- United States

- /

- Capital Markets

- /

- NYSE:BK

Bank of New York Mellon (NYSE:BK) Eyes Northern Trust for Potential Takeover Discussions

Reviewed by Simply Wall St

Recent speculation about a potential takeover of Northern Trust by the Bank of New York Mellon (NYSE:BK) has generated market interest, though Northern Trust has reaffirmed its commitment to staying independent. During the same period, Bank of New York Mellon's stock increased by almost 8% over the last quarter. This rise aligns closely with the broader market's performance, which grew significantly over the past year. Factors such as executive changes, product enhancements, and financial strengthening through debt financing have contributed to the company's positive momentum, counterbalancing any negative impact from legal issues faced by the company.

Bank of New York Mellon has 1 possible red flag we think you should know about.

The recent speculation about a potential takeover of Northern Trust by Bank of New York Mellon (BNY Mellon) could influence investor perceptions, potentially impacting the company's strategic positioning and operational forecasts. While BNY Mellon maintains its independence, the news could affect short-term investor sentiment and result in increased volatility in its stock price. Over the past five years, BNY Mellon's total shareholder return, including dividends, achieved 182.17%, showcasing significant growth for investors during this period. This long-term performance context is important for understanding its trajectory compared to the broader market.

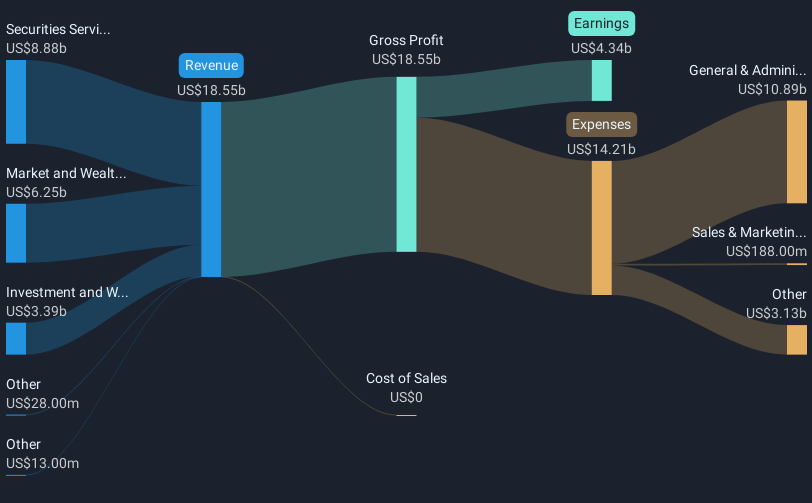

In the past year, BNY Mellon's stock outpaced both the US Market and the Capital Markets industry, which returned 12.2 and 30.9 percent, respectively. This indicates a relatively strong comparative performance in the shorter term. The news also has potential ramifications for revenue and earnings forecasts. With a platforms-oriented strategy and AI initiatives, the company aims to enhance operational efficiency and client engagement. However, any significant corporate developments could alter these projections by influencing client behavior or market confidence.

Currently, BNY Mellon's share price sits at US$82.91, offering an 8.9% discount to the consensus price target of US$91. This suggests that analysts see modest upside potential, reflecting cautious optimism about the company's future growth. Investors should consider how news of acquisitions or strategic changes might affect these projections, the company's current valuation, and its longer-term performance against industry benchmarks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives