There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Benton Resources (CVE:BEX) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business's cash, relative to its cash burn.

View our latest analysis for Benton Resources

When Might Benton Resources Run Out Of Money?

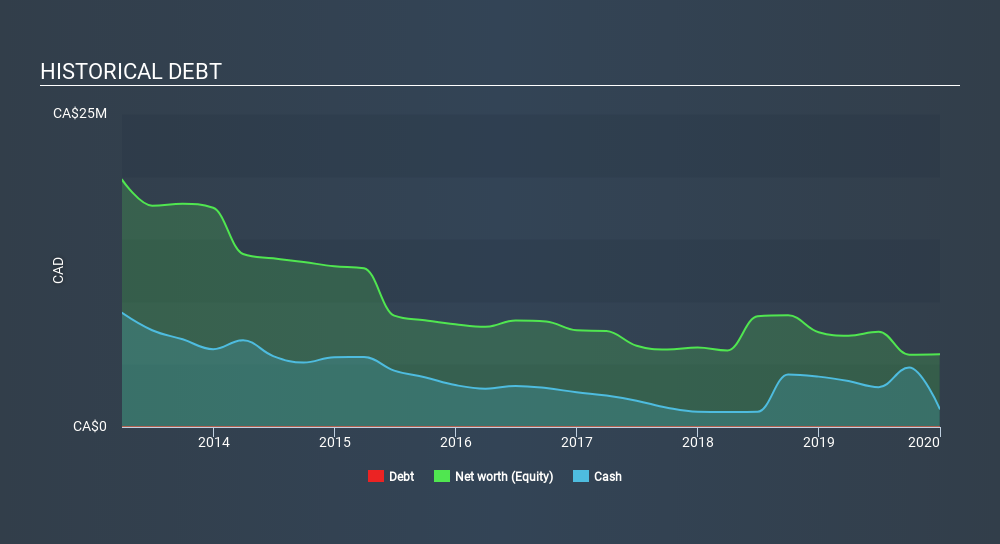

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2019, Benton Resources had CA$1.5m in cash, and was debt-free. In the last year, its cash burn was CA$4.5m. So it had a cash runway of approximately 4 months from December 2019. That's a very short cash runway which indicates an imminent need to douse the cash burn or find more funding. Depicted below, you can see how its cash holdings have changed over time.

How Hard Would It Be For Benton Resources To Raise More Cash For Growth?

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash to drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Benton Resources's cash burn of CA$4.5m is about 58% of its CA$7.8m market capitalisation. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

Is Benton Resources's Cash Burn A Worry?

Given it's an early stage company, we don't have a lot of data with which to judge Benton Resources's cash burn. Having said that, we can say that its cash runway was a real negative. But in truth we would avoid the stock as its cash burn seems rather high, and we simply don't know how it will continue to fund its spending. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: Benton Resources insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:BEX

Benton Resources

Engages in the acquisition, exploration, and development of mineral properties.

Moderate with adequate balance sheet.

Market Insights

Community Narratives