- Australia

- /

- Healthtech

- /

- ASX:ALC

ASX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As Australian shares edge closer to their all-time high, driven by positive market momentum and strong U.S. job numbers, investors are keeping a keen eye on potential opportunities. Penny stocks, often representing smaller or newer companies, continue to capture interest for their affordability and growth potential despite being considered a somewhat outdated term. This article will explore three such stocks that stand out for their financial strength and potential to offer compelling investment opportunities amidst the current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.695 | A$220.43M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.85 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.545 | A$72.88M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.42 | A$162.28M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.28 | A$766.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$3.15 | A$737.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.72 | A$454.78M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,001 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alcidion Group (ASX:ALC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alcidion Group Limited, with a market cap of A$116.84 million, develops and licenses healthcare software products in Australia, New Zealand, and the United Kingdom.

Operations: The company generates revenue of A$35.64 million from providing healthcare software solutions across its markets in Australia, New Zealand, and the United Kingdom.

Market Cap: A$116.84M

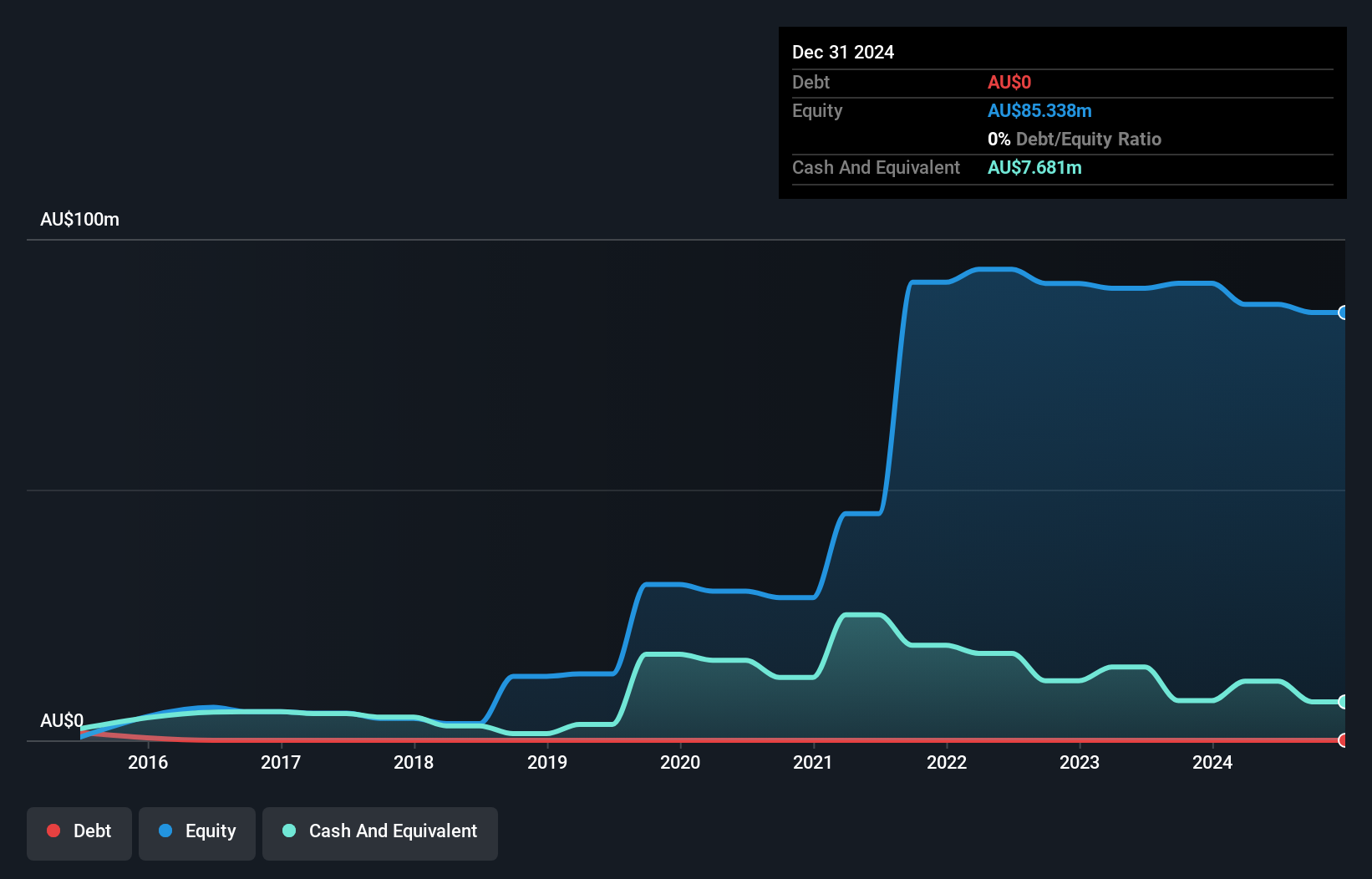

