- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Unveils Promising Phase III Results For Baxdrostat In Hypertension Trial

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) recently experienced a weekly price move of 2% amid announcements that could have supported its momentum. The successful Phase III trial results for Baxdrostat, targeting a significant global need for hypertension treatments, likely provided a positive catalyst. Additionally, the European Union's approval of Imfinzi for a new cancer indication may have added further support. These developments occurred against a backdrop of flat overall market performance, with major indexes barely changing as global investors assessed trade policy uncertainties and awaited key financial data releases.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments for AstraZeneca, particularly the successful Phase III trial results for Baxdrostat and the EU's approval of Imfinzi, could significantly enhance the company’s revenue and earnings forecasts. These breakthroughs address substantial medical needs in hypertension and cancer, potentially expanding AstraZeneca's market share and boosting prescription sales. Combined with AstraZeneca’s global strategic initiatives, these news items reinforce the company’s narrative of growth through innovation and market expansion.

Over the past five years, AstraZeneca has achieved a total shareholder return of 25.87%. This long-term performance provides a broader context compared to the recent weekly share price movement of 2%. While AstraZeneca underperformed both the UK market with a return of 5.9% and the UK Pharmaceuticals industry with a negative return of 9.3% over the past year, the strong long-term total returns highlight the company’s resilience and potential for enduring growth.

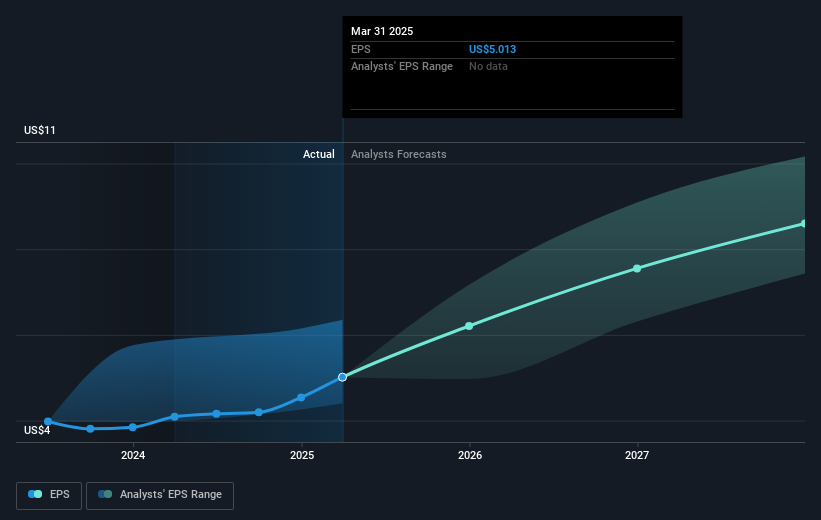

As analysts have set a price target of £135.83, approximately 30% above the current share price of £107.28, these recent developments may positively influence future investor sentiment. The new advancements in AstraZeneca's product pipeline and expansion in emerging markets bolster the expectation of future revenue, aligning with analysts’ forecasts of significant earnings improvements over the next few years. The current share price discount to the analyst price target could suggest that the market has not yet fully realized the potential upside of these recent achievements.

Gain insights into AstraZeneca's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives