- Hong Kong

- /

- Energy Services

- /

- SEHK:3337

Belle And 2 Other Promising Penny Stocks In Global

Reviewed by Simply Wall St

Global markets have recently experienced a surge, buoyed by expectations of interest rate cuts and optimism surrounding artificial intelligence advancements. Amid these developments, investors are increasingly looking beyond established names to explore opportunities in lesser-known sectors. Penny stocks, a term that may seem outdated but remains relevant, often refer to smaller or newer companies offering potential growth at lower price points. When backed by strong financials and solid fundamentals, these stocks can present attractive opportunities for those willing to explore this niche market segment.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.57 | HK$983.45M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$415.94M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.64 | MYR325.43M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$1.97B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.39 | MYR558.16M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.20 | SGD12.59B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.575 | $334.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.225 | £195.02M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.904 | €30.49M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,723 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Belle (PSE:BEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Belle Corporation is involved in real estate development both in the Philippines and internationally, with a market cap of ₱13.38 billion.

Operations: The company's revenue is derived from two main segments: Gaming and Gaming Related Activities, which generated ₱2.63 billion, and Real Estate Development and Property Management, contributing ₱3.03 billion.

Market Cap: ₱13.38B

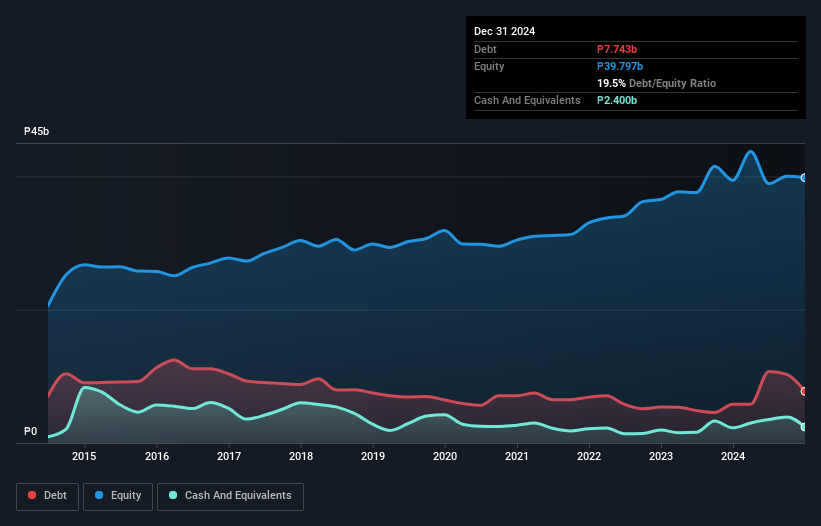

Belle Corporation has shown a strong financial footing with short-term assets of ₱13 billion surpassing both its short and long-term liabilities. Despite a decline in recent quarterly revenue to ₱1,172.7 million, the company maintains robust earnings growth at 39.2% over the past year, outpacing its five-year average and industry peers. The net profit margin improved significantly to 42.6%. While trading below estimated fair value suggests potential upside, investors should note the unstable dividend history and low return on equity at 6%. Debt levels are manageable with satisfactory coverage by operating cash flow and EBIT.

- Click to explore a detailed breakdown of our findings in Belle's financial health report.

- Examine Belle's past performance report to understand how it has performed in prior years.

Luzhou Bank (SEHK:1983)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. operates in the People’s Republic of China, offering corporate and retail banking services as well as financial market solutions, with a market cap of HK$6.44 billion.

Operations: Luzhou Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$6.44B

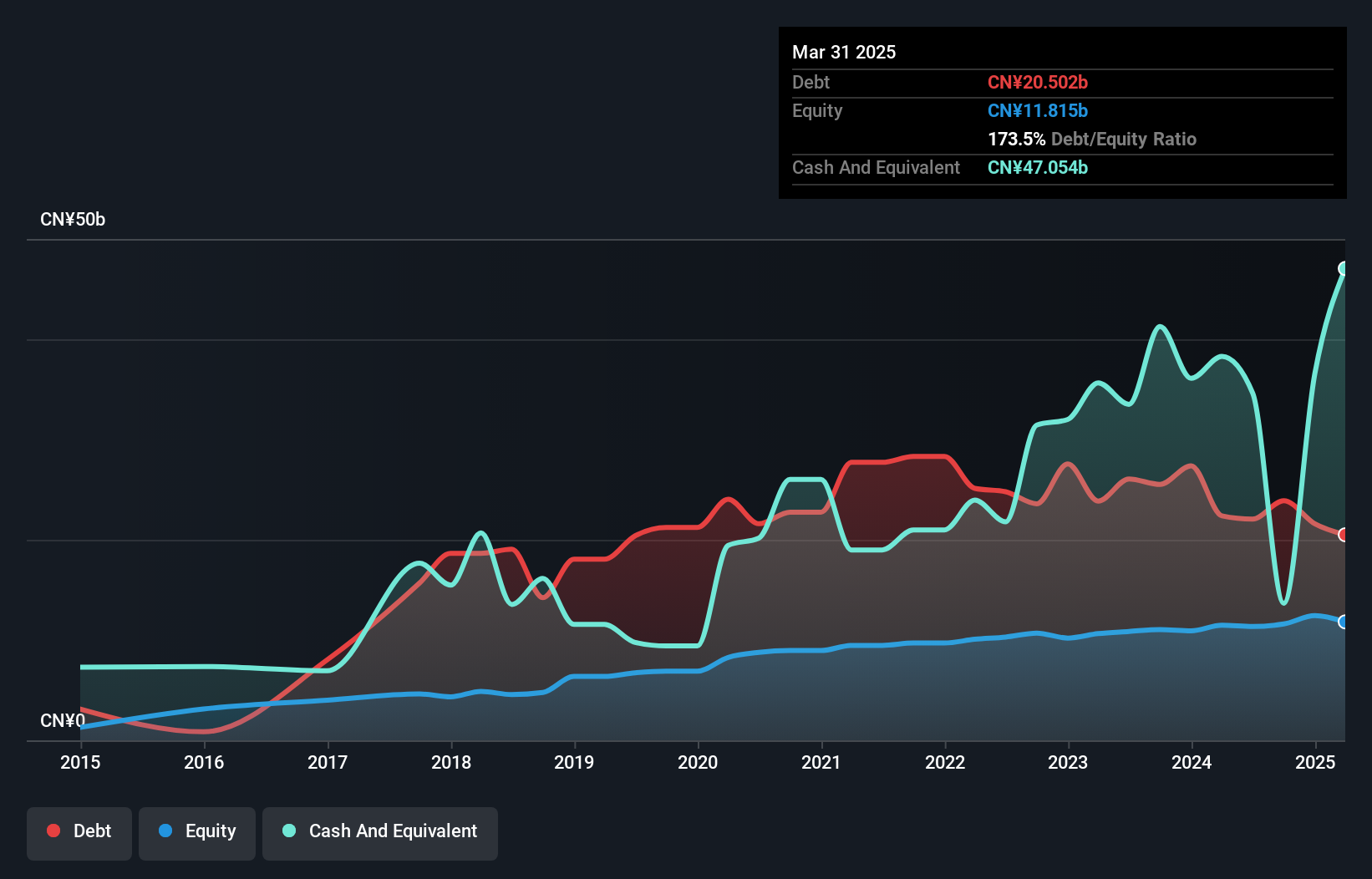

Luzhou Bank Co., Ltd. displays a solid financial profile with net income reaching CNY 902.49 million for the first half of 2025, reflecting an increase from the previous year. The bank's earnings growth of 23.5% over the past year surpasses its five-year average and industry benchmarks, indicating strong performance momentum. It maintains a stable loans-to-deposits ratio at 73%, suggesting prudent financial management, while its allowance for bad loans is more than sufficient at over four times potential losses, highlighting risk management capabilities. However, it trades significantly below estimated fair value and has a low return on equity at 10.5%.

- Unlock comprehensive insights into our analysis of Luzhou Bank stock in this financial health report.

- Assess Luzhou Bank's previous results with our detailed historical performance reports.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that provides integrated oilfield technology services in China, Iraq, and internationally, with a market cap of HK$3.83 billion.

Operations: The company's revenue is primarily derived from Oilfield Technical Services (CN¥2.35 billion), Oilfield Management Services (CN¥1.95 billion), Inspection Services (CN¥457.55 million), and Drilling Rig Services (CN¥452.38 million).

Market Cap: HK$3.83B

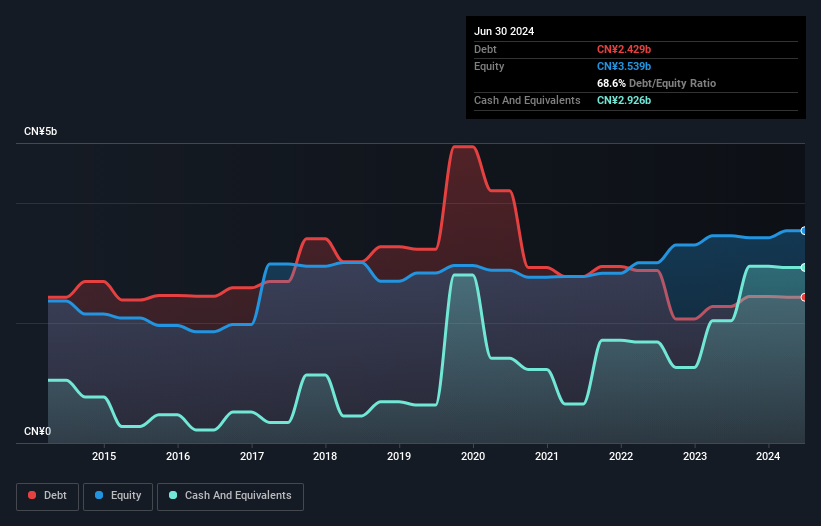

Anton Oilfield Services Group has demonstrated robust financial health with short-term assets of CN¥7.4 billion comfortably covering both short and long-term liabilities. The company reported significant earnings growth, with net income rising to CN¥165.14 million for the first half of 2025, driven by business expansion and reduced finance costs following bond repayments. Despite a low return on equity at 8.5%, Anton's debt is well-managed, evidenced by a satisfactory net debt to equity ratio of 5.8% and strong interest coverage from EBIT at 7.6 times payments, reflecting sound financial management in the penny stock domain.

- Get an in-depth perspective on Anton Oilfield Services Group's performance by reading our balance sheet health report here.

- Assess Anton Oilfield Services Group's future earnings estimates with our detailed growth reports.

Key Takeaways

- Reveal the 3,723 hidden gems among our Global Penny Stocks screener with a single click here.

- Ready For A Different Approach? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3337

Anton Oilfield Services Group

An investment holding company, operates as an integrated oilfield technology services company in the People’s Republic of China, Iraq, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives