- Australia

- /

- Oil and Gas

- /

- ASX:CE1

Can We See Significant Insider Ownership On The Calima Energy Limited (ASX:CE1) Share Register?

If you want to know who really controls Calima Energy Limited (ASX:CE1), then you'll have to look at the makeup of its share registry. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

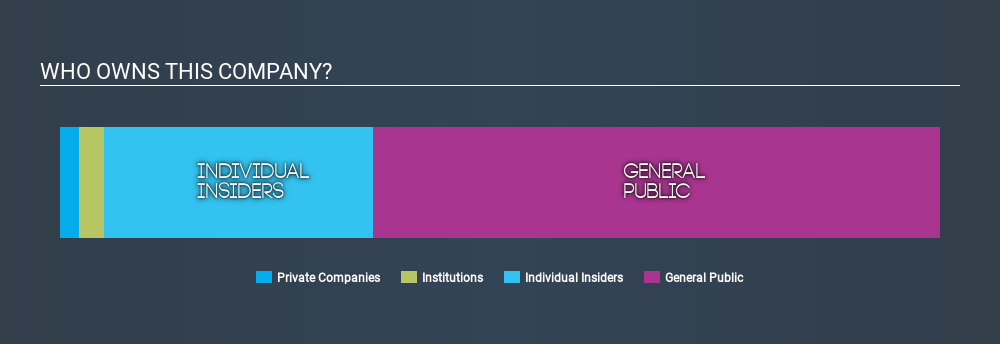

Calima Energy is a smaller company with a market capitalization of AU$17m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions don't own many shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Calima Energy.

View 6 warning signs we detected for Calima Energy

What Does The Institutional Ownership Tell Us About Calima Energy?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

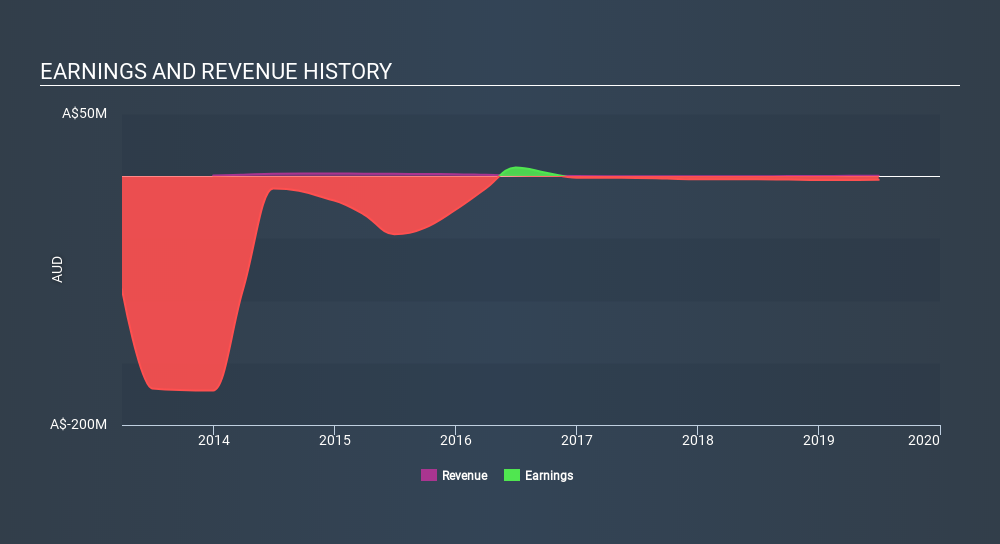

Less than 5% of Calima Energy is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. So if the company itself can improve over time, we may well see more institutional buyers in the future. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

We note that hedge funds don't have a meaningful investment in Calima Energy. Looking at our data, we can see that the largest shareholder is Craig Burton with 10% of shares outstanding. Next, we have Robert Brown and Glenn Whiddon as the second and third largest shareholders, holding 5.1% and 2.3%, of the shares outstanding, respectively. Glenn Whiddon also happens to hold the title of Chairman of the Board.

On studying our ownership data, we found that 24 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, It also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Calima Energy

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in Calima Energy Limited. Insiders have a AU$5.3m stake in this AU$17m business. When analysing a company, looking at ownership may seem a logical place to start. However, there are many other factors to consider, such as the risks within the company itself. For example, we've discovered 6 warning signs for Calima Energy (of which 3 are major) which any shareholder or potential investor should be aware of.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 64% of Calima Energy shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Calima Energy better, we need to consider many other factors.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:CE1

Calima Energy

A production-focused energy company, explores for and develops oil and natural gas assets in the Western Canadian Sedimentary Basin.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives