- Australia

- /

- Construction

- /

- ASX:DUR

ASX Value Insights Duratec And Two More Stocks Possibly Below Fair Value

Reviewed by Simply Wall St

As the Australian market navigates a mixed landscape, with materials stocks surging on the back of rising gold and rare earth prices while defence stocks dip following peace developments in the Middle East, investors are keenly observing sectors for potential opportunities. In such a fluctuating environment, identifying undervalued stocks like Duratec and others can offer promising prospects for those seeking to capitalize on discrepancies between current stock prices and perceived fair value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.09 | A$5.67 | 45.5% |

| Resimac Group (ASX:RMC) | A$1.155 | A$2.18 | 47% |

| Pantoro Gold (ASX:PNR) | A$6.25 | A$10.91 | 42.7% |

| NRW Holdings (ASX:NWH) | A$4.95 | A$9.22 | 46.3% |

| Liontown Resources (ASX:LTR) | A$1.08 | A$2.08 | 48.1% |

| Immutep (ASX:IMM) | A$0.29 | A$0.49 | 41.2% |

| Electro Optic Systems Holdings (ASX:EOS) | A$6.89 | A$13.19 | 47.7% |

| Cynata Therapeutics (ASX:CYP) | A$0.23 | A$0.44 | 47.5% |

| Credit Clear (ASX:CCR) | A$0.26 | A$0.47 | 44.4% |

| CleanSpace Holdings (ASX:CSX) | A$0.73 | A$1.41 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

Duratec (ASX:DUR)

Overview: Duratec Limited, listed as ASX:DUR, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure in Australia with a market cap of A$535.48 million.

Operations: Duratec's revenue is primarily derived from its key segments: Defence (A$181.36 million), Mining & Industrial (A$136.65 million), Buildings & Facades (A$111.87 million), and Energy (A$82.51 million).

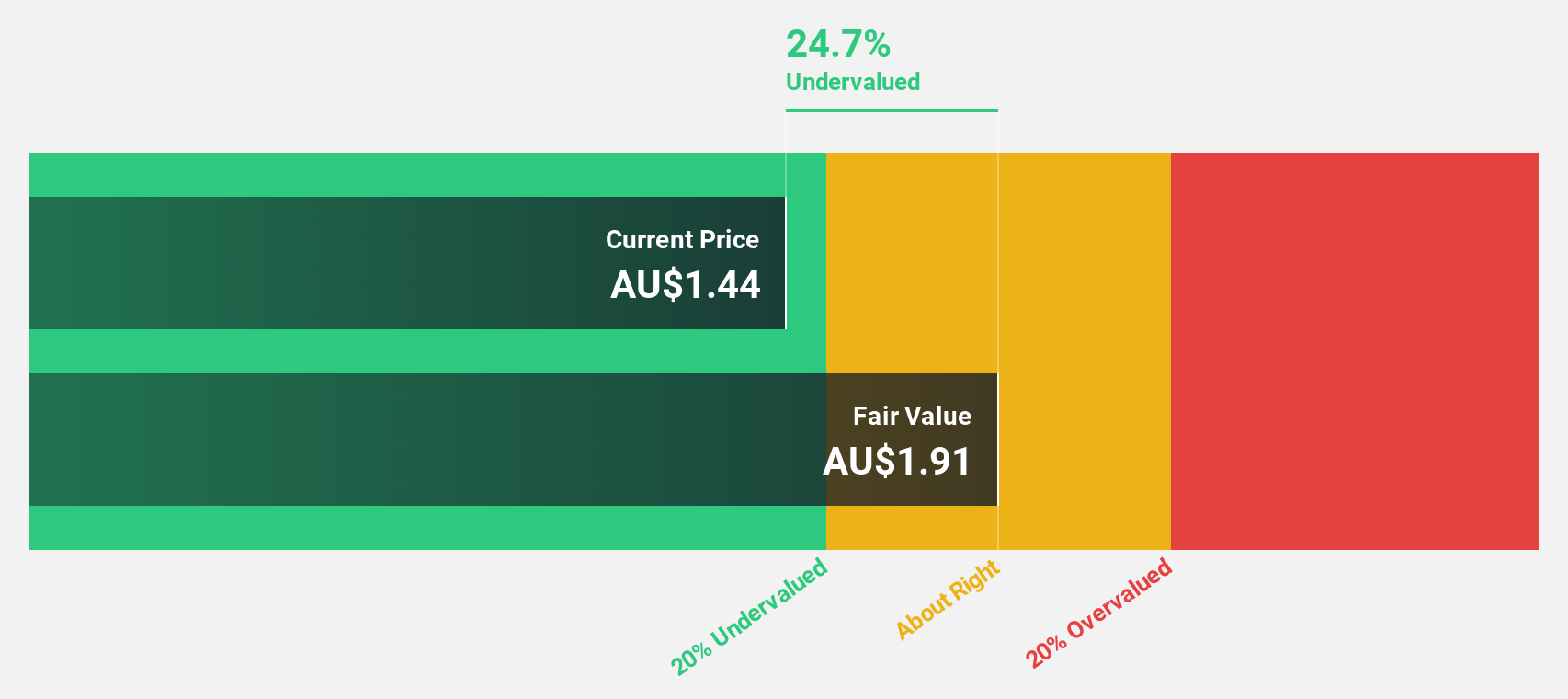

Estimated Discount To Fair Value: 15.5%

Duratec is trading at A$2.08, approximately 15.5% below its estimated fair value of A$2.46, suggesting it may be undervalued based on cash flows. The company's revenue growth forecast of 8.1% annually outpaces the Australian market's 5.9%. Recent earnings showed modest improvement with sales reaching A$573 million and net income at A$22.83 million for the year ended June 2025, reflecting stable financial health despite significant insider selling recently observed.

- Our comprehensive growth report raises the possibility that Duratec is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Duratec's balance sheet health report.

Lovisa Holdings (ASX:LOV)

Overview: Lovisa Holdings Limited operates in the retail sector, focusing on the sale of fashion jewelry and accessories, with a market capitalization of A$4.20 billion.

Operations: The company's revenue primarily comes from the retail sale of fashion jewelry and accessories, amounting to A$798.13 million.

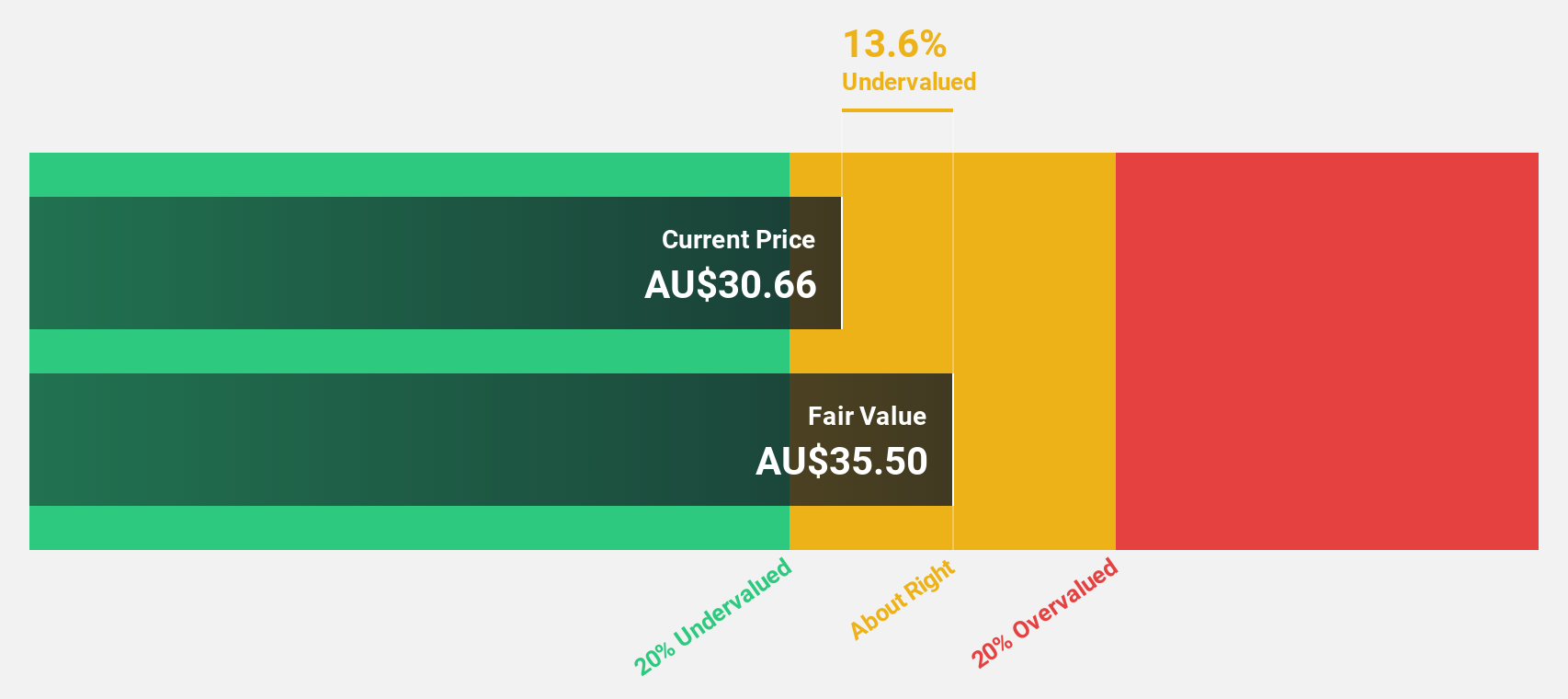

Estimated Discount To Fair Value: 15%

Lovisa Holdings is trading at A$37.95, below its estimated fair value of A$44.67, indicating potential undervaluation based on cash flows. The company reported sales of A$798.13 million and net income of A$86.33 million for the year ending June 2025, with earnings per share increasing to A$0.781 from the previous year. Revenue is forecast to grow at 12.7% annually, outpacing the market's 5.9%, while high return on equity is expected in three years.

- Insights from our recent growth report point to a promising forecast for Lovisa Holdings' business outlook.

- Click here to discover the nuances of Lovisa Holdings with our detailed financial health report.

Pantoro Gold (ASX:PNR)

Overview: Pantoro Gold Limited, with a market cap of A$2.46 billion, is involved in gold mining, processing, and exploration activities in Western Australia through its subsidiaries.

Operations: The company's revenue is primarily derived from the Norseman Gold Project, which generated A$357.30 million.

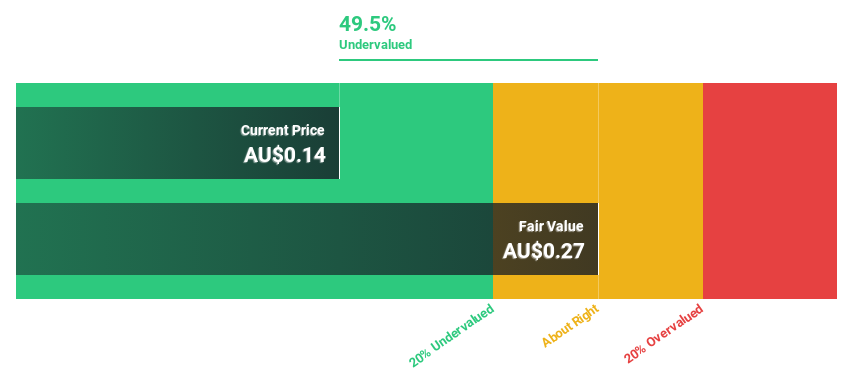

Estimated Discount To Fair Value: 42.7%

Pantoro Gold is trading at A$6.25, significantly below its estimated fair value of A$10.91, highlighting potential undervaluation based on cash flows. The company reported a net income of A$56.66 million for the year ending June 2025, reversing from a previous net loss. Forecasts show revenue growth at 22.3% annually, outpacing the broader Australian market's growth rate and supporting its strong earnings trajectory despite recent insider selling activity.

- Our growth report here indicates Pantoro Gold may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Pantoro Gold.

Turning Ideas Into Actions

- Embark on your investment journey to our 31 Undervalued ASX Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets primarily for steel and concrete infrastructure in Australia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives