- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Advances Lung Cancer Care With Revna Biosciences In Ghana

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) marked progress in its collaboration with Revna Biosciences, focusing on lung cancer care in Ghana, which includes launching targeted therapies and enhancing oncology treatment capacity. Despite this positive development, the stock's 13% rise last month aligns more closely with broader market dynamics, supported by solid earnings and a dividend increase. These factors added positive momentum as the S&P 500 and Nasdaq achieved record highs, driven by robust tech sector gains and easing tariff worries. The company's recent advancements likely complemented these broader economic trends, contributing to its upward trajectory.

We've spotted 2 possible red flags for AstraZeneca you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

AstraZeneca's recent collaboration with Revna Biosciences signals a strong commitment to expanding its oncology footprint, specifically in Ghana. Such partnerships potentially strengthen market presence and may enhance revenue projections by opening new market avenues for targeted therapies. Coupled with a successful history, where the company's total return over the past five years reached 51.86%, these developments suggest a promising growth trajectory. However, it's important to recognize that AstraZeneca's shares lagged behind the broader UK Pharmaceuticals industry over the last year, which saw a 4.9% decline relative to market activity, potentially indicating areas for improvement.

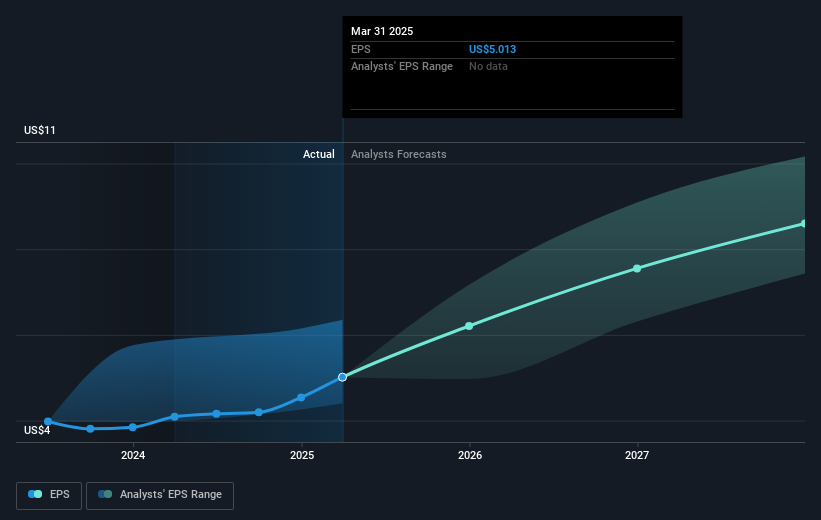

In the short term, the stock's 13% rise aligns with strong earnings and increased dividends, but a share price of £114.98 still remains below analyst consensus targets of £137.64, suggesting room for future appreciation if projected revenue and earnings materialize. Analysts forecast earnings growth of 14.1% per year, driven by pipeline advancements and emerging market expansion. Nonetheless, potential risks like competitive pressures and regulatory adjustments remain considerations for AstraZeneca's long-term financial outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives