- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Boston Scientific (NYSE:BSX) Expands FARAPULSE System FDA Approval For Persistent Atrial Fibrillation

Reviewed by Simply Wall St

Boston Scientific (NYSE:BSX) recently achieved FDA approval to expand the FARAPULSE™ Pulsed Field Ablation (PFA) System's use, enhancing treatment options for persistent atrial fibrillation. This significant development aligns with the 15% share price increase over the last quarter. The company's inclusion in key Russell indices and positive clinical trial results may have amplified its stock performance. While the broader market experienced growth, Boston Scientific's strategic advancements in its medical technology offering likely reinforced investor confidence, contributing additional momentum to the stock's rise amidst generally optimistic market conditions.

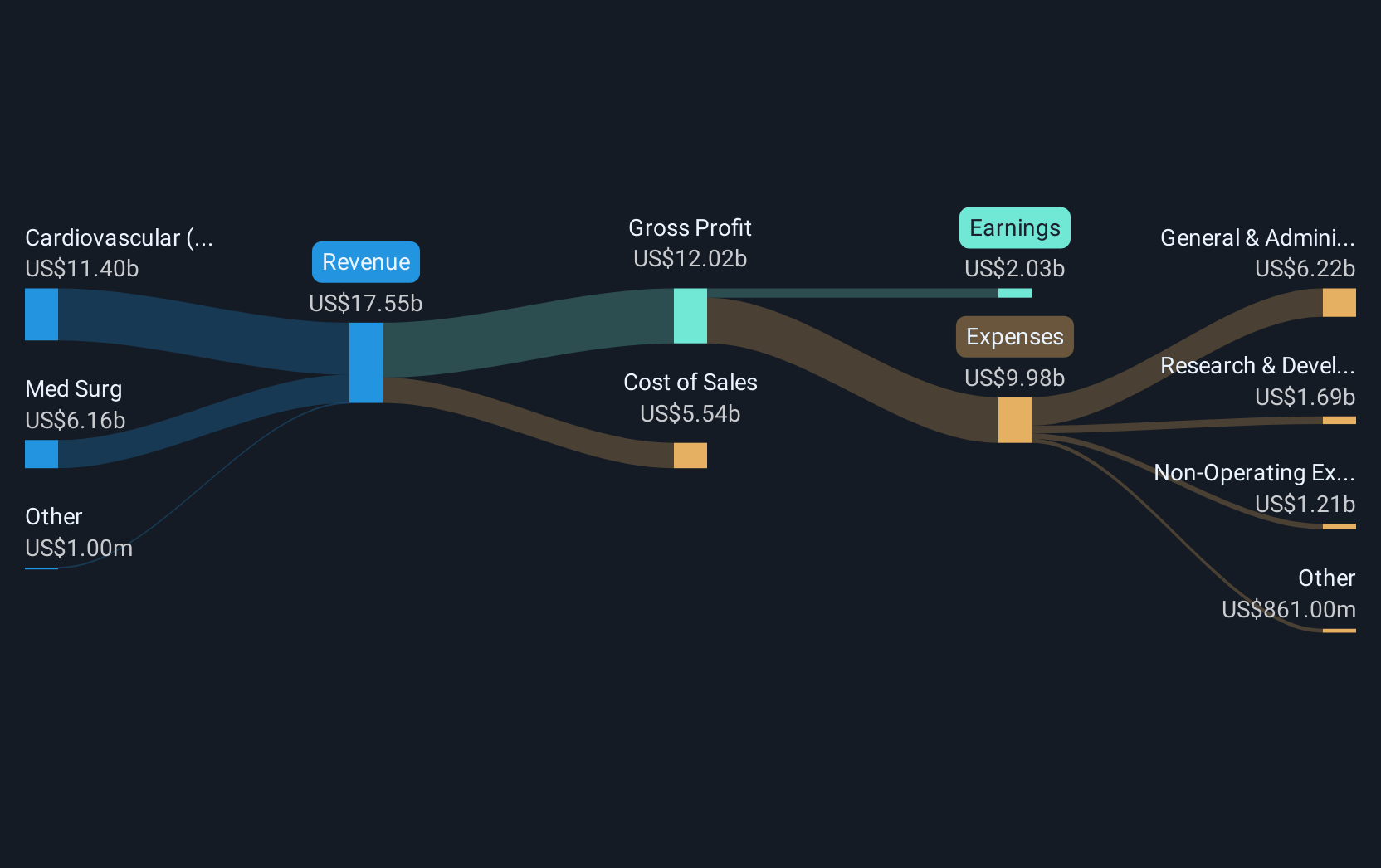

The recent FDA approval for Boston Scientific's FARAPULSE PFA System might bolster investor sentiment, supporting the company's narrative of innovation-driven growth. The emphasis on expanding treatment options for atrial fibrillation aligns with their strategy to enhance offerings in cardiology, potentially boosting revenue forecasts. With analysts projecting revenue growth of 11.3% annually, these new developments could provide further momentum.

Over a five-year period, Boston Scientific's total return reached an impressive 202.9%, providing a stark contrast to the recent 15% rise witnessed over the past quarter. In the past year alone, the company's performance has surpassed both the US Medical Equipment industry, which achieved a 10.8% return, and the broader US market, which saw a 13.7% return.

The expansion facilitated by FDA approval could impact earnings forecasts, with analysts predicting earnings to increase to $4.3 billion by July 2028. This growth is key to achieving the consensus price target of US$117.55, which is 10.9% above the current share price of US$104.78. With earnings margins expected to rise, the approval strengthens the company's position to potentially meet or exceed these targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives