- United States

- /

- Mortgage REITs

- /

- NYSE:ARI

Can You Imagine How Apollo Commercial Real Estate Finance's (NYSE:ARI) Shareholders Feel About The 11% Share Price Increase?

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI) share price is up 11% in the last five years, that's less than the market return. However, if you include the dividends then the return is market beating. The last year hasn't been great either, with the stock up just 3.2%.

View our latest analysis for Apollo Commercial Real Estate Finance

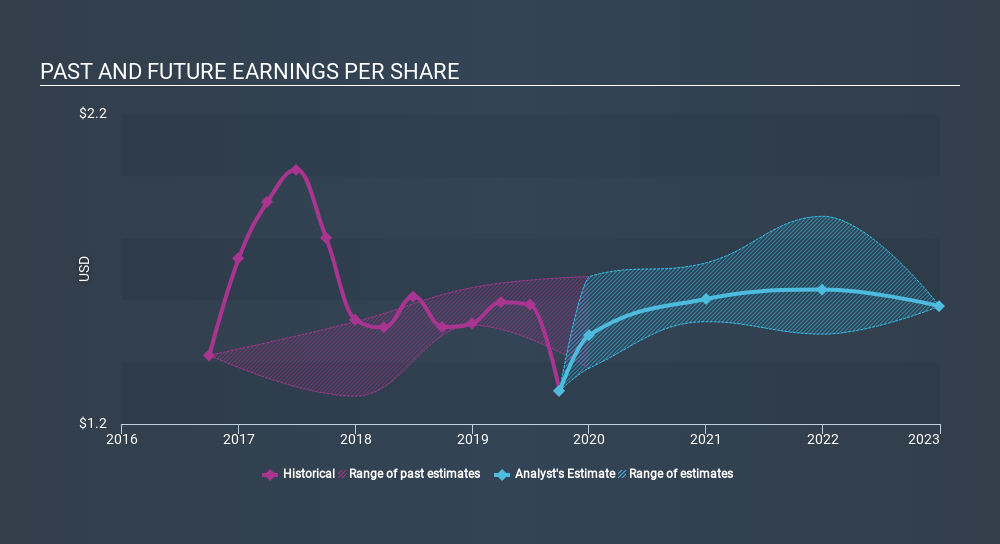

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Apollo Commercial Real Estate Finance's earnings per share are down 4.9% per year, despite strong share price performance over five years.

Since EPS is down a bit, and the share price is up, it's probably that the market previously had some concerns about the company, but the reality has been better than feared. Having said that, if the EPS falls continue we'd be surprised to see a sustained increase in share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Apollo Commercial Real Estate Finance the TSR over the last 5 years was 86%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Apollo Commercial Real Estate Finance shareholders are up 14% for the year (even including dividends) . But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 13% per year over five year. It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Apollo Commercial Real Estate Finance (of which 1 doesn't sit too well with us!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ARI

Apollo Commercial Real Estate Finance

Apollo Commercial Real Estate Finance, Inc.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives