentures by Canadian Imperial Bank of Commerce (CIBC) aligns with its focus on financial stabilization and strategic growth, as highlighted in its aim to expand digital banking and reinforce client relationships in the mass affluent sector. These efforts underline the company's commitment to increasing both high-margin revenue and client retention. This could positively affect revenue and earnings forecasts, emphasizing its robust cost-management strategies and consistent operating leverage.

Over a five-year span, CIBC achieved a total shareholder return of 163.19%, reflecting a strong performance that surpasses typical market returns. Although over the past year, CIBC outpaced the Canadian market, which experienced a 15.5% increase, and the wider Canadian Banks industry, which saw a growth of 21.5% in the same timeframe. The recent price surge aligns closely with the analyst consensus price target of CA$95.64, suggesting limited immediate upside from current levels, with the stock trading at CA$86.47, a 9.6% increase to reach the target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives