Can You Imagine How Vishay Precision Group's (NYSE:VPG) Shareholders Feel About The 67% Share Price Increase?

While Vishay Precision Group, Inc. (NYSE:VPG) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. While that's not great, the returns over five years have been decent. After all, the stock has performed better than the market (59%) in that time, and is up 67%. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 37% decline over the last twelve months.

Check out our latest analysis for Vishay Precision Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

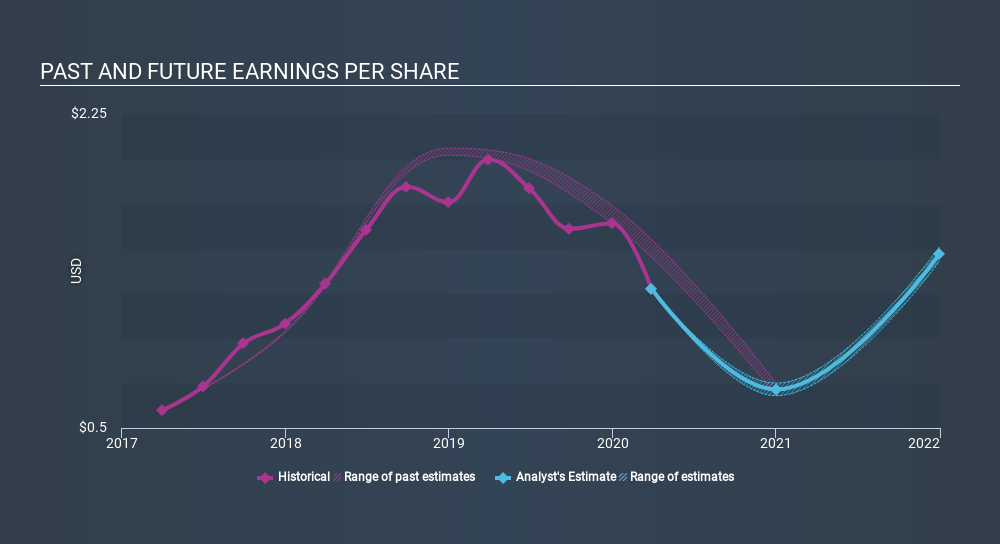

During five years of share price growth, Vishay Precision Group achieved compound earnings per share (EPS) growth of 51% per year. This EPS growth is higher than the 11% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Vishay Precision Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 11% in the last year, Vishay Precision Group shareholders lost 37%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research Vishay Precision Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NYSE:VPG

Vishay Precision Group

Operates in the precision measurement and sensing technologies in the United States, Europe, Israel, Asia, and Canada.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives