- India

- /

- Communications

- /

- NSEI:UMIYA-MRO

Can You Imagine How Chuffed MRO-TEK Realty's (NSE:MRO-TEK) Shareholders Feel About Its 173% Share Price Gain?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term MRO-TEK Realty Limited (NSE:MRO-TEK) shareholders would be well aware of this, since the stock is up 173% in five years. In more good news, the share price has risen 13% in thirty days. We note that MRO-TEK Realty reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

See our latest analysis for MRO-TEK Realty

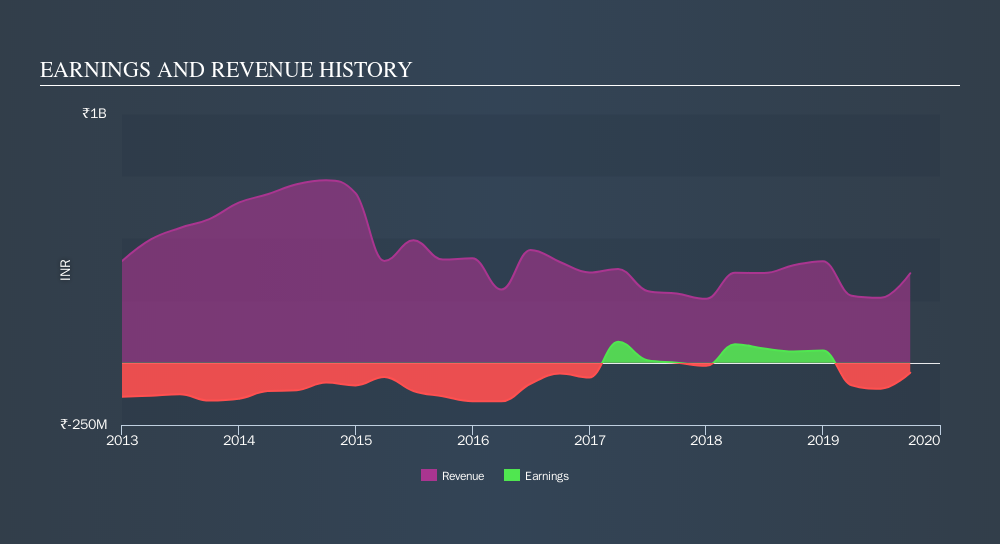

Given that MRO-TEK Realty didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years MRO-TEK Realty saw its revenue shrink by 14% per year. On the other hand, the share price done the opposite, gaining 22%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

The image below shows how earnings and revenue have tracked over time.

Take a more thorough look at MRO-TEK Realty's financial health with this free report on its balance sheet.

A Different Perspective

MRO-TEK Realty shareholders are down 35% for the year, but the market itself is up 7.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 22%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:UMIYA-MRO

Umiya Buildcon

Engages in the manufacture, supply, and distribution of access and networking equipment and solutions in India and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives