- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Launches FluMist Home For At-Home Influenza Vaccination

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) recently launched "FluMist Home," an at-home flu vaccine delivery service, marking an important milestone for easier access to vaccinations in 34 U.S. states. This initiative likely contributed to its stock price increase of 12% last quarter, as it aligns with AstraZeneca's push towards innovative healthcare solutions. Despite this positive development, the overall market also experienced an upward trend, with the Dow hitting record highs and the market up 1% over the last week. AstraZeneca's performance seems to have been buoyed by both its strategic product launches and the broader market gains.

The launch of AstraZeneca’s "FluMist Home" aligns well with the company's focus on innovative healthcare solutions, potentially impacting the narrative around its future growth. This new service might enhance revenue streams by tapping into the demand for convenient medical solutions. Over the last five years, AstraZeneca's total shareholder returns, including both share price and dividends, have risen by 54.08%. This growth provides a broader context to the company's performance, indicating resilience and strong returns for investors.

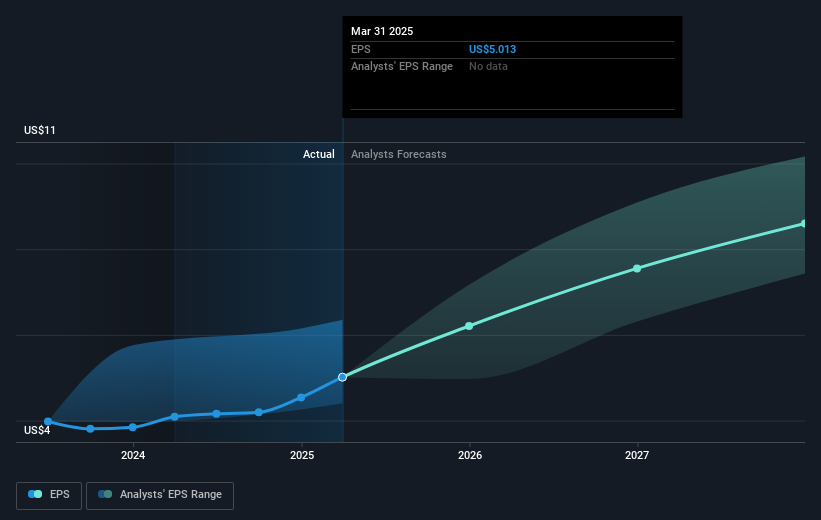

Over the past year, AstraZeneca's share price movement has been in line with the performance of the UK Pharmaceuticals industry, which returned 10.3%. Looking at the potential impact on revenue and earnings forecasts, the initiative could bolster AstraZeneca’s earnings as analysts anticipate a growth to $13.9 billion by 2028, up from $8.3 billion today. The recent stock price increase narrows the gap to the consensus analyst price target of £137.89, reflecting a potential 18.95% discount from the current share price of £115.92. This price movement suggests optimism among investors regarding the company's ability to meet future expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives