BioTelemetry's (NASDAQ:BEAT) Wonderful 395% Share Price Increase Shows How Capitalism Can Build Wealth

Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held BioTelemetry, Inc. (NASDAQ:BEAT) shares for the last five years, while they gained 395%. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 17% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 7.7% in 90 days).

See our latest analysis for BioTelemetry

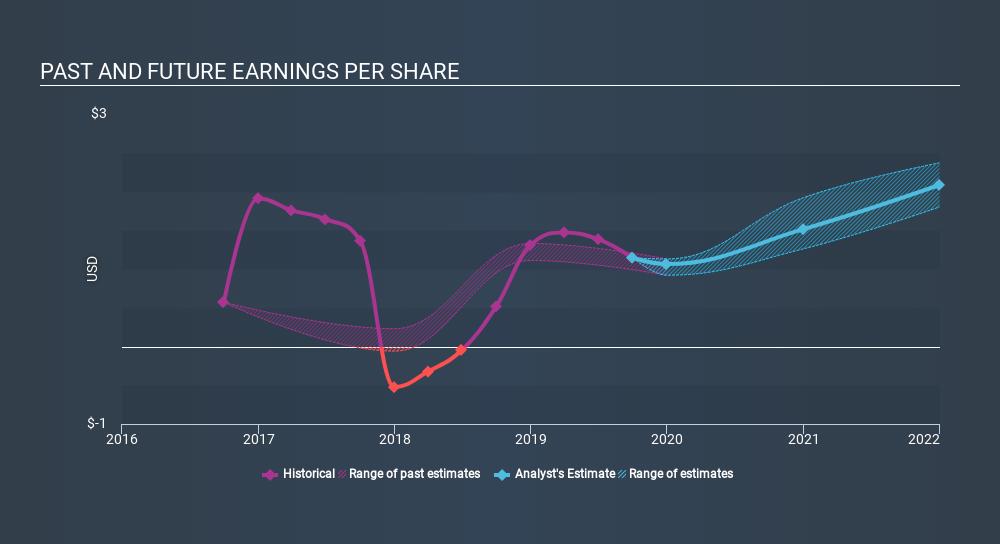

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, BioTelemetry became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the BioTelemetry share price has gained 115% in three years. In the same period, EPS is up 26% per year. That makes the EPS growth rather close to the annualized share price gain of 29% over the same period. So one might argue that investor sentiment towards the stock hss not changed much over time. Arguably the share price is reflecting the earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that BioTelemetry has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

While the broader market gained around 23% in the last year, BioTelemetry shareholders lost 29%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 38%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand BioTelemetry better, we need to consider many other factors. Be aware that BioTelemetry is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives