- Australia

- /

- Auto Components

- /

- ASX:PWH

ASX Value Picks Including PointsBet Holdings And Two More Stocks Below Estimated Worth

Reviewed by Simply Wall St

As the ASX200 hit an all-time intra-day high of 8,827 points, investors observed significant activity across sectors like Materials, Energy, and Real Estate while Utilities lagged behind. In this buoyant market environment, identifying undervalued stocks can offer potential opportunities for growth; in this article, we explore PointsBet Holdings and two other stocks that may be trading below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vysarn (ASX:VYS) | A$0.525 | A$0.99 | 46.9% |

| Superloop (ASX:SLC) | A$3.32 | A$6.54 | 49.3% |

| SKS Technologies Group (ASX:SKS) | A$2.32 | A$4.22 | 45.1% |

| PointsBet Holdings (ASX:PBH) | A$1.21 | A$2.13 | 43.2% |

| Fenix Resources (ASX:FEX) | A$0.31 | A$0.51 | 39.2% |

| Collins Foods (ASX:CKF) | A$9.04 | A$15.95 | 43.3% |

| Charter Hall Group (ASX:CHC) | A$20.73 | A$36.21 | 42.8% |

| Austal (ASX:ASB) | A$7.37 | A$13.15 | 44% |

| archTIS (ASX:AR9) | A$0.205 | A$0.41 | 50% |

| Advanced Braking Technology (ASX:ABV) | A$0.093 | A$0.16 | 43.6% |

Let's dive into some prime choices out of the screener.

PointsBet Holdings (ASX:PBH)

Overview: PointsBet Holdings Limited operates a cloud-based platform offering sports, racing, and iGaming betting services in Australia with a market cap of A$407.57 million.

Operations: The company generates revenue from Canadian Trading at A$36.24 million and Australian Trading at A$216.01 million through its cloud-based technology platform.

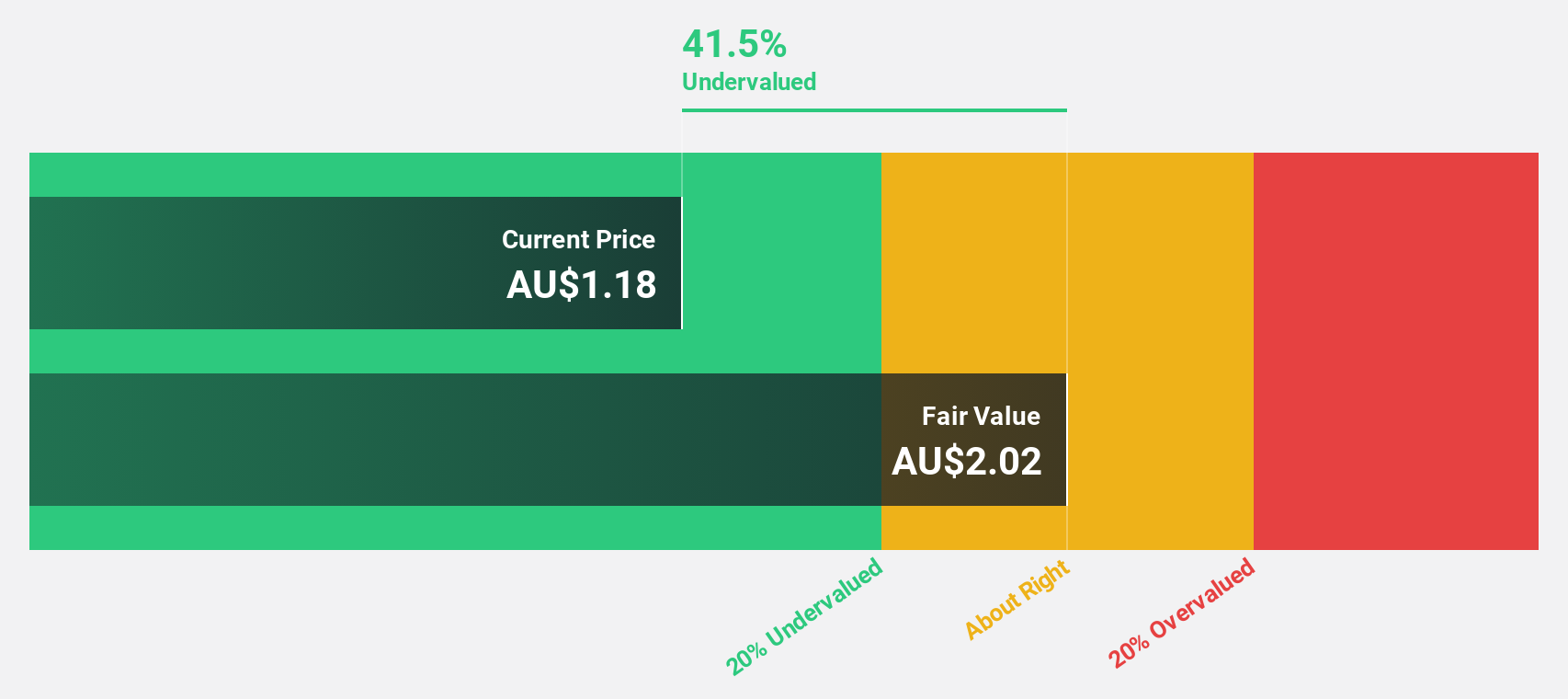

Estimated Discount To Fair Value: 43.2%

PointsBet Holdings is trading at A$1.21, significantly below its estimated fair value of A$2.13, indicating it may be undervalued based on cash flows. Despite a forecasted revenue growth rate of 10.5% per year, which is slower than the desired 20%, its earnings are expected to grow substantially at 112.8% annually, with profitability anticipated within three years. Recent investor activism highlights potential governance issues that could impact future valuations and operations.

- Our growth report here indicates PointsBet Holdings may be poised for an improving outlook.

- Get an in-depth perspective on PointsBet Holdings' balance sheet by reading our health report here.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in the design, prototyping, production, testing, validation, and sale of cooling products and solutions across Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, and other international markets with a market cap of A$815.57 million.

Operations: PWR Holdings generates revenue from two primary segments: PWR C&R, contributing A$46.48 million, and PWR Performance Products, adding A$109.04 million.

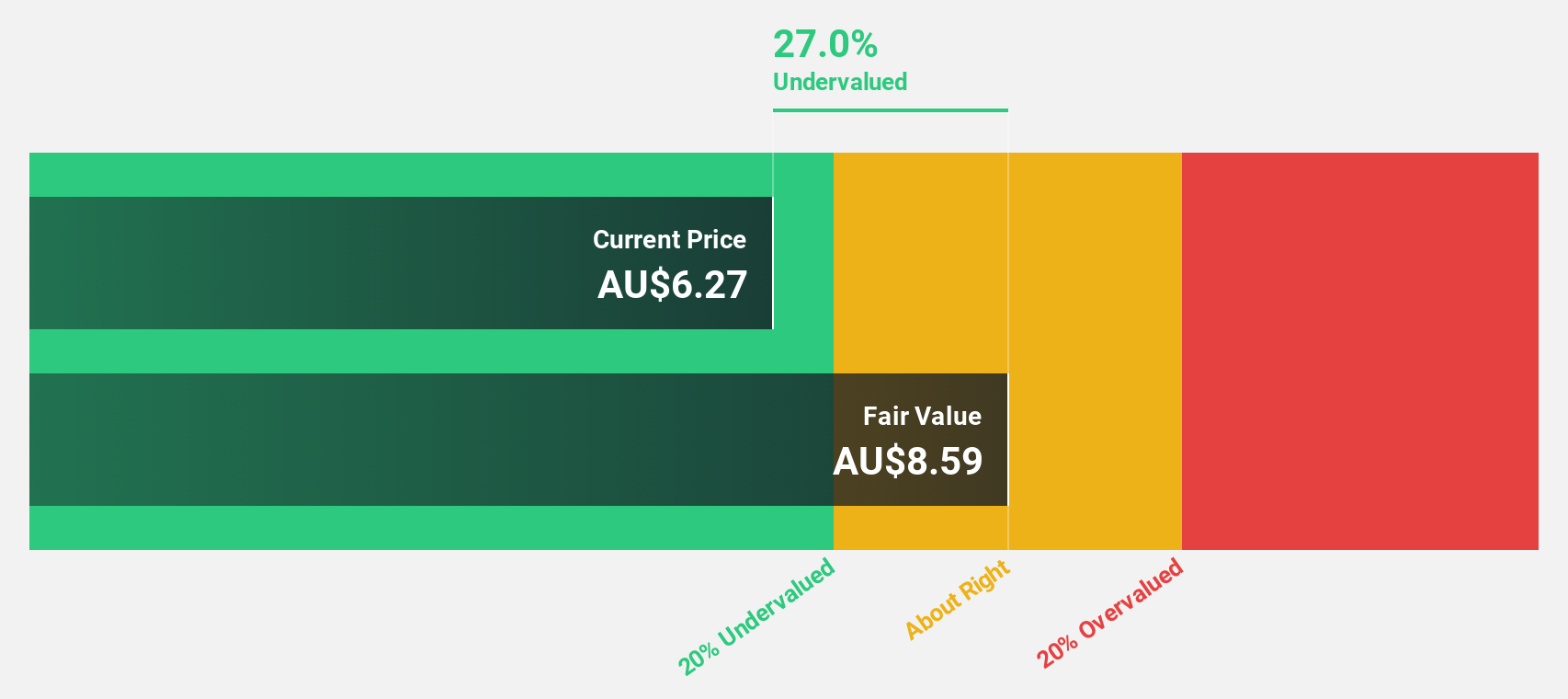

Estimated Discount To Fair Value: 21.2%

PWR Holdings, trading at A$8.11, is considered undervalued with a fair value estimate of A$10.3. The company's earnings are projected to grow at 22% annually, outpacing the broader Australian market's growth rate of 10.9%. Revenue growth is also expected to exceed the market average at 12.6% per year. Recent executive changes include founder Kees Weel transitioning to Non-Executive Chairman by October 2025 while a global search for a permanent CEO is underway.

- According our earnings growth report, there's an indication that PWR Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of PWR Holdings stock in this financial health report.

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and internationally, with a market cap of A$1.58 billion.

Operations: The company's revenue is primarily generated from its Business to Business Travel (B2B) segment, which accounts for A$328.40 million.

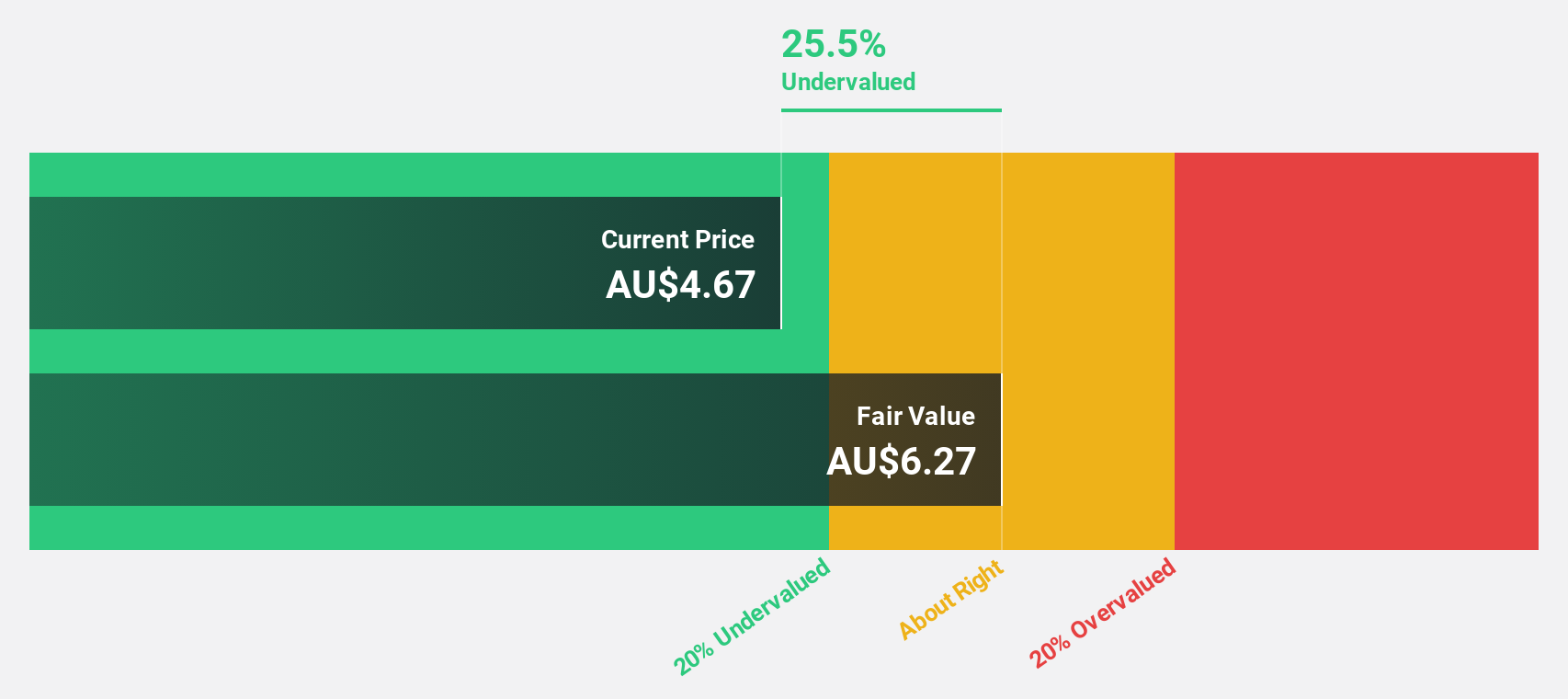

Estimated Discount To Fair Value: 32.2%

Web Travel Group, priced at A$4.37, is trading below its estimated fair value of A$6.45 by over 20%. The company's earnings are forecast to grow significantly at 31.9% annually, surpassing the market average of 10.9%, although revenue growth is slower than desired at 12% per year. Recent board changes include the addition of experienced directors Melanie Wilson and Paul Scurrah, enhancing governance as Brad Holman retires in September 2025.

- The growth report we've compiled suggests that Web Travel Group's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Web Travel Group's balance sheet health report.

Make It Happen

- Reveal the 32 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, Finland, Croatia, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives