- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Be Sure To Check Out CME Group Inc. (NASDAQ:CME) Before It Goes Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see CME Group Inc. (NASDAQ:CME) is about to trade ex-dividend in the next 4 days. You will need to purchase shares before the 9th of March to receive the dividend, which will be paid on the 25th of March.

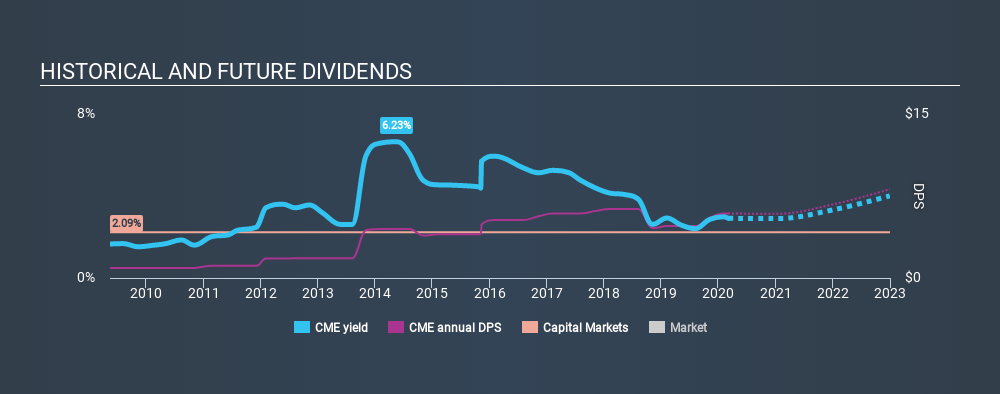

CME Group's next dividend payment will be US$0.85 per share, and in the last 12 months, the company paid a total of US$5.90 per share. Based on the last year's worth of payments, CME Group stock has a trailing yield of around 2.7% on the current share price of $216.12. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether CME Group has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for CME Group

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. CME Group paid out 51% of its earnings to investors last year, a normal payout level for most businesses.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Fortunately for readers, CME Group's earnings per share have been growing at 12% a year for the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. CME Group has delivered 20% dividend growth per year on average over the past ten years. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Has CME Group got what it takes to maintain its dividend payments? Earnings per share are growing nicely, and CME Group is paying out a percentage of its earnings that is around the average for dividend-paying stocks. CME Group ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

In light of that, while CME Group has an appealing dividend, it's worth knowing the risks involved with this stock. Case in point: We've spotted 2 warning signs for CME Group you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives