- United States

- /

- Gas Utilities

- /

- NYSE:ATO

Atmos Energy (ATO) Reports Strong Q3 Earnings and Raises 2025 Guidance

Reviewed by Simply Wall St

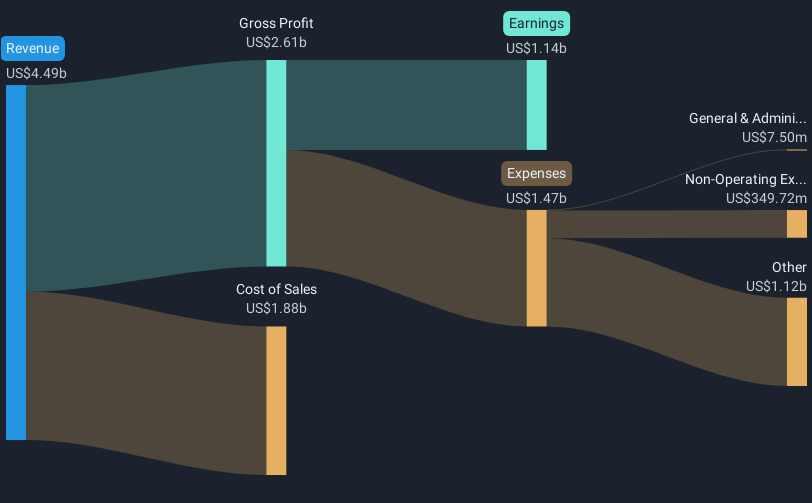

Atmos Energy (ATO) announced its third-quarter earnings results on August 6, 2025, showcasing a healthy increase in sales and net income compared to the previous year. The company also raised its earnings guidance for 2025, signaling confidence in its future financial performance. Additionally, Atmos Energy affirmed a quarterly dividend of 87 cents per share, marking its 167th consecutive quarterly dividend. Despite the broader market's fluctuation due to tariff-related concerns and mixed corporate earnings, Atmos Energy's share price moved up by 2.77% over the last month. These positive corporate announcements likely supported the company's share price amidst the prevailing market conditions.

Atmos Energy has 2 risks we think you should know about.

Atmos Energy's robust third-quarter earnings results and raised earnings guidance for 2025 signal a positive outlook, potentially bolstering its narrative of continued revenue stability and growth. Infrastructure improvements and customer satisfaction initiatives align with this narrative, possibly enhancing future earnings and supply reliability. The company's strategy to manage earnings growth through system modernization is underscored by these recent announcements, yet potential risks remain due to the high level of spending and regulatory uncertainties.

Over a five-year period, Atmos Energy's total shareholder return, including both share price appreciation and dividends, soared 69.85%, underscoring its sustained performance. Comparatively, over the last year, Atmos Energy exceeded the US Market, which returned 21.3%, and the US Gas Utilities industry, which returned 17.3%. This demonstrates the company's relative strength in shorter-term market conditions while maintaining long-term growth.

The recent share price movement of a 2.77% increase places Atmos Energy closer to the consensus analyst price target of US$164.45, representing a modest 4.73% discount to this target. Though a small gap exists, it suggests analysts view the current valuation as relatively appropriate, considering the expected earnings growth and profit margin improvements. The impact of recent earnings and guidance may continue to influence revenue and earnings forecasts positively, yet stakeholder caution remains prudent due to potential financial and regulatory challenges.

Review our growth performance report to gain insights into Atmos Energy's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATO

Atmos Energy

Engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives