BlackBerry Limited (TSE:BB) Analysts Are Reducing Their Forecasts For This Year

Today is shaping up negative for BlackBerry Limited (TSE:BB) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. The stock price has risen 7.2% to US$5.77 over the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

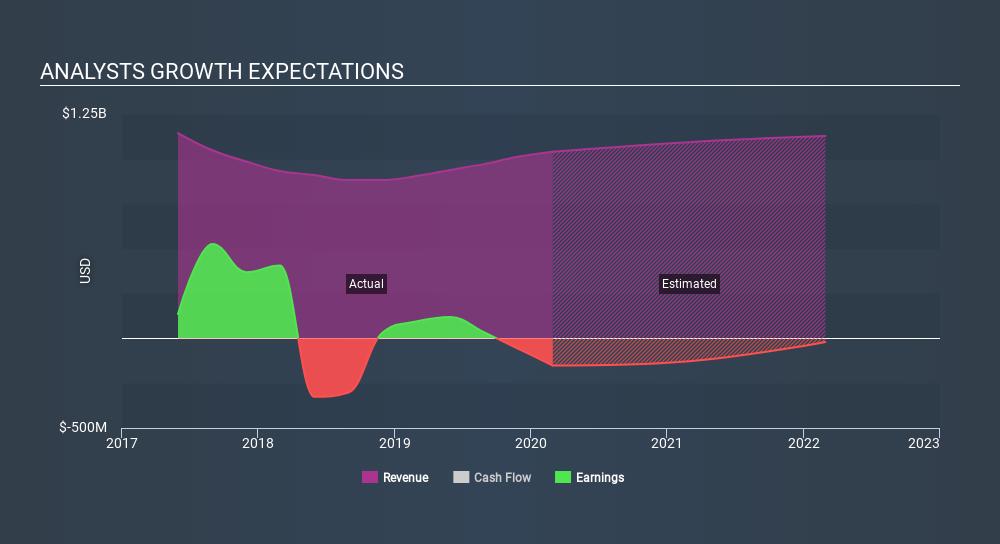

Following the downgrade, the consensus from ten analysts covering BlackBerry is for revenues of US$990m in 2021, implying a measurable 4.8% decline in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing US$1.2b of revenue in 2021. It looks like forecasts have become a fair bit less optimistic on BlackBerry, given the substantial drop in revenue estimates.

View our latest analysis for BlackBerry

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the BlackBerry's past performance and to peers in the same industry. One thing that stands out from these estimates is that shrinking revenues are expected to moderate from the historical decline of 29% per annum over the past five years.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for BlackBerry this year. They're also anticipating slower revenue growth than the wider market. After a cut like that, investors could be forgiven for thinking analysts are a lot more bearish on BlackBerry, and a few readers might choose to steer clear of the stock.

Need some more information? We have estimates for BlackBerry from its ten analysts out until 2022, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion