- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (NYSE:BX) Considers Acquisitions in India and French Telecom Sector

Reviewed by Simply Wall St

Blackstone (NYSE:BX) has been actively engaged in substantial acquisition discussions and strategic bids, including their interest in acquiring Axis Finance Limited and the potential joint bid for SFR. Over the last quarter, Blackstone's share price increased by 27%, a notable move amidst market conditions influenced by trade uncertainties and tariff deferments. While broader market forces may impact stock movements, Blackstone's involvement in high-profile deals, like the aforementioned discussions and other strategic alliances, likely bolstered investor sentiment. As the market remained generally stable, these specific corporate actions could have contributed added momentum to the company's share price.

The recent acquisition discussions involving Blackstone, such as their interest in Axis Finance Limited and the potential joint bid for SFR, could significantly influence Blackstone's future business landscape. Such activities, while enhancing investor confidence in the short term, may have longer-term implications on the company's operational efficiencies and profitability, specifically as it continues to expand in infrastructure and digital sectors. These strategic moves could challenge Blackstone's ability to maintain high revenue and earnings growth, given the potential risks of saturation and technological shifts within these rapidly evolving industries.

Over the past five years, Blackstone has achieved a total return, inclusive of share price and dividends, of approximately 240.18%. This long-term performance underlines its strong value creation, although recent 12.5% U.S. market returns outpaced Blackstone's, which underperformed relative to the Capital Markets industry return of 37% over the last year. Despite this, Blackstone's earnings growth of 18.2% last year surpassed the industry average of 14%, signifying robust operating performance even with market challenges.

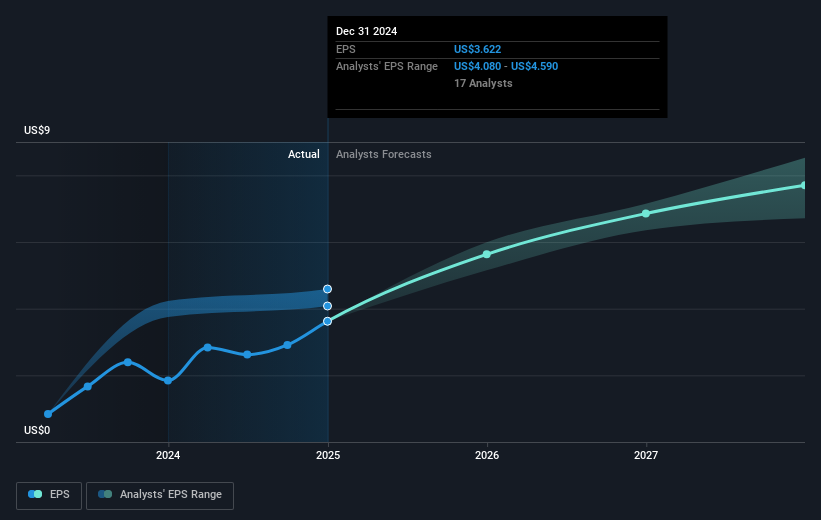

As analysts project Blackstone's revenue to grow at 15.7% annually, any successful acquisitions or joint ventures could catalyze these forecasts. However, the company's reliance on large-scale projects and potential operational inefficiencies could temper earnings growth, which is forecasted to rise 27.09% per year. With Apple's current share price at US$137.36 closely aligned with the bearish analyst's price target of US$138.17, any forward-looking revenue and earnings projections developed in light of recent strategic activity will need to be critically assessed against Blackstone’s current valuation and industry landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives