- United States

- /

- Capital Markets

- /

- NYSE:BK

Bank of New York Mellon (NYSE:BK) Announces 13% Dividend Increase to US$0.53 per Share

Reviewed by Simply Wall St

The Bank of New York Mellon (NYSE:BK) has announced plans to increase its quarterly cash dividend by 13%, reflecting a concerted effort to enhance shareholder value, while its stock price saw a movement of 8% over the last quarter. This dividend announcement, alongside solid earnings reports and an aggressive share buyback program, might have contributed positively to the stock's recent performance. Additionally, the inclusion of BK in several Russell indices could have bolstered investor optimism. Overall, these company-specific developments provided a complement to broader market trends, with the index up by 14% over the past year.

You should learn about the 1 weakness we've spotted with Bank of New York Mellon.

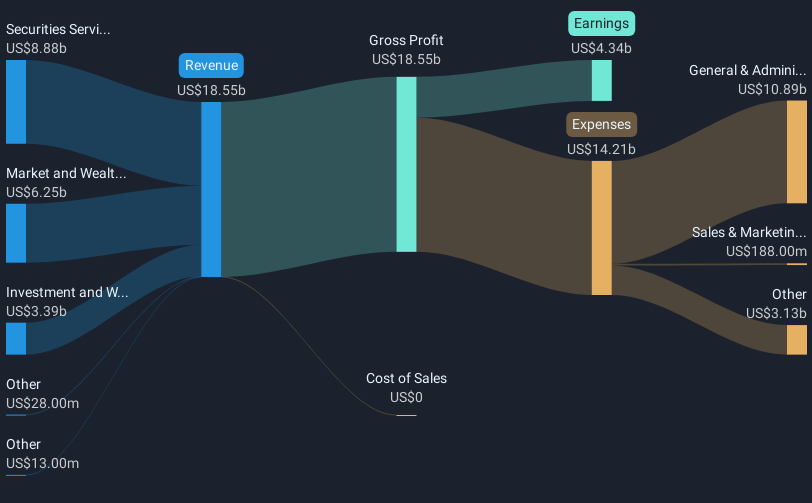

The recent announcement by Bank of New York Mellon about increasing its quarterly cash dividend by 13% highlights the company’s ongoing efforts to improve shareholder value. This move, in conjunction with solid earnings reports and an aggressive share buyback program, supports the company’s platforms-oriented strategy aimed at boosting revenue and operational efficiency. Over the past five years, BNY Mellon stocks achieved a total return—a combination of share price appreciation and dividends—of 179.14%. This performance provides a substantial context for understanding management’s current initiatives to enhance long-term growth and profitability.

In the past year, BNY Mellon shares have demonstrated resilience by outperforming the US Capital Markets industry, which saw a return of 34.2%. The stock’s return has also exceeded broader market indicators. The recent inclusion in several Russell indices further strengthens investor confidence. As BNY Mellon integrates digital initiatives and AI to improve efficiency, earnings are forecasted to increase slightly, with analysts projecting earnings to reach US$5.4 billion by 2028. The company’s focus on AI and technology may drive revenue and earnings growth while counteracting any geopolitical or strategic execution risks.

With the stock priced at US$82.91, it remains below the consensus analyst price target of US$91.0, indicating an 8.9% discount. This suggests that, despite recent positive developments, there is room for appreciation if the company delivers on its transformation goals. Investors are encouraged to consider these factors and analyze the potential implications of BNY Mellon's strategies on its long-term revenue and earnings forecasts. The dividend increase and share buyback efforts could further support the stock's attractiveness compared to its industry and market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives