- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Aya Gold & Silver (TSX:AYA) Announces New High-Grade Silver Discoveries In Morocco

Reviewed by Simply Wall St

Aya Gold & Silver (TSX:AYA) recently announced the discovery of a new mineralized zone at their Zgounder Silver Mine in Morocco, highlighted by significant high-grade silver intersections from ongoing exploration efforts. This positive development likely supported the company's 20% share price appreciation over the past month. Meanwhile, the broader market saw record highs, with the S&P 500 and Nasdaq both continuing to climb, buoyed by favorable inflation data and expectations of interest rate adjustments. While Aya Gold & Silver's gains are aligned with this broader upward trend, the company's attractive exploration results added substantial depth to their market performance.

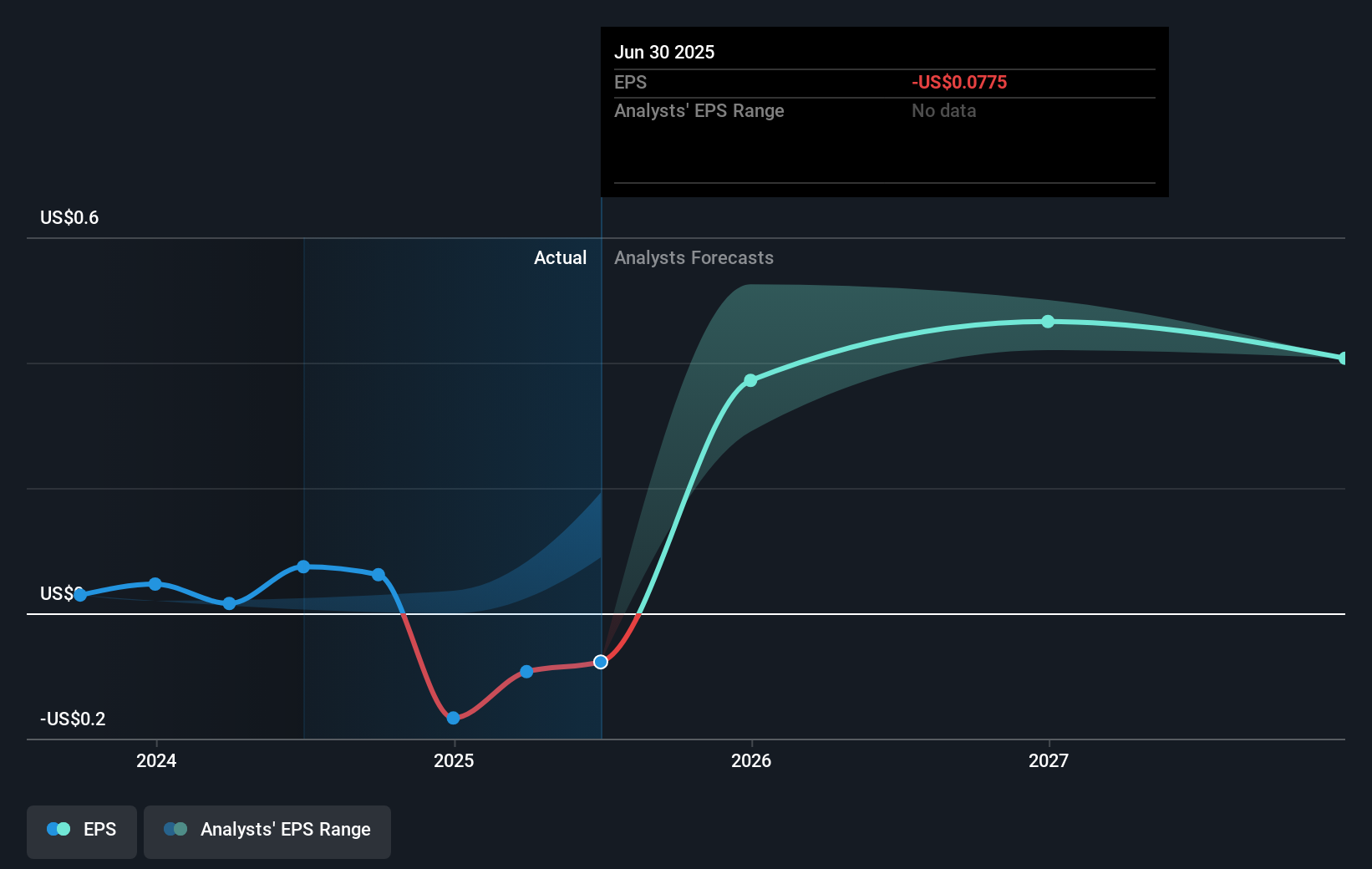

The recent discovery of a new mineralized zone at Aya Gold & Silver's Zgounder Silver Mine in Morocco is likely to positively influence the company's growth narrative, enhancing future revenue and earnings expectations. This exploration success aligns with Aya's strategy to ramp up production and reduce costs at Zgounder, potentially contributing to sustained revenue growth and higher profit margins. Analysts anticipate these operational improvements to elevate revenue over 26.8% annually, further supporting Aya's long-term financial trajectory.

Over the past five years, Aya Gold & Silver's total shareholder return, inclusive of share price and dividends, has experienced a significant 439.86% increase, indicating robust long-term growth. This performance contrasts with the past year, where Aya underperformed relative to the Canadian Metals and Mining industry, which returned 70.5%, and the broader Canadian market, which saw a 23% rise. The current price of CA$14.90 positions Aya at a 30.8% discount to the consensus analyst price target of CA$19.49, suggesting potential upside if the company achieves projected earnings growth and benefits from positive market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives