ASX June 2025 Stocks That Might Be Underestimated By Investors

Reviewed by Simply Wall St

As the Australian market experiences a gradual decline amid profit-taking and global tensions, investors are keenly observing potential opportunities that may be overlooked. In such an environment, identifying undervalued stocks requires a careful analysis of fundamentals and market sentiment to uncover companies with strong prospects that might not yet be fully appreciated by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$2.80 | A$4.92 | 43.1% |

| Praemium (ASX:PPS) | A$0.695 | A$1.16 | 40% |

| Polymetals Resources (ASX:POL) | A$0.87 | A$1.54 | 43.6% |

| PointsBet Holdings (ASX:PBH) | A$1.195 | A$2.05 | 41.6% |

| Nuix (ASX:NXL) | A$2.30 | A$4.04 | 43.1% |

| Infomedia (ASX:IFM) | A$1.23 | A$1.98 | 37.8% |

| Fenix Resources (ASX:FEX) | A$0.28 | A$0.47 | 40% |

| DGL Group (ASX:DGL) | A$0.39 | A$0.76 | 48.5% |

| Charter Hall Group (ASX:CHC) | A$19.35 | A$33.88 | 42.9% |

| Catalyst Metals (ASX:CYL) | A$6.84 | A$13.08 | 47.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Integral Diagnostics (ASX:IDX)

Overview: Integral Diagnostics Limited is a healthcare services company that provides diagnostic imaging services to medical professionals and patients in Australia and New Zealand, with a market cap of A$863.54 million.

Operations: The company's revenue is primarily generated from operating diagnostic imaging facilities, amounting to A$491.32 million.

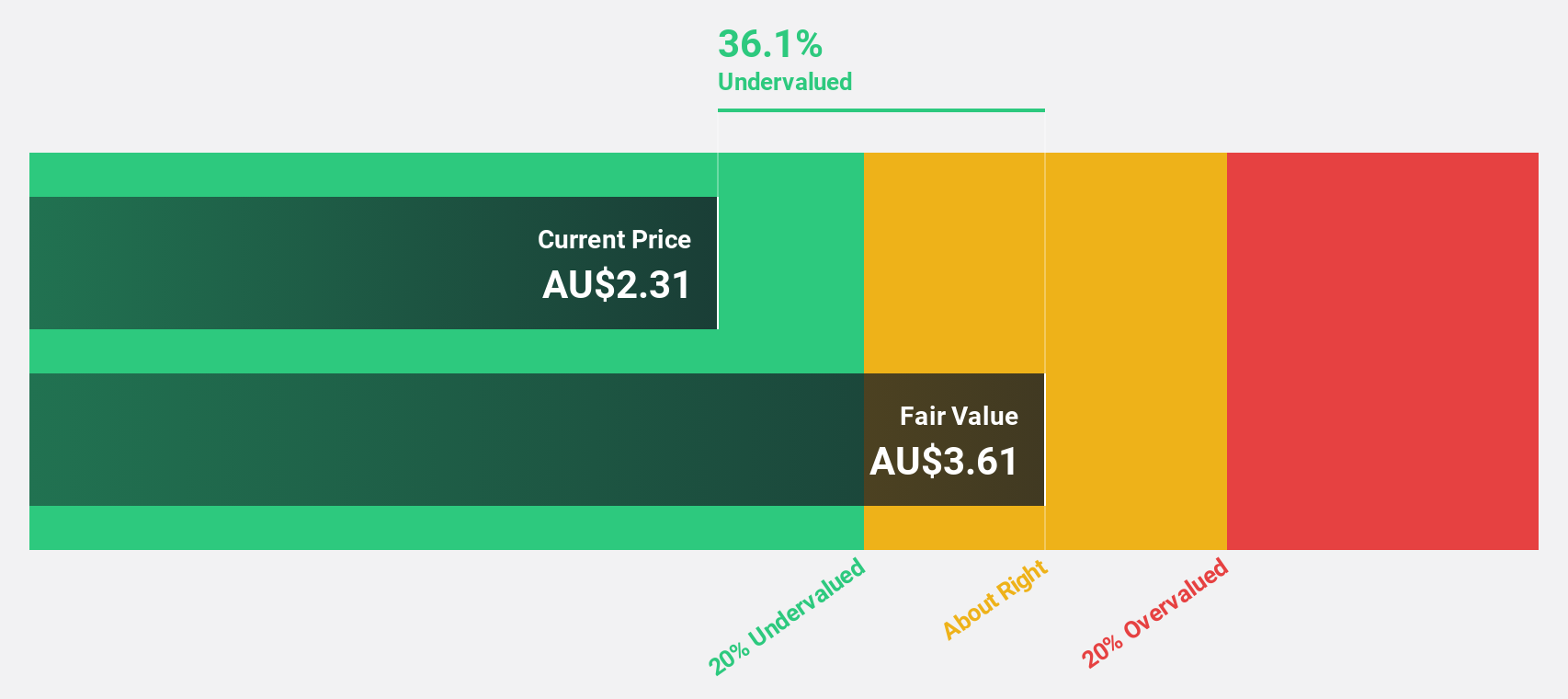

Estimated Discount To Fair Value: 35.7%

Integral Diagnostics (A$2.32) trades significantly below its estimated fair value of A$3.61, suggesting potential undervaluation based on cash flows. Despite recent shareholder dilution, the company has become profitable this year with earnings forecast to grow at 39.4% annually, outpacing the Australian market's growth rate of 11.7%. However, revenue growth is expected to be slower than desired at 16% per year. Recent M&A rumors highlight private equity interest following a dip in market valuation to A$837 million.

- Our comprehensive growth report raises the possibility that Integral Diagnostics is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Integral Diagnostics' balance sheet health report.

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$464.19 million.

Operations: The company's revenue segment includes Publishing - Periodicals, generating A$142.41 million.

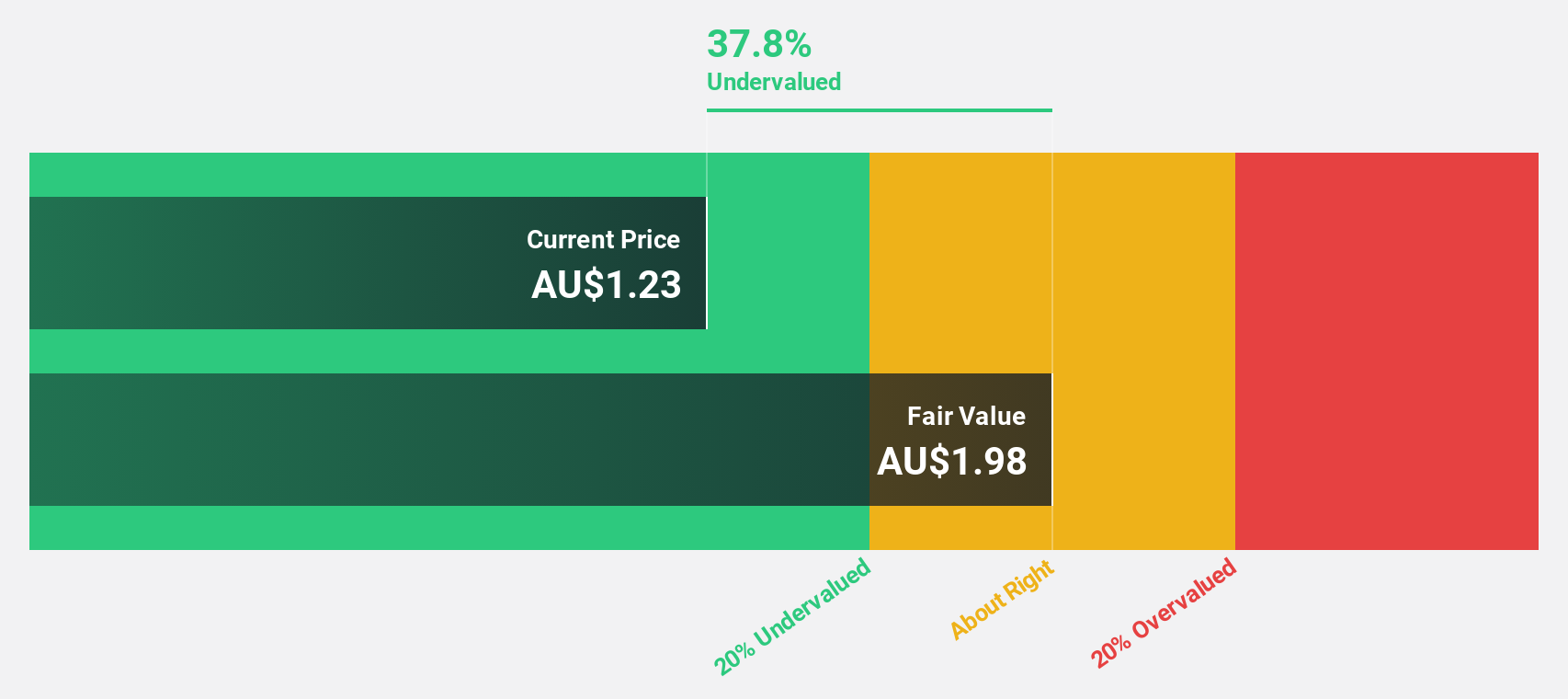

Estimated Discount To Fair Value: 37.8%

Infomedia, trading at A$1.23, is significantly undervalued with a fair value estimate of A$1.98. Despite recent executive changes, its earnings grew by 61.3% last year and are forecasted to grow 19.9% annually, outpacing the Australian market's growth rate of 11.7%. However, its dividend yield of 3.41% isn't well-covered by earnings due to large one-off items impacting financial results. Revenue growth is expected at 6.9%, slightly above the market average.

- Our earnings growth report unveils the potential for significant increases in Infomedia's future results.

- Dive into the specifics of Infomedia here with our thorough financial health report.

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and internationally, with a market cap of A$1.82 billion.

Operations: The company generates revenue from its Business to Business Travel (B2B) segment, amounting to A$328.40 million.

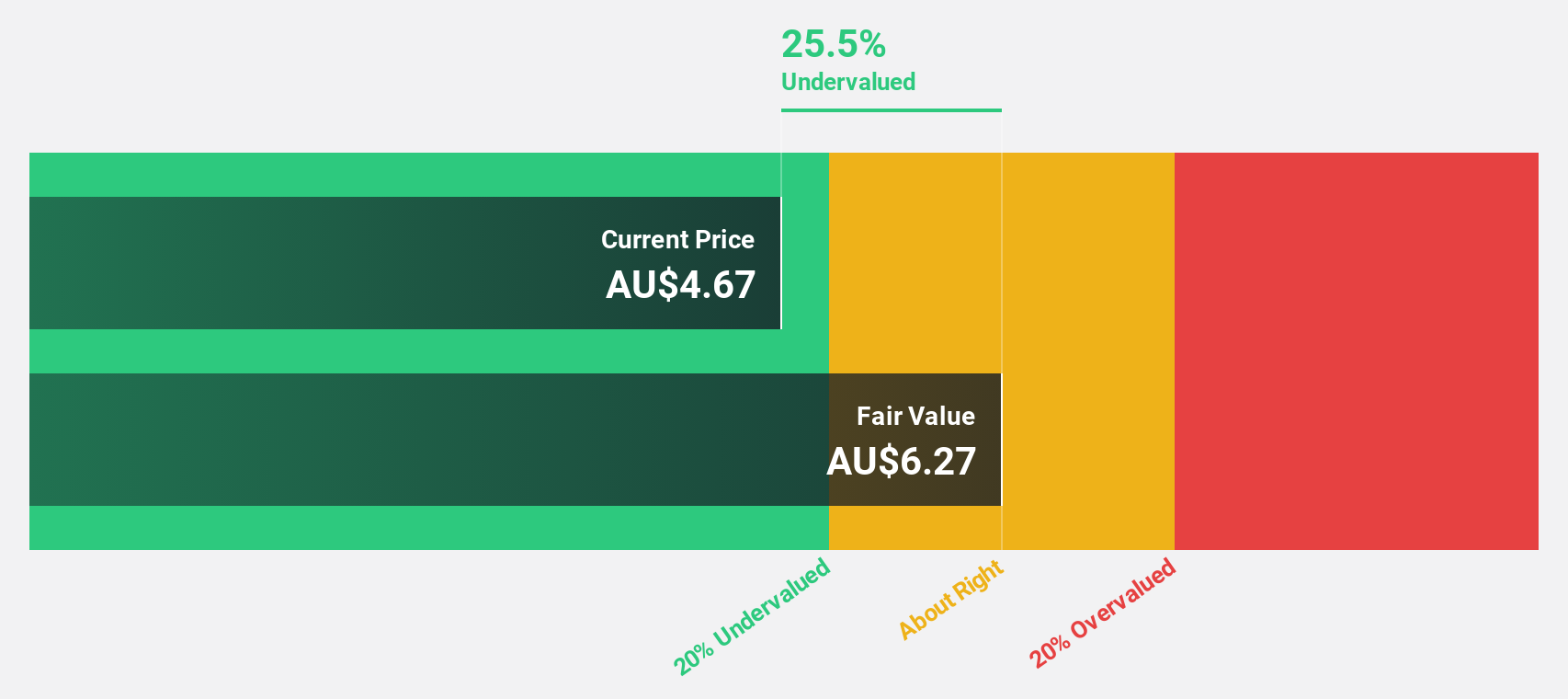

Estimated Discount To Fair Value: 19.8%

Web Travel Group, priced at A$5.03, trades below its estimated fair value of A$6.27, though not significantly. Its earnings are projected to grow substantially at 31.9% annually over the next three years, surpassing the Australian market's growth rate of 11.7%. Recent financials show net income surged to A$201.5 million from A$68 million last year, despite profit margins dropping from 24.6% to 3.4%. The company completed a share buyback worth A$150 million for 7.98% of shares.

- Insights from our recent growth report point to a promising forecast for Web Travel Group's business outlook.

- Take a closer look at Web Travel Group's balance sheet health here in our report.

Next Steps

- Navigate through the entire inventory of 34 Undervalued ASX Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives