- Australia

- /

- Metals and Mining

- /

- ASX:PNR

ASX Opportunities: Bubs Australia And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As Australian shares face a potential dip, with ASX 200 futures down 0.29%, global tensions and economic uncertainties are influencing market sentiment. Despite these challenges, the allure of penny stocks remains strong for investors seeking growth opportunities at lower price points. Often representing smaller or newer companies, these stocks can offer hidden value when backed by solid financials, making them an intriguing option for those looking to uncover potential in the market's less explored corners.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.24 | A$105.67M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.42M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$425.54M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.32 | A$2.64B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.75M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.19 | A$751.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.10 | A$705.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.715 | A$226.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.35 | A$158.96M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.76 | A$141.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,007 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Bubs Australia (ASX:BUB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bubs Australia Limited operates in the manufacture and sale of infant nutrition and wellbeing products across Australia, China, the United States, and other international markets, with a market cap of A$138.44 million.

Operations: The company's revenue segment is primarily derived from its Food Processing operations, totaling A$88.82 million.

Market Cap: A$138.44M

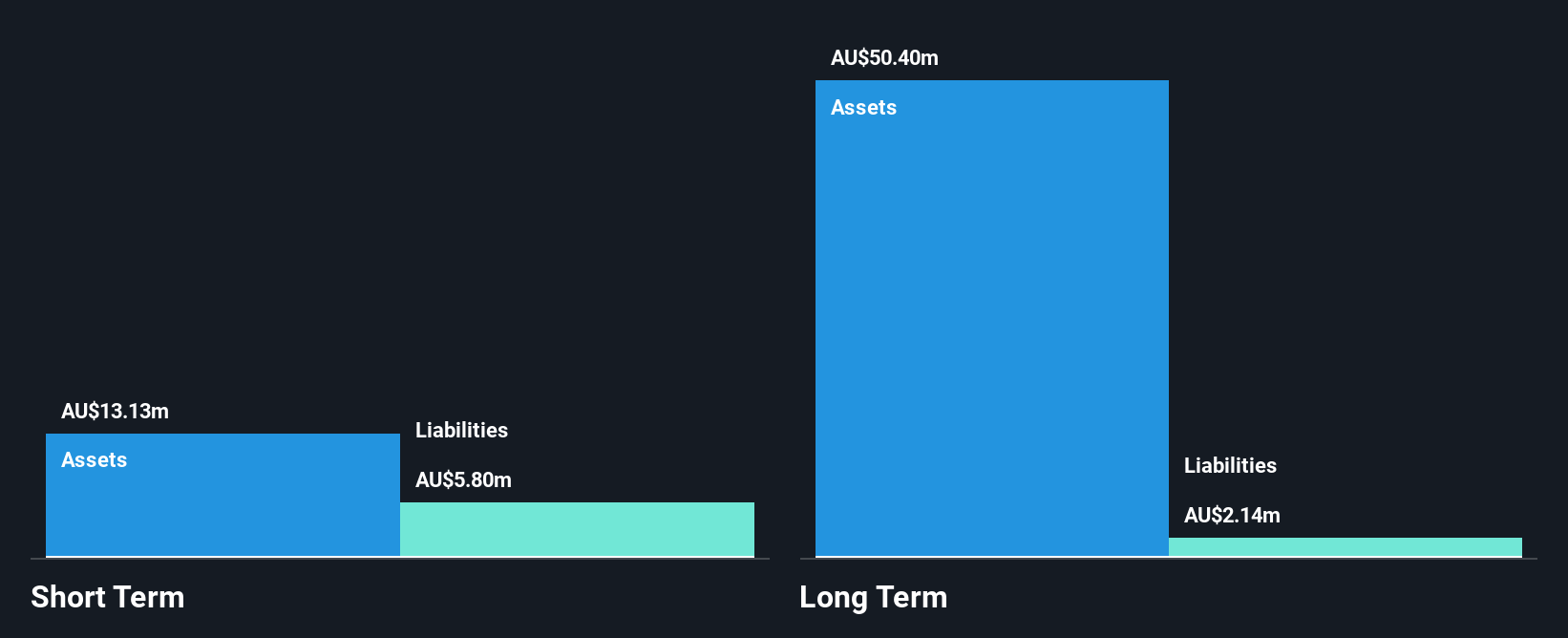

Bubs Australia, with a market cap of A$138.44 million, derives significant revenue from its Food Processing operations totaling A$88.82 million. While the company is currently unprofitable and has seen increasing losses over the past five years, it maintains more cash than total debt and has sufficient cash runway for over a year based on current free cash flow. Bubs' short-term assets exceed both its short-term and long-term liabilities, providing some financial stability despite challenges in profitability. The stock trades significantly below estimated fair value, with earnings forecasted to grow substantially in the future.

- Dive into the specifics of Bubs Australia here with our thorough balance sheet health report.

- Explore Bubs Australia's analyst forecasts in our growth report.

Element 25 (ASX:E25)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Element 25 Limited is an Australian company focused on the exploration of mineral properties, with a market cap of A$56.01 million.

Operations: The company generates revenue from its exploration activities, amounting to A$8.73 million.

Market Cap: A$56.01M

Element 25 Limited, with a market cap of A$56.01 million, is focused on mineral exploration and is currently pre-revenue. The company has announced a non-binding MoU with Nissan Chemical Corporation to explore developing a High Purity Manganese Sulphate Monohydrate facility in Japan, leveraging synergies at the Tokyo Bay site. Despite being debt-free and having short-term assets exceeding liabilities, Element 25 faces challenges with less than one year of cash runway and increasing losses over five years. Its board is experienced but the management tenure data is insufficient to assess experience levels fully.

- Click here to discover the nuances of Element 25 with our detailed analytical financial health report.

- Examine Element 25's past performance report to understand how it has performed in prior years.

Pantoro Gold (ASX:PNR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pantoro Gold Limited, with a market cap of A$1.42 billion, is involved in gold mining, processing, and exploration activities in Western Australia.

Operations: The company's revenue is primarily derived from the Norseman Gold Project, which generated A$289.11 million.

Market Cap: A$1.42B

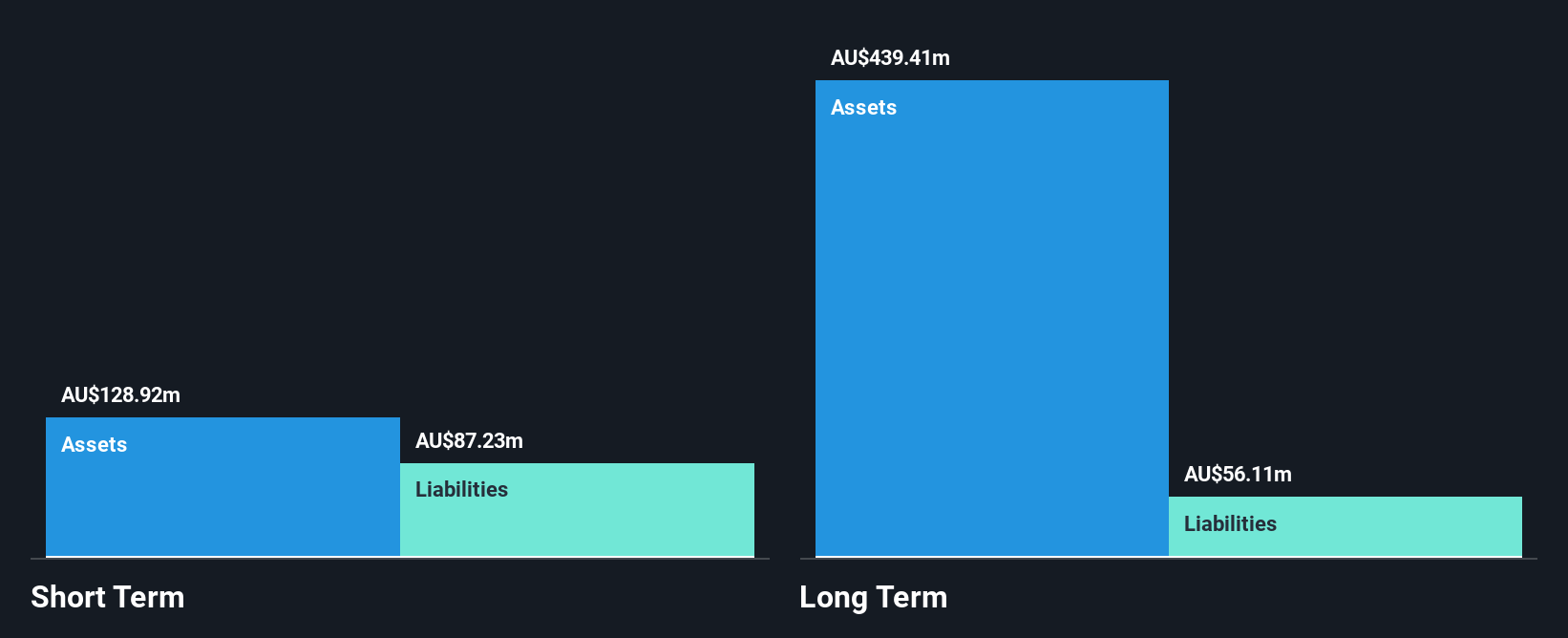

Pantoro Gold Limited, with a market cap of A$1.42 billion, is involved in gold mining and exploration activities primarily through the Norseman Gold Project, generating revenue of A$289.11 million. Despite being unprofitable and having increased losses over the past five years, Pantoro's short-term assets exceed both its short-term and long-term liabilities. The company has more cash than debt and maintains a stable weekly volatility at 10%. Recent drilling results from the OK Underground Mine indicate strong continuity in mineralization, supporting potential future Ore Reserve upgrades as part of its growth program initiated in late 2024.

- Get an in-depth perspective on Pantoro Gold's performance by reading our balance sheet health report here.

- Assess Pantoro Gold's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Discover the full array of 1,007 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNR

Pantoro Gold

Engages in the gold mining, processing, and exploration activities in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives