- Canada

- /

- Metals and Mining

- /

- TSX:BTO

B2Gold (TSX:BTO) Reports Positive Feasibility Study For Gramalote With US$940 Million NPV

Reviewed by Simply Wall St

B2Gold (TSX:BTO) recently announced the successful results of a feasibility study for its Gramalote Gold Project in Colombia, which underscores its potential for strong economic returns and could have played a part in its 3% price increase over the last quarter. Additionally, the company's financial projections and strong community ties contribute positively to its image. Despite the broader market remaining flat and facing trade policy uncertainties, B2Gold's recent dividend affirmations and robust earnings announcements, including increased net income, likely supported investor confidence and added stability to its share price movement.

Over the past three years, B2Gold's total shareholder return, including dividends, was 32.52%. While this reflects a positive outcome over a longer-term horizon, the company's performance over the last year did not match the broader Canadian Metals and Mining industry, which saw returns of 27.4%. This suggests some improvement but indicates a need for further growth to meet industry peers in a shorter timeframe. Meanwhile, B2Gold matched the overall Canadian market, which returned 16.5% in the same period.

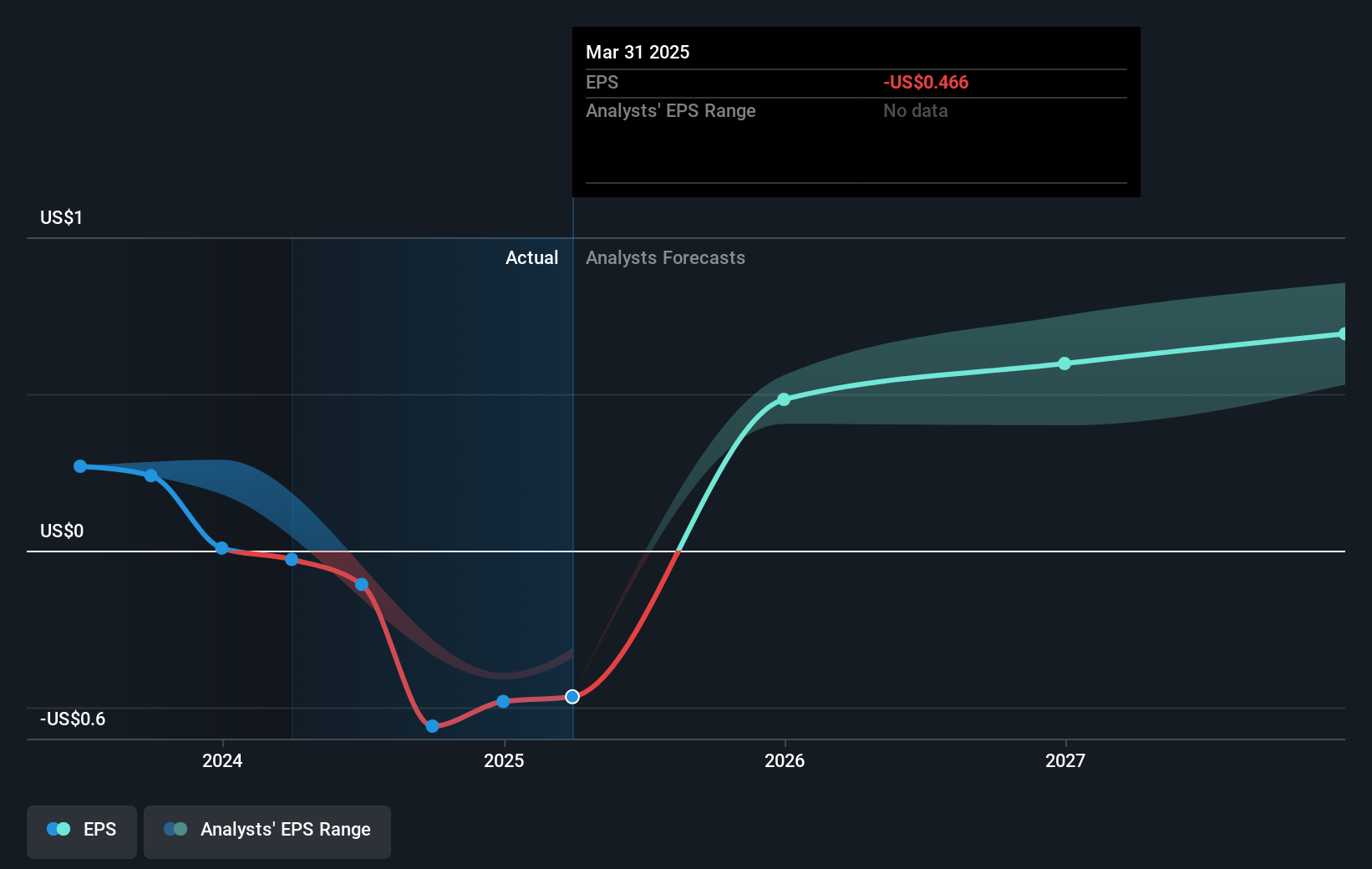

The recent feasibility study for the Gramalote Project, along with dividend affirmations and earnings improvement, potentially positions B2Gold for revenue and earnings growth. While current earnings are negative at US$612.06 million, forecasts predict significant profit growth over the next three years. However, B2Gold shares remain undervalued against the analyst consensus price target of CA$6.62. The current discount of approximately 38.54% from this target reflects investor caution, possibly tied to industry uncertainties and the company’s ongoing transition to profitability.

Get an in-depth perspective on B2Gold's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B2Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTO

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives