ASX Dividend Stocks Including EQT Holdings And 2 More Top Picks

Reviewed by Simply Wall St

As the Australian market navigates through high local inflation, an RBA pause, and geopolitical tensions impacting commodities like iron ore and gold, investors are seeking stability amidst uncertainty. In this environment, dividend stocks such as EQT Holdings offer potential for steady income streams, making them appealing options for those looking to balance risk with reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 5.66% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.90% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.23% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.31% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.73% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.85% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.65% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.79% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.67% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

EQT Holdings (ASX:EQT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EQT Holdings Limited, with a market cap of A$641.45 million, operates in Australia offering philanthropic, trustee, and investment services through its subsidiaries.

Operations: EQT Holdings Limited generates revenue through its Corporate & Superannuation Trustee Services, amounting to A$79.99 million, and Trustee & Wealth Services (excluding Superannuation Trustee Services), contributing A$102.18 million.

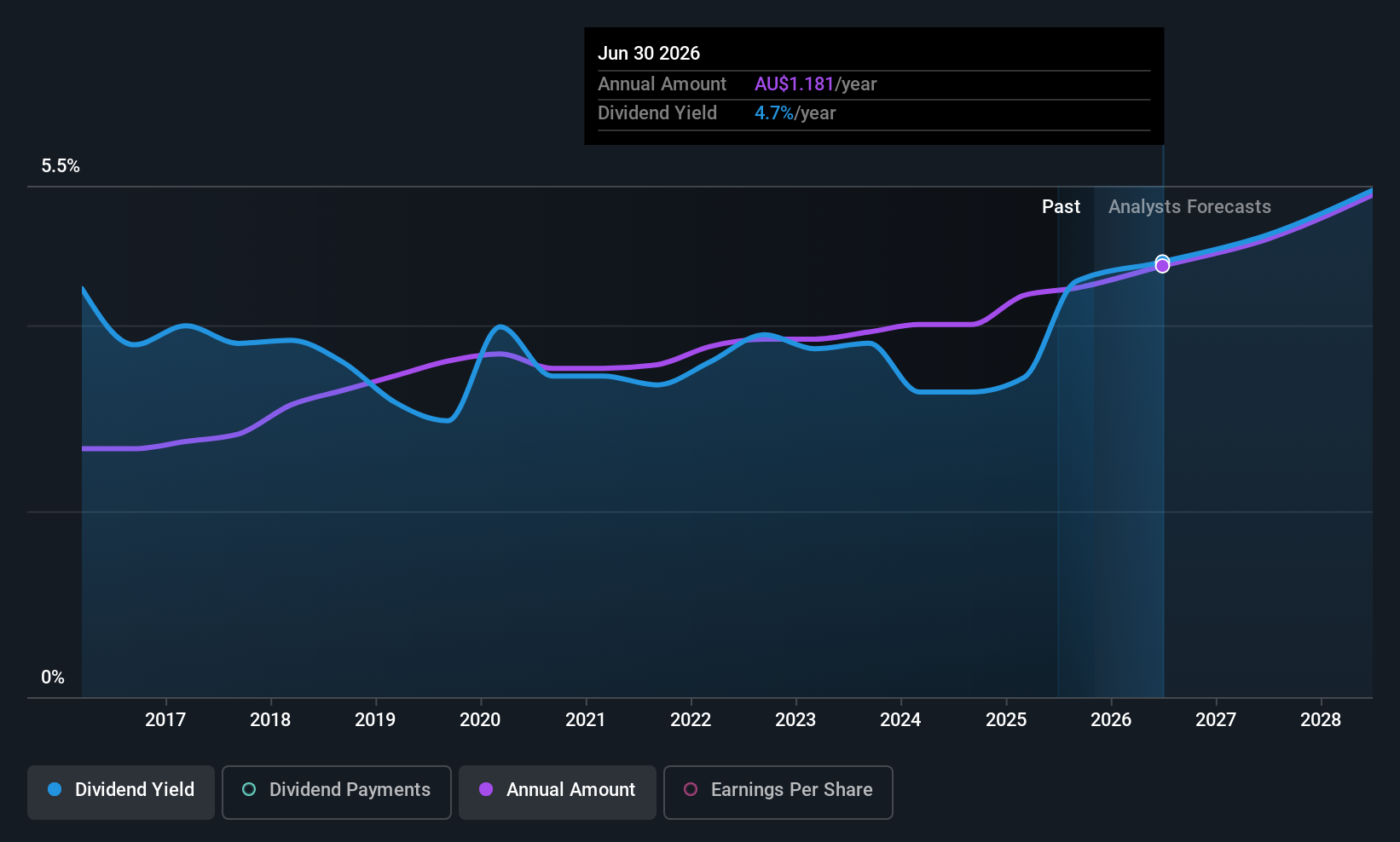

Dividend Yield: 4.7%

EQT Holdings offers a stable dividend yield of 4.67%, with payments reliably covered by earnings and cash flows, despite being below the top tier in Australia. The company's dividends have shown consistent growth over the past decade, supported by strong earnings growth of A$33.22 million for the year ending June 30, 2025. However, regulatory scrutiny from ASIC regarding its subsidiary may pose risks to investor confidence and future stability.

- Click to explore a detailed breakdown of our findings in EQT Holdings' dividend report.

- Upon reviewing our latest valuation report, EQT Holdings' share price might be too optimistic.

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector in Australia and has a market capitalization of A$431.86 million.

Operations: IVE Group Limited generates revenue from its advertising segment, which amounts to A$959.25 million.

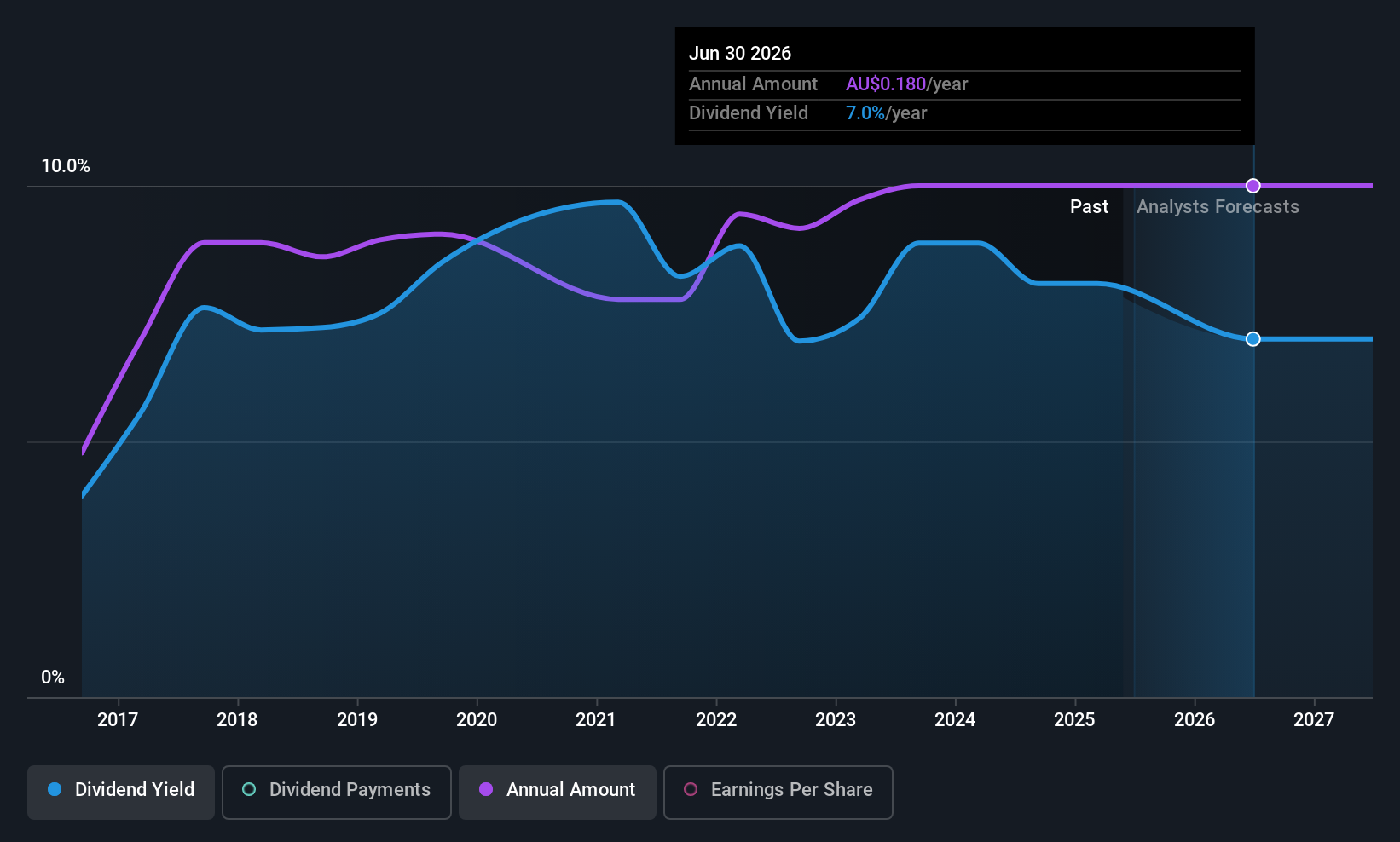

Dividend Yield: 6.4%

IVE Group's dividend yield of 6.43% ranks in the top 25% of Australian dividend payers, supported by a payout ratio of 59.6% and a cash payout ratio of 35%, indicating coverage by earnings and cash flows. However, its dividend history is less stable, with volatility over nine years. Recent earnings growth to A$46.71 million enhances its financial position despite high debt levels, while strategic acquisitions are being pursued to bolster future prospects.

- Delve into the full analysis dividend report here for a deeper understanding of IVE Group.

- The valuation report we've compiled suggests that IVE Group's current price could be quite moderate.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.83 billion.

Operations: MFF Capital Investments Limited generates revenue primarily through its equity investment segment, amounting to A$631.43 million.

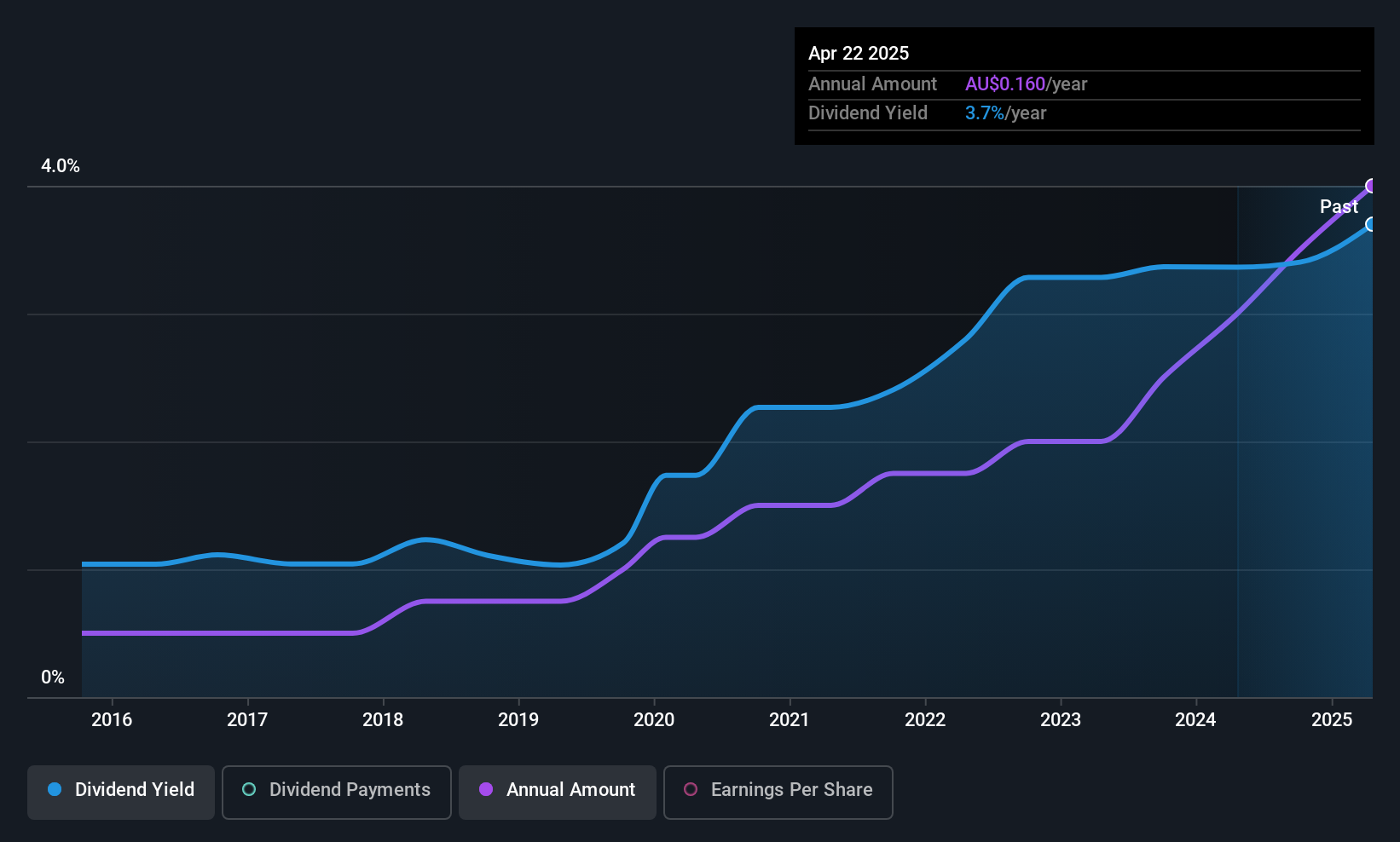

Dividend Yield: 3.7%

MFF Capital Investments offers a reliable dividend with a yield of 3.73%, though below the top quartile in Australia. Its dividends are well-covered by earnings and cash flows, with low payout ratios of 22.9% and 31.3% respectively, ensuring sustainability. Recent earnings showed a slight decline to A$431.97 million, yet MFF increased its semi-annual dividend to A$0.09 per share, payable on October 31, 2025. Leadership changes include new CFO Kirsten Morton and Chief Risk Officer Matthew Githens.

- Click here and access our complete dividend analysis report to understand the dynamics of MFF Capital Investments.

- Our valuation report unveils the possibility MFF Capital Investments' shares may be trading at a discount.

Seize The Opportunity

- Explore the 31 names from our Top ASX Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives