- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (NasdaqGS:BKR) Expands Power And AI Ventures With New Deals In 2025

Reviewed by Simply Wall St

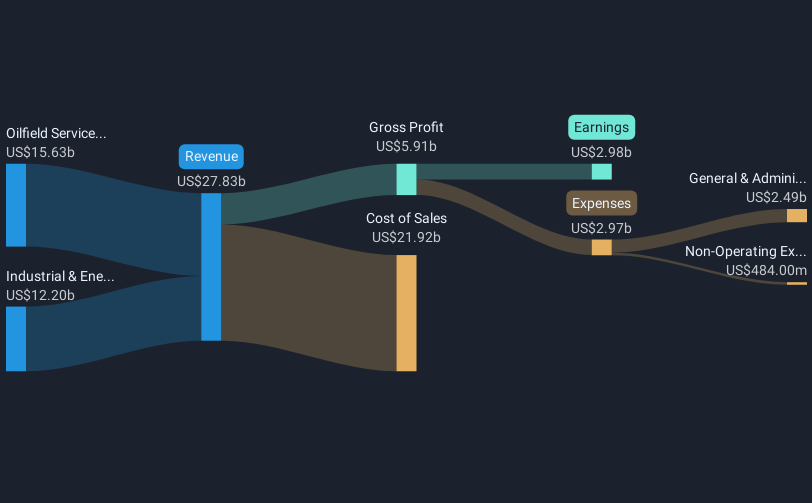

Baker Hughes (NasdaqGS:BKR) has made significant strides in expanding its technological and strategic alliances, as demonstrated by its recent agreement to supply Frontier Infrastructure Holdings with NovaLT™ gas turbines. This move aligns with their broader efforts, including expanding their joint venture with C3.ai to enhance AI solutions in the energy sector. Over the past month, the company's stock experienced a 1.3% increase, which mirrors the generally flat market conditions noted by the recent moves of major indices. While these positive developments likely added weight to Baker Hughes' stock movement, they aligned with broader market trends.

Buy, Hold or Sell Baker Hughes? View our complete analysis and fair value estimate and you decide.

The recent agreement between Baker Hughes and Frontier Infrastructure Holdings to supply NovaLT gas turbines could support the company's narrative by potentially boosting long-term revenue through rising gas-fired power demand. This move also complements Baker Hughes' joint ventures in AI energy solutions, potentially stabilizing its strategic position. Over the past five years, Baker Hughes has delivered a total shareholder return of 143.48%, reflecting significant growth beyond short-term fluctuations like the recent 1.3% share price increase. This longer-term performance contextualizes Baker Hughes' resilience and ability to capitalize on industry opportunities over extended periods.

In comparison to the broad market and the US Energy Services industry, Baker Hughes' recent annual return has been promising, exceeding both the US Energy Services industry's negative return and the US market's positive return over the past year. The stock's current price of US$36.4 remains below the analyst consensus price target of US$46.63, indicating potential upside based on projected revenue and earnings growth. However, ongoing challenges such as geopolitical tensions and price volatility could impact these forecasts. The recent strategic advances in technological alliances may mitigate some risks, offering avenues for revenue enhancements and margin improvements, aligning with analysts' projections of stable, albeit modest, growth.

Dive into the specifics of Baker Hughes here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion