With the ASX200 reaching fresh intraday records around 8,650 points, there's a growing sense of optimism among some investors about a potentially stronger second half for 2025. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies with potential growth opportunities. These stocks can offer a mix of affordability and growth potential when backed by strong financials. Let's explore several penny stocks that stand out for their financial strength and long-term promise in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.82 | A$85.86M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.64 | A$122.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.66 | A$410.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.63 | A$430.99M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.95 | A$695.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.30 | A$773.18M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.80 | A$1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.73 | A$231.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.33 | A$158.01M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,006 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, import, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$641.80 million.

Operations: The company generates revenue from its Water Solutions segment, which accounted for A$417.40 million.

Market Cap: A$641.8M

GWA Group, with a market cap of A$641.80 million, presents a mixed outlook for investors. The company's short-term assets exceed its short-term liabilities, indicating solid liquidity management; however, long-term liabilities remain uncovered by these assets. Despite satisfactory debt levels and interest coverage from EBIT (8.1x), GWA's net profit margins have declined to 8.9% from last year's 11%, and earnings growth has been negative over the past year at -18%. While trading below estimated fair value and forecasted earnings growth of 15.1% per year offer potential upside, the dividend yield of 6.41% is not well covered by earnings, suggesting caution for income-focused investors.

- Navigate through the intricacies of GWA Group with our comprehensive balance sheet health report here.

- Evaluate GWA Group's prospects by accessing our earnings growth report.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IVE Group Limited operates in the marketing sector in Australia with a market capitalization of A$410.12 million.

Operations: The company generates revenue primarily from its advertising segment, which amounts to A$975.43 million.

Market Cap: A$410.12M

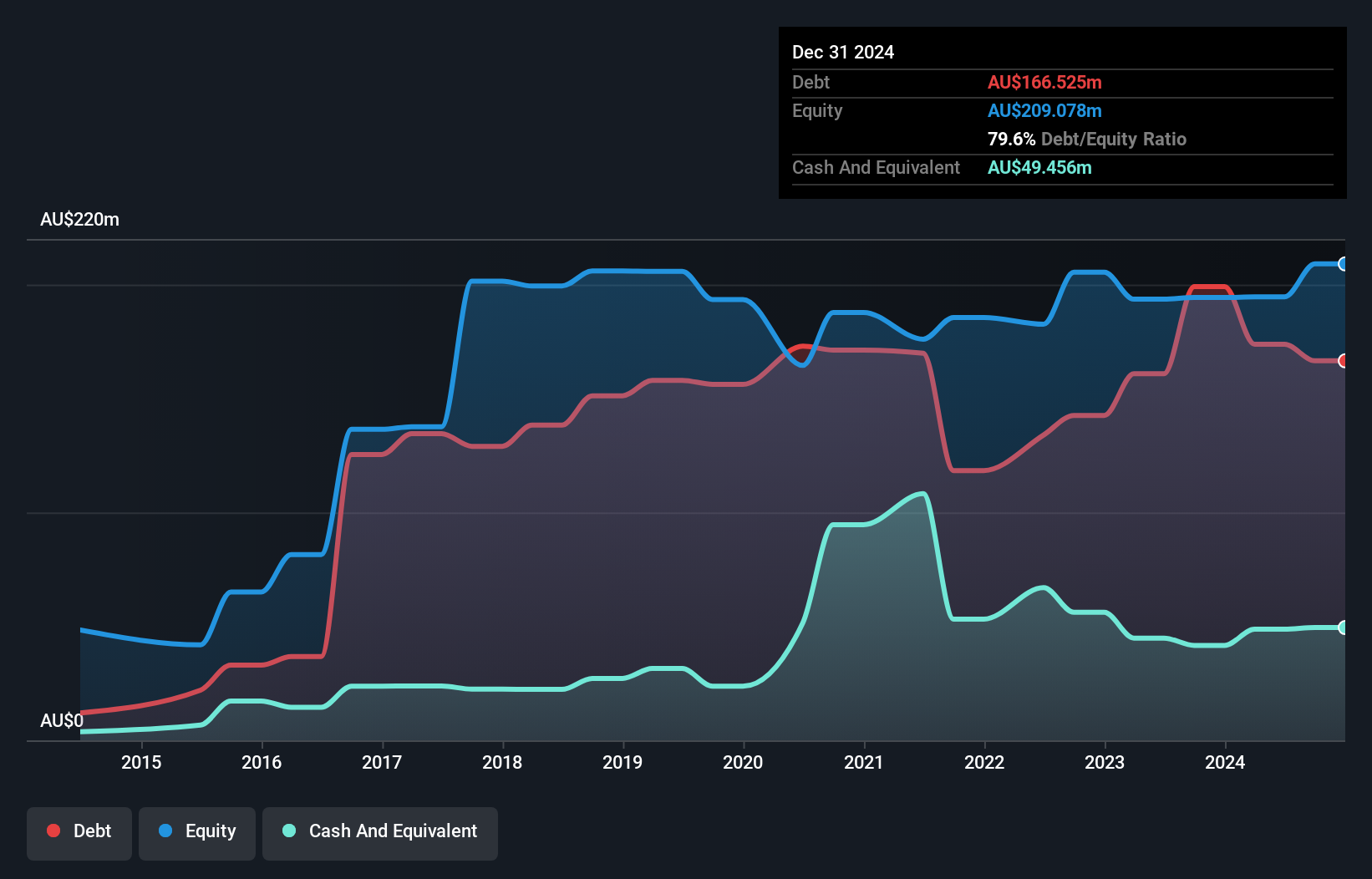

IVE Group, with a market cap of A$410.12 million, shows promising aspects for investors in the penny stock segment. The company has demonstrated robust earnings growth of 179.7% over the past year, significantly outpacing industry averages and its own five-year growth rate of 28.9% annually. While it maintains high-quality earnings and stable weekly volatility at 4%, IVE Group's financial position is marked by a high net debt to equity ratio of 56%. Despite this leverage, interest payments are well-covered by EBIT (4.5x), and operating cash flow effectively covers debt (76.8%). Trading below estimated fair value suggests potential investment appeal amidst these dynamics.

- Take a closer look at IVE Group's potential here in our financial health report.

- Gain insights into IVE Group's outlook and expected performance with our report on the company's earnings estimates.

Stanmore Resources (ASX:SMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stanmore Resources Limited is involved in the exploration, development, production, and sale of metallurgical coal in Australia with a market cap of A$1.75 billion.

Operations: The company generates revenue of $2.40 billion from its Metals & Mining segment, specifically focused on coal.

Market Cap: A$1.75B

Stanmore Resources, with a market cap of A$1.75 billion, presents a mixed picture for investors in the penny stock arena. The company generates significant revenue of $2.40 billion from its coal operations, yet it faces challenges such as declining profit margins (currently 8% compared to last year's 16.8%) and negative earnings growth over the past year (-59.5%). Despite these hurdles, Stanmore's debt is well-managed with operating cash flow covering 132.4% of debt obligations and interest payments covered by EBIT at 3.5x. Trading at a discount to its estimated fair value may offer some investment potential despite forecasted earnings decline.

- Jump into the full analysis health report here for a deeper understanding of Stanmore Resources.

- Learn about Stanmore Resources' future growth trajectory here.

Make It Happen

- Dive into all 1,006 of the ASX Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives