Can You Imagine How Chuffed Vishay Precision Group's (NYSE:VPG) Shareholders Feel About Its 111% Share Price Gain?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Vishay Precision Group, Inc. (NYSE:VPG) share price has soared 111% in the last half decade. Most would be very happy with that. It's down 1.4% in the last seven days.

View our latest analysis for Vishay Precision Group

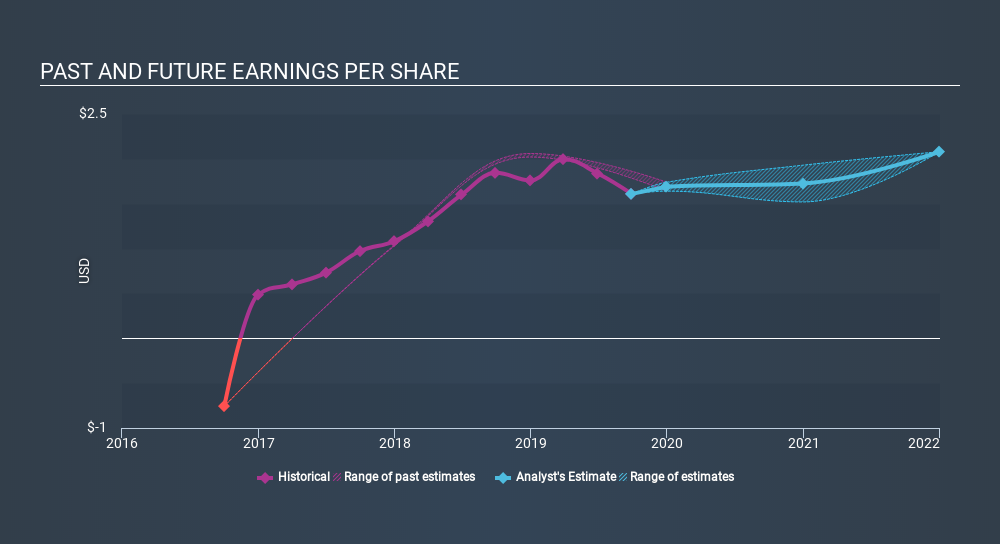

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Vishay Precision Group moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Vishay Precision Group has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Vishay Precision Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Vishay Precision Group provided a TSR of 6.2% over the last twelve months. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 16% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:VPG

Vishay Precision Group

Operates in the precision measurement and sensing technologies in the United States, Europe, Israel, Asia, and Canada.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives