- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital (NYSE:OWL) Partners With Koda Capital to Launch Fund for Australian Investors

Reviewed by Simply Wall St

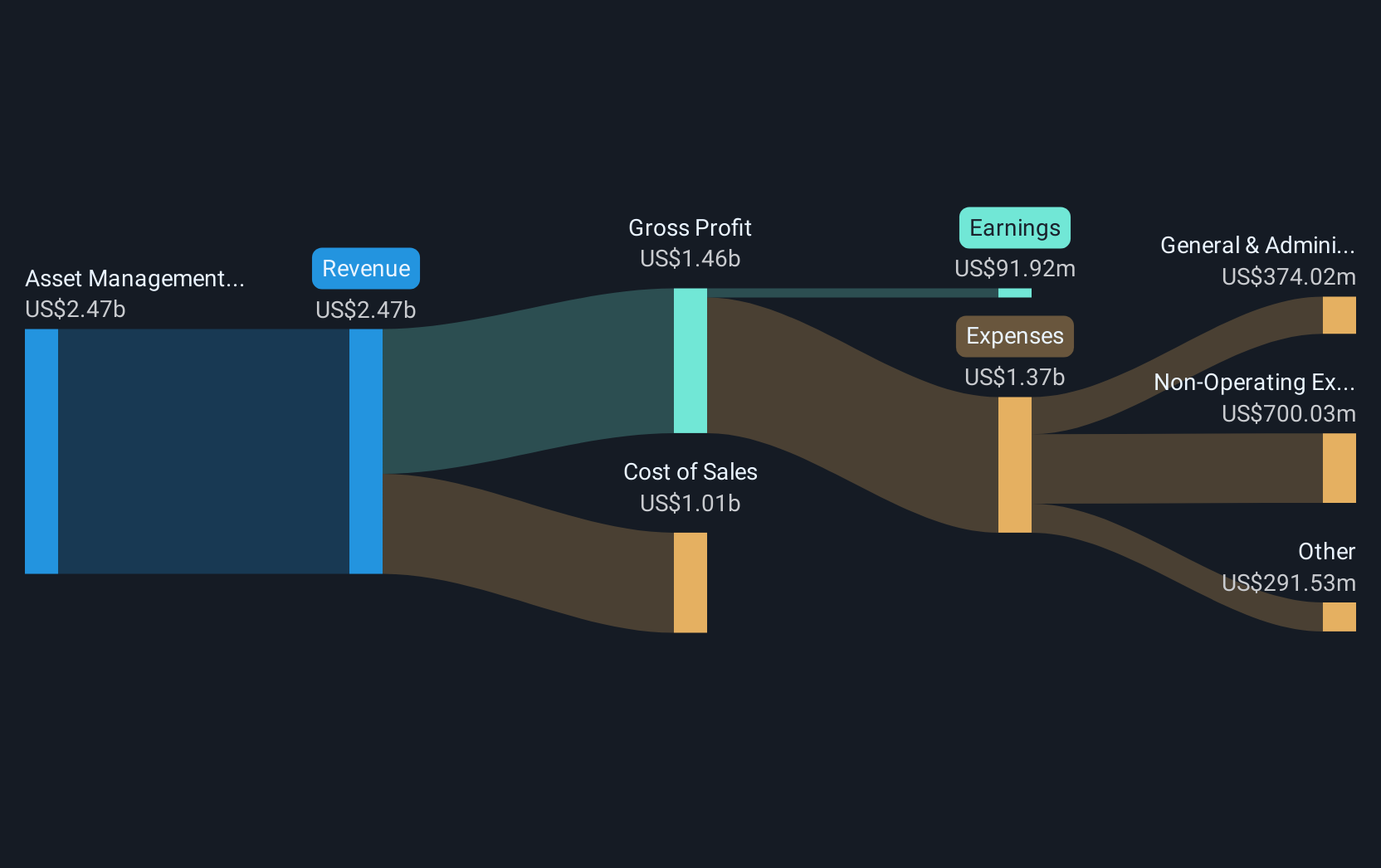

Blue Owl Capital (NYSE:OWL) recently announced the launch of its Credit Income Fund AUT, targeting Australian financial advisors. This move into the Australian market, alongside its involvement in a significant $15 billion AI data center venture, positioned Blue Owl for growth. As the market remained largely unchanged with various sectors experiencing mixed movements, Blue Owl's stock rose by 21% over the last quarter, outperforming broad market trends. The company’s strategic alliances and innovative product rollouts, like the fund partnership with Koda Capital, likely provided a supportive backdrop for this impressive share price appreciation.

The recent announcement of Blue Owl Capital's entry into the Australian market with its Credit Income Fund AUT, coupled with its participation in a substantial $15 billion AI data center venture, highlights the company's expansion efforts and focus on high-growth sectors. These initiatives could enhance long-term revenue and earnings potential by tapping into new markets and strengthening partnerships like the one with Koda Capital. Over the past three years, Blue Owl's total shareholder return was a substantial 111.33%. This performance underscores the effectiveness of their strategic expansion plans, despite the challenges faced by the broader market.

In the shorter term, Blue Owl's stock has laced behind the US Capital Markets industry, but matched the broader US market, with a yearly gain of 13.7%. Revenue and earnings forecasts suggest significant growth, supported by a management fee-driven model and an extensive asset base poised for fee activation. However, the stock's recent price movement positions it at a 17.6% discount to the consensus price target of US$21.67, reflecting potential upside if the forecasts are met. The entry into high-growth areas like digital infrastructure aligns with the earnings forecasts, projecting US$3.5 billion by 2028.

Learn about Blue Owl Capital's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives