- Australia

- /

- Specialty Stores

- /

- ASX:AX1

ASX Penny Stocks Under A$2B Market Cap To Watch

Reviewed by Simply Wall St

Australian shares are anticipated to open modestly higher, buoyed by a slight uptick despite mixed signals from Wall Street and fluctuating U.S. economic data. In this context, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or emerging companies with potential value. By focusing on those with strong financials and growth prospects, investors can uncover promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.715 | A$226.78M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.83 | A$147.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.88 | A$1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.52 | A$71.7M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.60 | A$400.87M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.49 | A$165.6M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.30 | A$773.18M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$3.13 | A$732.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.705 | A$450.82M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,000 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Aims Property Securities Fund (ASX:APW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aims Property Securities Fund, with a market cap of A$133.11 million, is a close-ended fund of funds launched by MacArthurCook Ltd.

Operations: The fund generates revenue primarily from its AIMS Growth Investment Fund, which contributes A$86.51 million, alongside income from the AIMS Real Estate Opportunity Fund at A$1.70 million and the AIMS APAC REIT at A$0.74 million, while other segments such as Blackwall Limited and various property funds reflect negative contributions.

Market Cap: A$133.11M

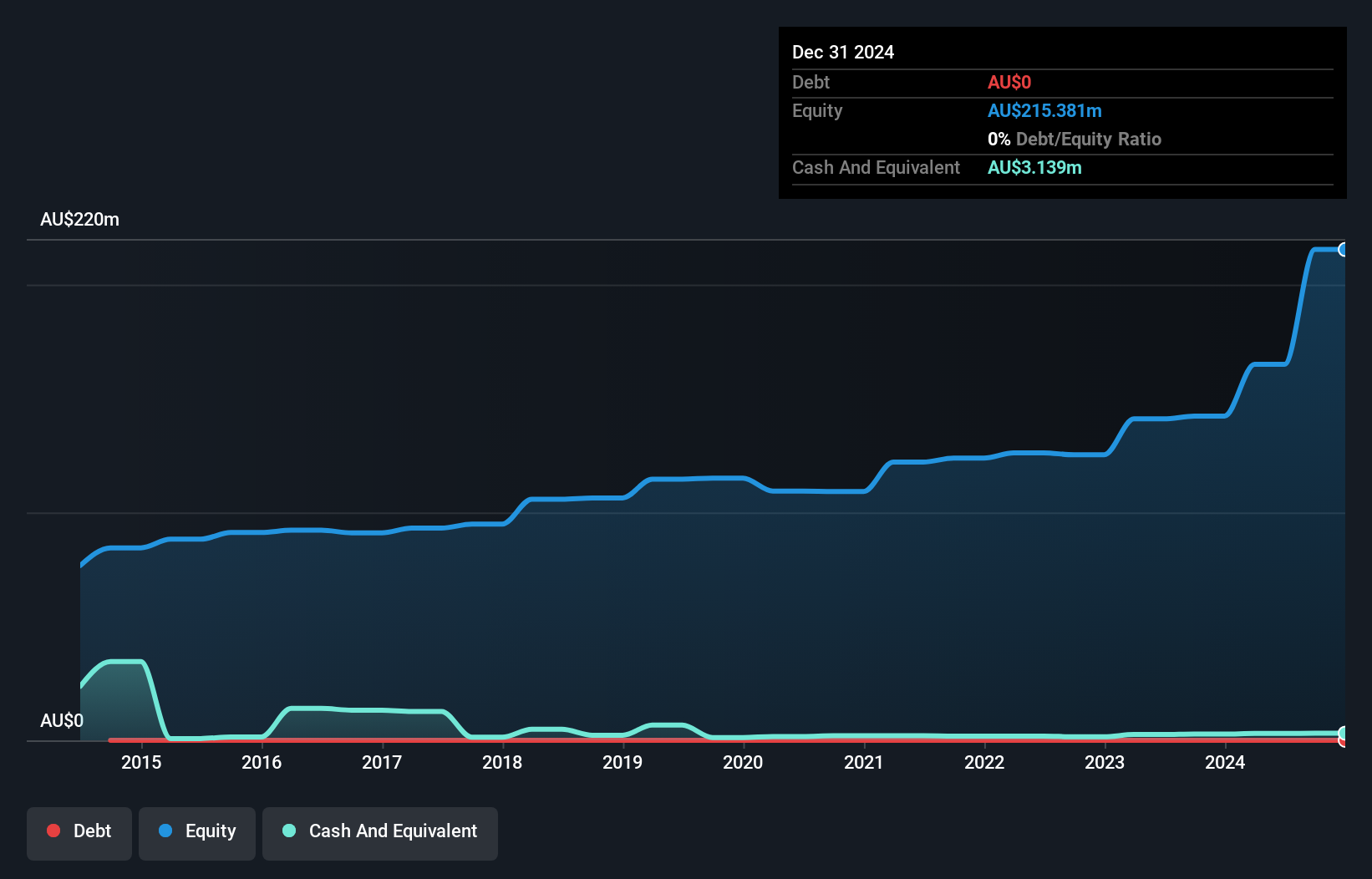

Aims Property Securities Fund stands out with a market cap of A$133.11 million, primarily driven by its AIMS Growth Investment Fund generating A$86.51 million in revenue. The fund has demonstrated impressive earnings growth of 330.6% over the past year, significantly outperforming the REITs industry average of 7.5%. Its net profit margins improved to 98.3%, and with no debt burden, interest coverage is not an issue. Additionally, its Price-To-Earnings ratio is attractively low at 1.8x compared to the broader Australian market's 18x, presenting a potentially appealing value proposition for investors seeking exposure in this segment.

- Get an in-depth perspective on Aims Property Securities Fund's performance by reading our balance sheet health report here.

- Assess Aims Property Securities Fund's previous results with our detailed historical performance reports.

Articore Group (ASX:ATG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Articore Group Limited operates as an online marketplace for art and design products across Australia, the United States, the United Kingdom, and internationally, with a market cap of A$54.48 million.

Operations: The company generates revenue of A$456.84 million from its Redbubble and Teepublic marketplaces.

Market Cap: A$54.48M

Articore Group Limited, with a market cap of A$54.48 million, faces challenges as it remains unprofitable and has seen increased losses over the past five years. Despite being debt-free and having sufficient cash runway for over three years based on current free cash flow, its short-term assets (A$87.8M) do not cover short-term liabilities (A$107.6M). The company's share price is highly volatile, further complicated by recent executive changes including the resignation of its CFO and a drop from the S&P/ASX Emerging Companies Index. Articore trades significantly below fair value estimates but lacks stable earnings growth prospects.

- Take a closer look at Articore Group's potential here in our financial health report.

- Gain insights into Articore Group's outlook and expected performance with our report on the company's earnings estimates.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$1.13 billion.

Operations: The company generates revenue through its retail segment, which accounts for A$1.30 billion, and its wholesale segment, contributing A$475.92 million.

Market Cap: A$1.13B

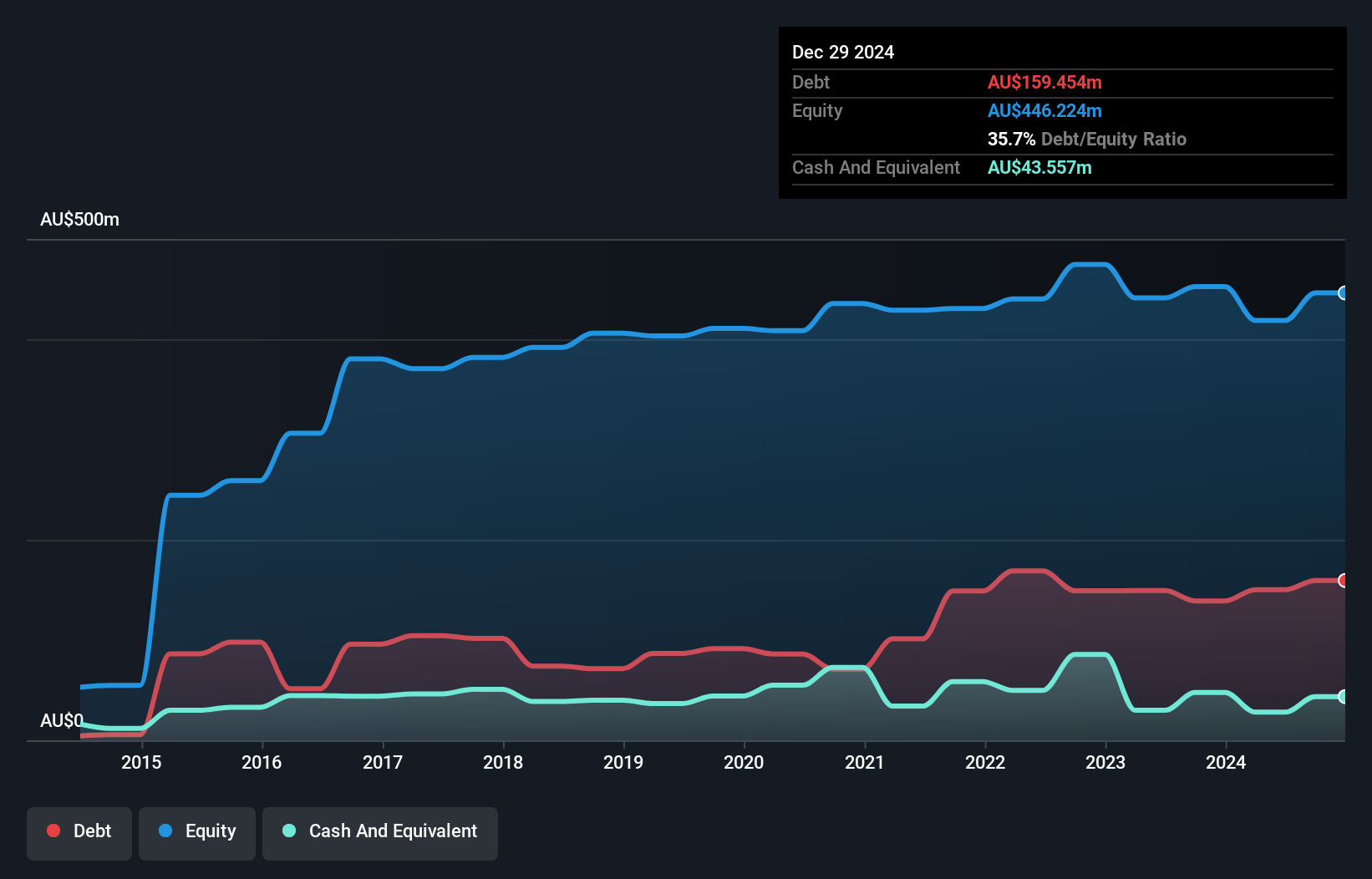

Accent Group Limited, with a market cap of A$1.13 billion, offers a mixed outlook for investors interested in penny stocks. The company has stable weekly volatility and an experienced management team but faces challenges such as negative earnings growth over the past year and lower profit margins than previously recorded. Recent strategic moves include a partnership with Frasers Group to expand Sports Direct across Australia and New Zealand, supported by a follow-on equity offering raising A$60.45 million. This collaboration provides access to global brands and potential growth opportunities, although insider selling raises some concerns about internal confidence levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Accent Group.

- Review our growth performance report to gain insights into Accent Group's future.

Key Takeaways

- Reveal the 1,000 hidden gems among our ASX Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives