- Australia

- /

- Metals and Mining

- /

- ASX:STK

ASX Penny Stocks Worth Watching In July 2025

Reviewed by Simply Wall St

The Australian market has reached a new all-time closing high, driven by strong performances in the mining and real estate sectors, amid expectations of a potential interest rate cut by the Reserve Bank of Australia. As investors navigate this dynamic landscape, penny stocks continue to offer intriguing opportunities for those seeking value and growth potential. Despite being an older term, penny stocks represent smaller or newer companies that can provide significant returns when backed by solid financials. In this article, we'll explore three noteworthy penny stocks on the ASX that stand out for their financial strength and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.42 | A$114.16M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.765 | A$466.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.68 | A$867.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$828.23M | ✅ 5 ⚠️ 3 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.57 | A$169.4M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 474 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Hansen Technologies (ASX:HSN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hansen Technologies Limited develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$998.59 million.

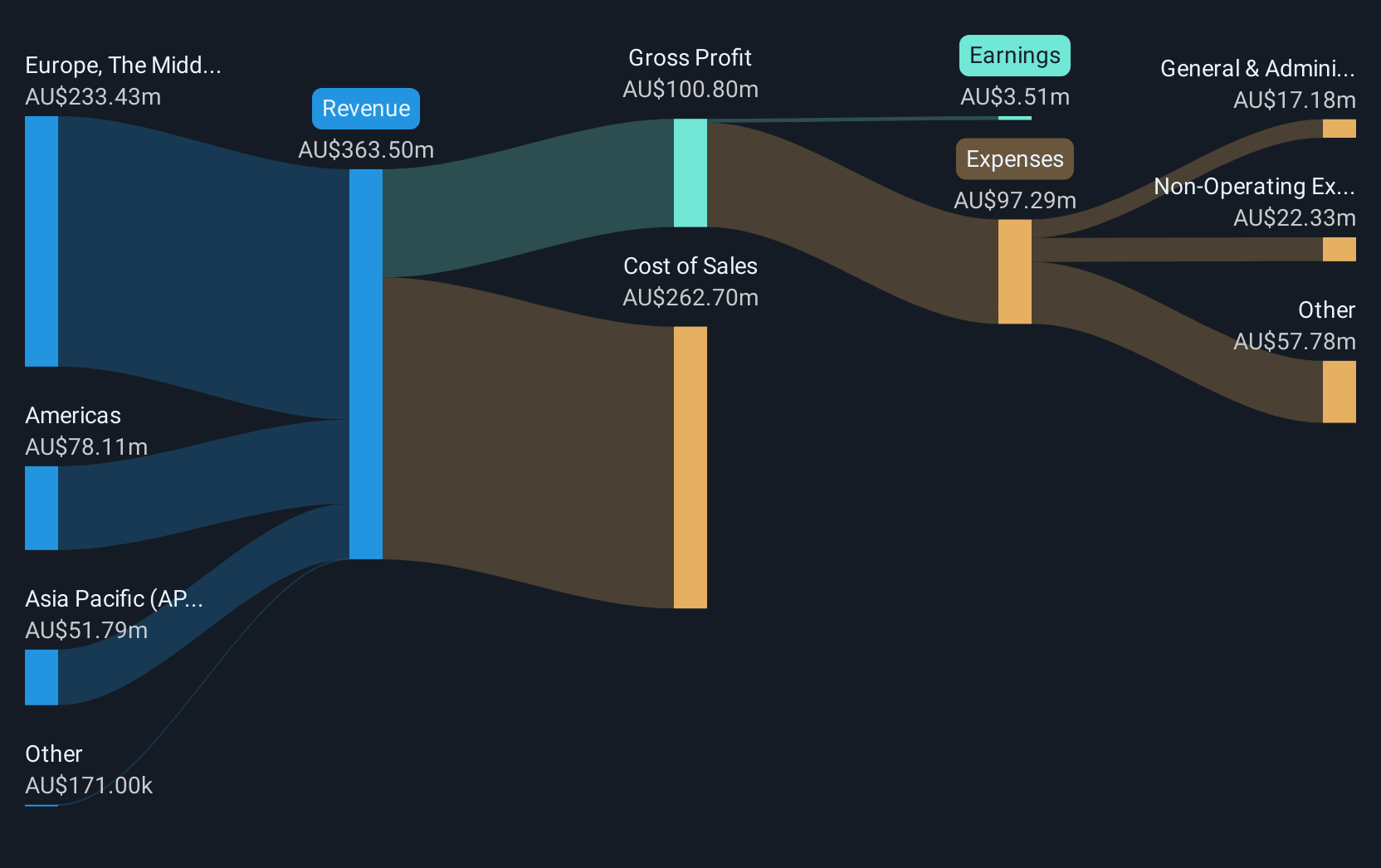

Operations: The company's revenue is derived from three main geographical segments: Americas contributing A$78.11 million, Asia Pacific (APAC) with A$51.79 million, and Europe, The Middle East and Africa (EMEA) generating A$233.43 million.

Market Cap: A$998.59M

Hansen Technologies, with a market cap of A$998.59 million, has shown financial stability through strong interest coverage by EBIT and satisfactory debt levels. However, its return on equity is low at 1%, and earnings have declined over recent years. Despite this, the company is actively involved in significant transformation projects with major clients like Telefonica Germany and DIRECTV Latin America, emphasizing cloud-native solutions to enhance scalability and efficiency. These partnerships highlight Hansen's strategic focus on digital transformation in competitive markets, potentially positioning it for future growth despite current financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Hansen Technologies.

- Explore Hansen Technologies' analyst forecasts in our growth report.

Melbana Energy (ASX:MAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Melbana Energy Limited is involved in oil and gas exploration in Cuba and Australia, with a market cap of A$80.88 million.

Operations: Melbana Energy Limited does not report any specific revenue segments.

Market Cap: A$80.88M

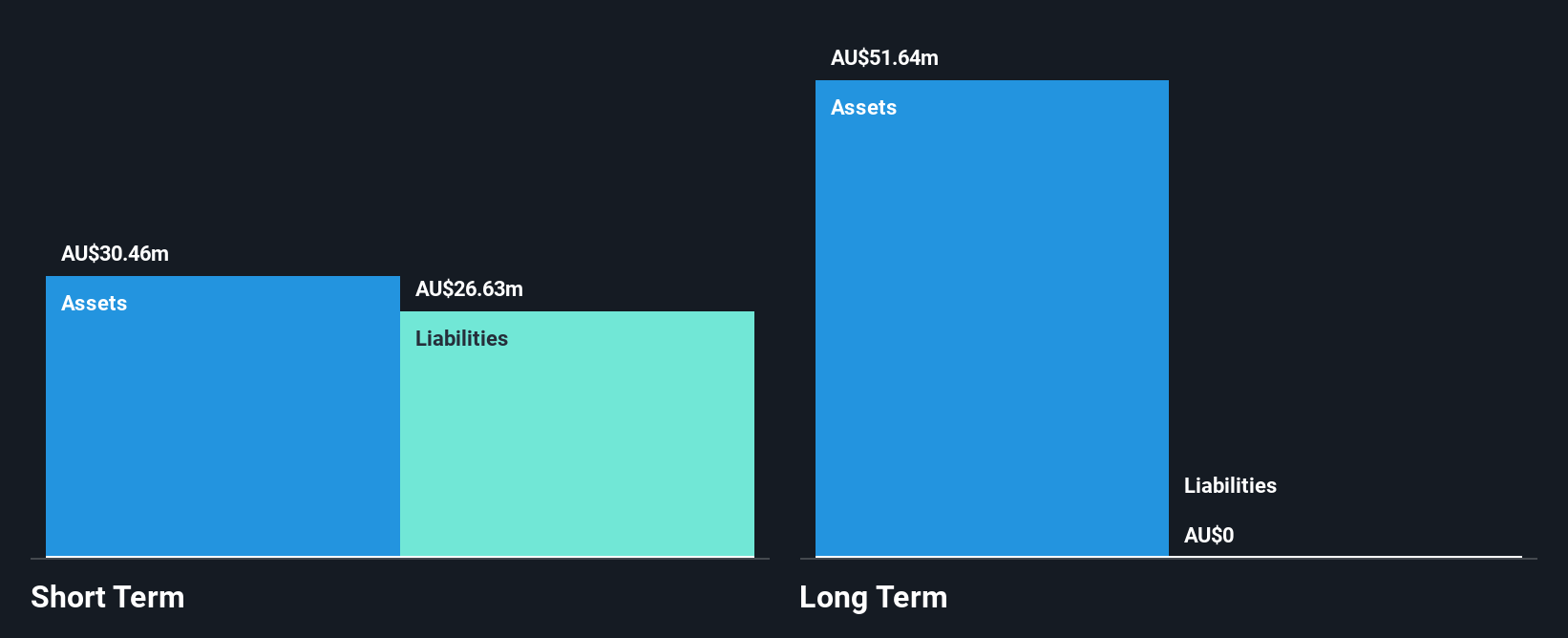

Melbana Energy, with a market cap of A$80.88 million, operates in oil and gas exploration in Cuba and Australia. The company is pre-revenue, making it speculative but potentially rewarding for investors seeking high-risk opportunities. It has no debt or long-term liabilities, alleviating concerns about financial leverage. The management team is experienced with an average tenure of 2.7 years, while the board's tenure averages 10 years, suggesting stability at the leadership level. Recent profitability marks a significant milestone; however, its return on equity remains low at 3.6%, indicating room for improvement in generating shareholder value.

- Click to explore a detailed breakdown of our findings in Melbana Energy's financial health report.

- Review our historical performance report to gain insights into Melbana Energy's track record.

Strickland Metals (ASX:STK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Strickland Metals Limited is involved in the exploration of mineral resources in Australia, with a market cap of A$320.08 million.

Operations: Strickland Metals Limited has not reported any revenue segments.

Market Cap: A$320.08M

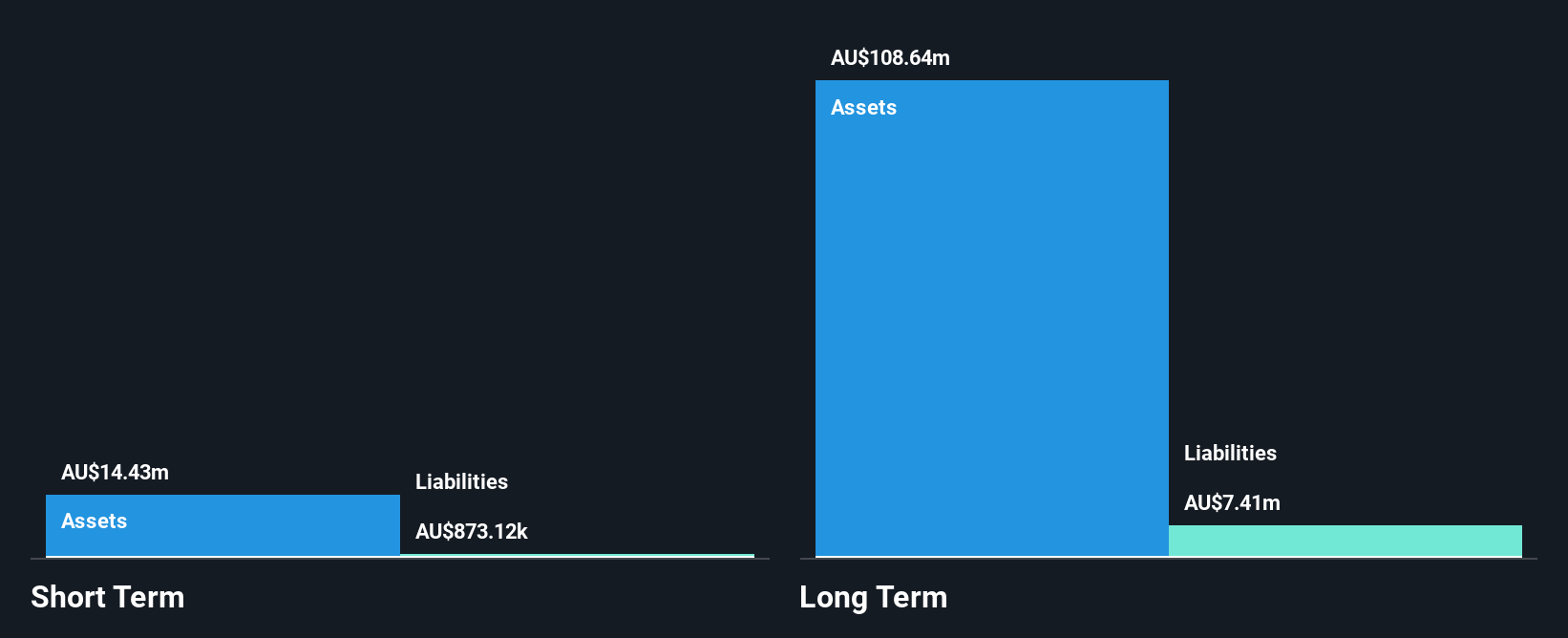

Strickland Metals Limited, with a market cap of A$320.08 million, is pre-revenue and currently unprofitable. The company has no debt, which reduces financial risk, and its short-term assets significantly exceed both short- and long-term liabilities. However, the management team and board are relatively inexperienced with an average tenure of 1.1 years each. Despite stable weekly volatility at 11%, earnings are expected to decline by an average of 46.3% annually over the next three years. Recent community initiatives in Serbia highlight efforts toward environmental sustainability but do not directly impact financial performance or profitability prospects.

- Get an in-depth perspective on Strickland Metals' performance by reading our balance sheet health report here.

- Evaluate Strickland Metals' prospects by accessing our earnings growth report.

Make It Happen

- Explore the 474 names from our ASX Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STK

Strickland Metals

Engages in the exploration of mineral resources in Australia.

Excellent balance sheet slight.

Market Insights

Community Narratives