Alcidion Group Limited, with a market cap of A$116.84 million and revenue of A$35.64 million, is navigating the challenges typical for penny stocks by maintaining a positive cash runway exceeding three years despite being unprofitable. The company's short-term assets do not fully cover its liabilities, yet it remains debt-free, which can be appealing to risk-tolerant investors seeking growth potential in healthcare software solutions across Australia, New Zealand, and the UK. Recent board changes include appointing Professor Andrew Way AM as a Non-Executive Director to enhance governance and strategic direction amid evolving customer complexity.

- Jump into the full analysis health report here for a deeper understanding of Alcidion Group.

- Explore Alcidion Group's analyst forecasts in our growth report.

Aurumin (ASX:AUN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aurumin Limited is involved in the exploration and development of gold properties in Australia, with a market capitalization of A$49.43 million.

Operations: The company's revenue segment is primarily focused on Gold Exploration, generating A$0.48 million.

Market Cap: A$49.43M

Aurumin Limited, with a market cap of A$49.43 million, is pre-revenue and focused on gold exploration in Australia. The company's short-term assets of A$1.8 million cover both its short- and long-term liabilities, but it has less than a year of cash runway. Recent developments include drilling at the Johnson Range Gold Project to enhance resource confidence and potentially upgrade classifications for future mining studies. Despite being debt-free, Aurumin's management and board are relatively inexperienced with average tenures under two years, posing potential challenges in navigating strategic decisions in the volatile penny stock landscape.

- Click to explore a detailed breakdown of our findings in Aurumin's financial health report.

- Gain insights into Aurumin's historical outcomes by reviewing our past performance report.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL is involved in the exploration of oil and gas properties in Namibia and Australia, with a market cap of A$89.50 million.

Operations: Pancontinental Energy NL currently does not report any revenue segments.

Market Cap: A$89.5M

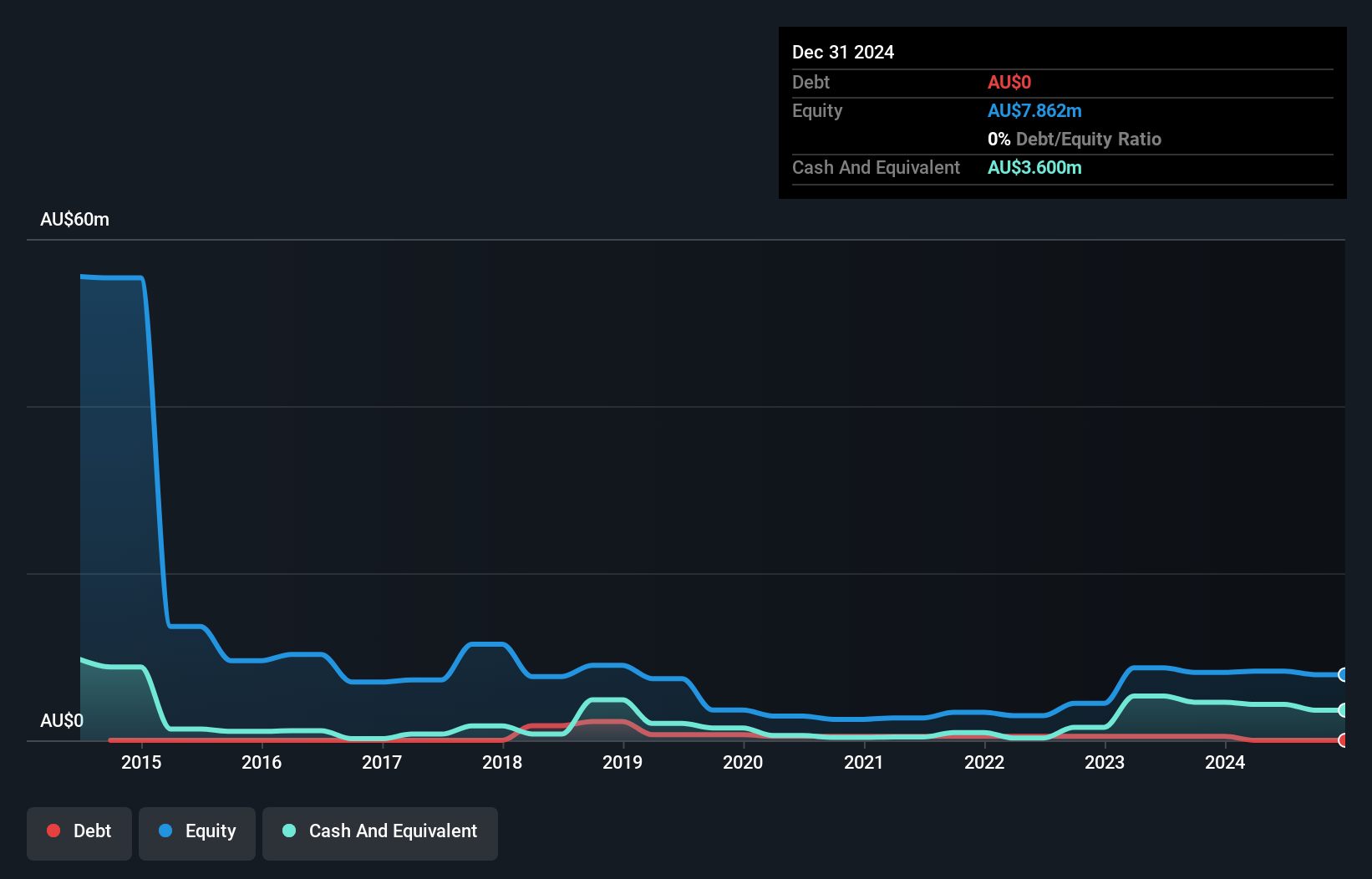

Pancontinental Energy NL, with a market cap of A$89.50 million, is pre-revenue and engaged in oil and gas exploration in Namibia and Australia. The company benefits from a debt-free status and has short-term assets of A$3.7 million that cover both its short- and long-term liabilities. Despite experiencing increased share price volatility over the past year, Pancontinental has reduced losses at an annual rate of 6.4% over five years. The board's average tenure is 16.4 years, indicating seasoned governance which could be advantageous as the company navigates its exploration activities while maintaining a cash runway exceeding one year.

- Unlock comprehensive insights into our analysis of Pancontinental Energy stock in this financial health report.

- Explore historical data to track Pancontinental Energy's performance over time in our past results report.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 998 more companies for you to explore.Click here to unveil our expertly curated list of 1,001 ASX Penny Stocks.

- Seeking Other Investments? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALC

Alcidion Group

Engages in the development and licensing of healthcare software products in Australia, New Zealand, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives