- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai Holdings (NYSE:BBAI) Expands Biometric Software Deployment at Major International Airports

Reviewed by Simply Wall St

BigBear.ai Holdings (NYSE:BBAI) recently confirmed multiple deployments of its biometric software at key travel hubs, reflecting a robust commitment to enhancing international travel security and efficiency. Despite the global market's flat performance amid geopolitical tensions and rising Fed interest rate deliberations, BigBear.ai's significant 30% gain over the last quarter was likely influenced by the positive client announcements, including collaborations for military and shipbuilding AI applications. Earnings improvements and operational efficiency, along with pivotal partnerships, provided a solid foundation amidst an otherwise cautious market environment.

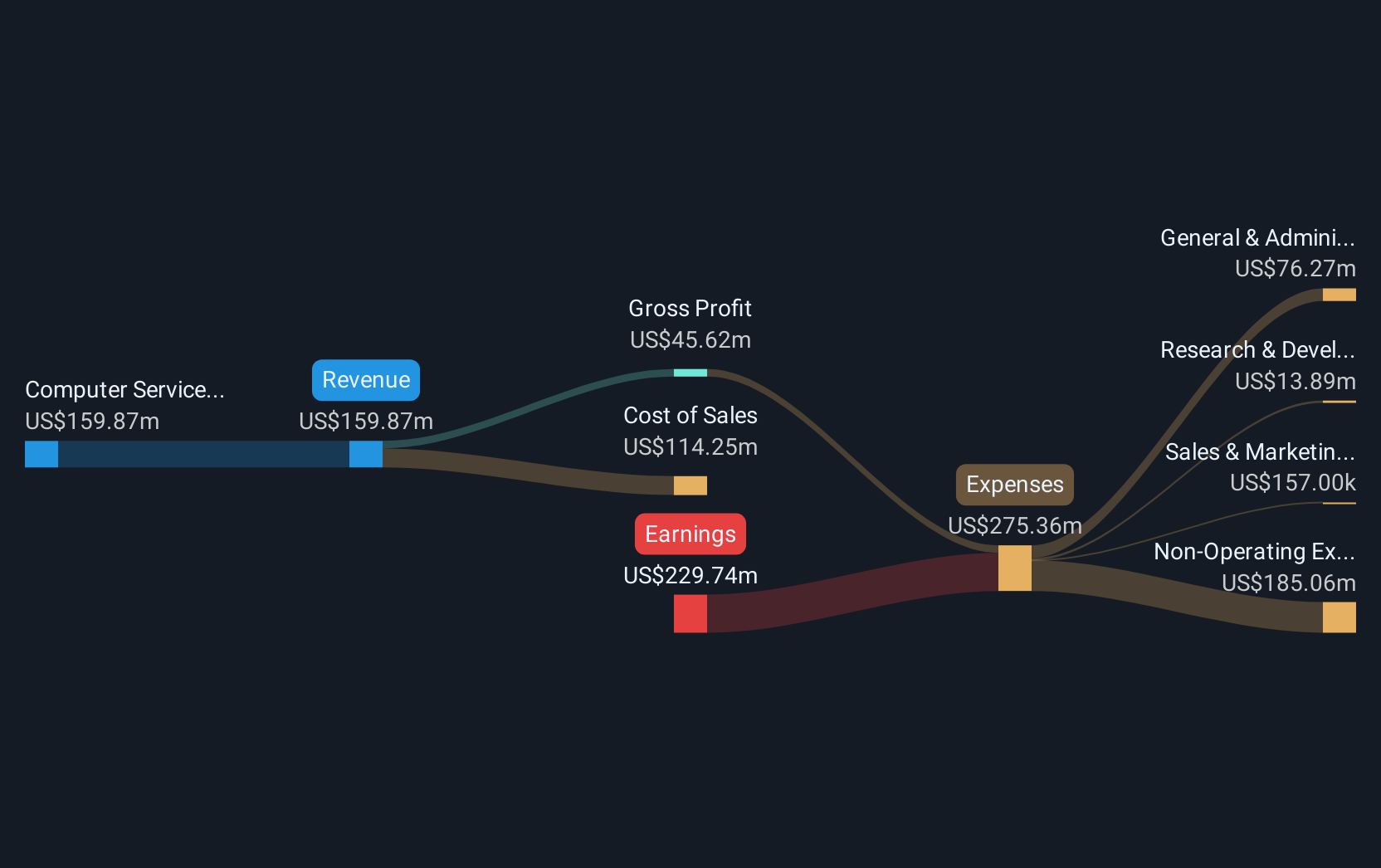

The recent deployment of BigBear.ai Holdings' biometric software in key travel hubs underscores the company's strategy to enhance its international footprint and security solutions. This initiative aligns with their broader focus on establishing regional partnerships and pursuing government contracts, potentially increasing revenue streams. Such developments may also bolster earnings forecasts as the company continues to leverage AI-driven solutions like Pangiam and veriScan to meet security and efficiency demands. However, analysts' consensus suggests that despite these promising moves, profitability remains a distant goal, with earnings expected to improve but still not meet positive thresholds in the near term.

Over the past year, BigBear.ai shares have demonstrated significant volatility, achieving a remarkable total shareholder return of 213.95%. This performance outpaces both the broader US Market and the IT industry's one-year returns of 9.8% and 39.2% respectively. Despite this robust short-term performance, the analyst price target of US$4.83 remains only 22% above the current share price of US$3.77, reflecting a mix of optimism tempered with caution. The disparity between the longer-term surge and short-term market assessments suggests that while BigBear.ai is making strides in its strategic plans, the market remains cautiously optimistic about its ability to sustain this growth over the longer term.

Understand BigBear.ai Holdings' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet slight.

Market Insights

Community Narratives