- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (BAC) Reports Higher Earnings and Slight Drop in Net Charge-Offs

Reviewed by Simply Wall St

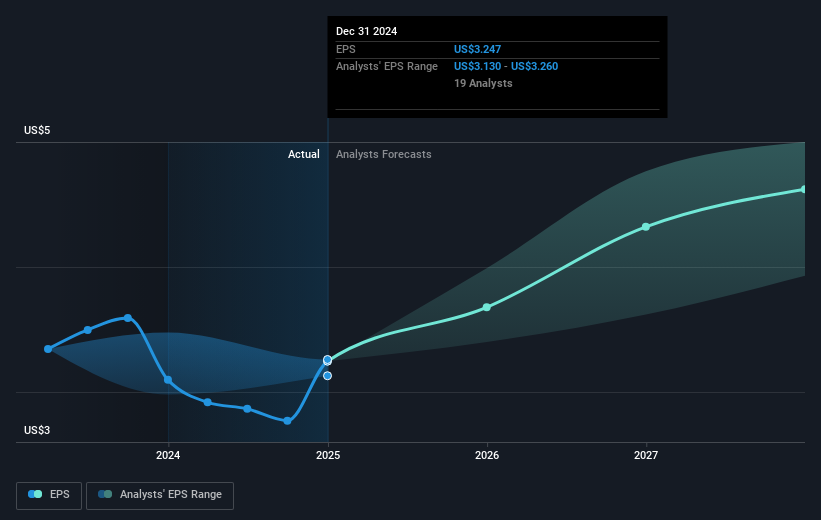

Bank of America (BAC) displayed strong financial performance in the latest quarter, reporting significant increases in net income and earnings per share compared to the previous year. The robust earnings announcement on July 16, 2025, alongside increased net interest income, arguably supported the company's stock price surge of 23% over the last quarter. The company’s strategic move to increase dividends, coupled with a slight reduction in net charge-offs, likely added further positive momentum. The market's broader positive trend, marked by record highs in major indices like the S&P 500 and Nasdaq, provided a conducive backdrop for BAC's impressive total shareholder return.

The recent robust financial performance by Bank of America (BAC) enhances the narrative of strengthening its position through digital engagement and credit diversification. The tangible impacts of increased net income and earnings per share observed in the latest quarter could support further revenue and earnings growth as the company continues its technological investments. This positive earnings outlook potentially bolsters the company's aim to fortify its credit portfolio and net margins despite current economic and policy challenges.

Over the longer term, BAC's shares have delivered a total return of 112.16% across the last five years, reflecting significant value creation for shareholders. However, it's noteworthy that BAC underperformed both the US Banks industry, which returned 18.4%, and the broader US market, which yielded a 12.4% return over the past year. This context highlights the potential for the recent earnings growth to bridge the performance gap relative to its peers.

The current share price of US$46.03 places it at a 14% discount to the consensus analyst price target of US$52.65, suggesting room for potential appreciation if the company continues on its current trajectory. Analysts foresee BAC's revenue growing at 6.5% annually over the coming three years and earnings reaching US$31 billion by 2028. These forecasts underpin the potential support for share price gains, contingent upon sustained performance aligning with projected growth rates.

Take a closer look at Bank of America's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives