- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (NYSE:BLK) Considers Selling Stake In Aramco Gas Pipeline Rights

Reviewed by Simply Wall St

BlackRock (NYSE:BLK) is currently in talks to sell its stake in the leasing rights to Saudi Aramco’s natural-gas pipeline, a move that highlights its proactive asset management approach. Over the past quarter, BlackRock's share price rose by 21% amid these negotiations. While the market saw robust gains, BlackRock's involvement in strategic discussions and positive quarterly revenue growth may have also contributed to the price movement. The confirmation of dividends and ongoing buyback initiatives further solidified investor confidence, despite a slight decline in net income compared to the previous year.

We've discovered 1 warning sign for BlackRock that you should be aware of before investing here.

BlackRock's (NYSE:BLK) negotiations to sell its stake in Saudi Aramco’s natural-gas pipeline leasing rights reflect a proactive approach to asset management that could influence earnings and revenue forecasts. This potential divestment might empower the company to allocate resources to its core growth areas, including private markets and technology-driven solutions like Aladdin. As BlackRock expands in these segments, the revenue outlook could be bolstered despite geopolitical and economic risks.

Over the past five years, BlackRock’s total shareholder return reached 116.78%, indicating substantial long-term gains. However, when we turn to short-term performance, BlackRock shares saw a sharp rise of 21% in the last quarter, exceeding the US Market's 1-year return of 13.2%. This surge aligns with the anticipated outcomes of the company's ongoing initiatives, even as BlackRock matched the US Capital Markets industry's 34.9% return over the past year.

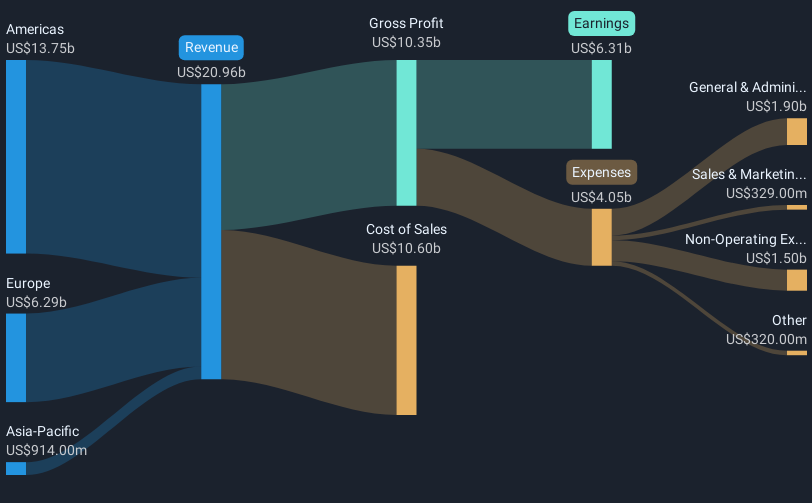

With revenue reported at US$20.96 billion and earnings at US$6.31 billion, BlackRock is poised to capitalize on strong client demand in private markets. The current share price of US$914.97 remains close to the analyst consensus price target of US$1,023.32, representing a discount of roughly 10.6%. Investors should consider how this news impacts future projections, weighing the potential for revenue diversification and market growth against industry challenges and economic pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives