- China

- /

- Communications

- /

- SZSE:300308

Asian Value Stocks Trading Below Estimated Worth In June 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflationary pressures, Asian economies are experiencing varied impacts, with some regions showing resilience amid these uncertainties. Against this backdrop, identifying undervalued stocks becomes crucial for investors seeking potential opportunities in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$219.50 | NT$436.79 | 49.7% |

| cottaLTD (TSE:3359) | ¥432.00 | ¥860.83 | 49.8% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.36 | CN¥26.46 | 49.5% |

| Dive (TSE:151A) | ¥915.00 | ¥1819.08 | 49.7% |

| TLB (KOSDAQ:A356860) | ₩17230.00 | ₩34141.01 | 49.5% |

| ALUX (KOSDAQ:A475580) | ₩10450.00 | ₩20815.81 | 49.8% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥21.44 | CN¥42.38 | 49.4% |

| BalnibarbiLtd (TSE:3418) | ¥1165.00 | ¥2301.36 | 49.4% |

| ikeGPS Group (NZSE:IKE) | NZ$0.97 | NZ$1.92 | 49.6% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.87 | HK$1.71 | 49.2% |

We'll examine a selection from our screener results.

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. focuses on the research, development, production, and sales of optical communication transceiver modules and optical devices in China, with a market cap of CN¥101.77 billion.

Operations: Zhongji Innolight Co., Ltd. generates revenue primarily from its operations in optical communication transceiver modules and optical devices within the Chinese market.

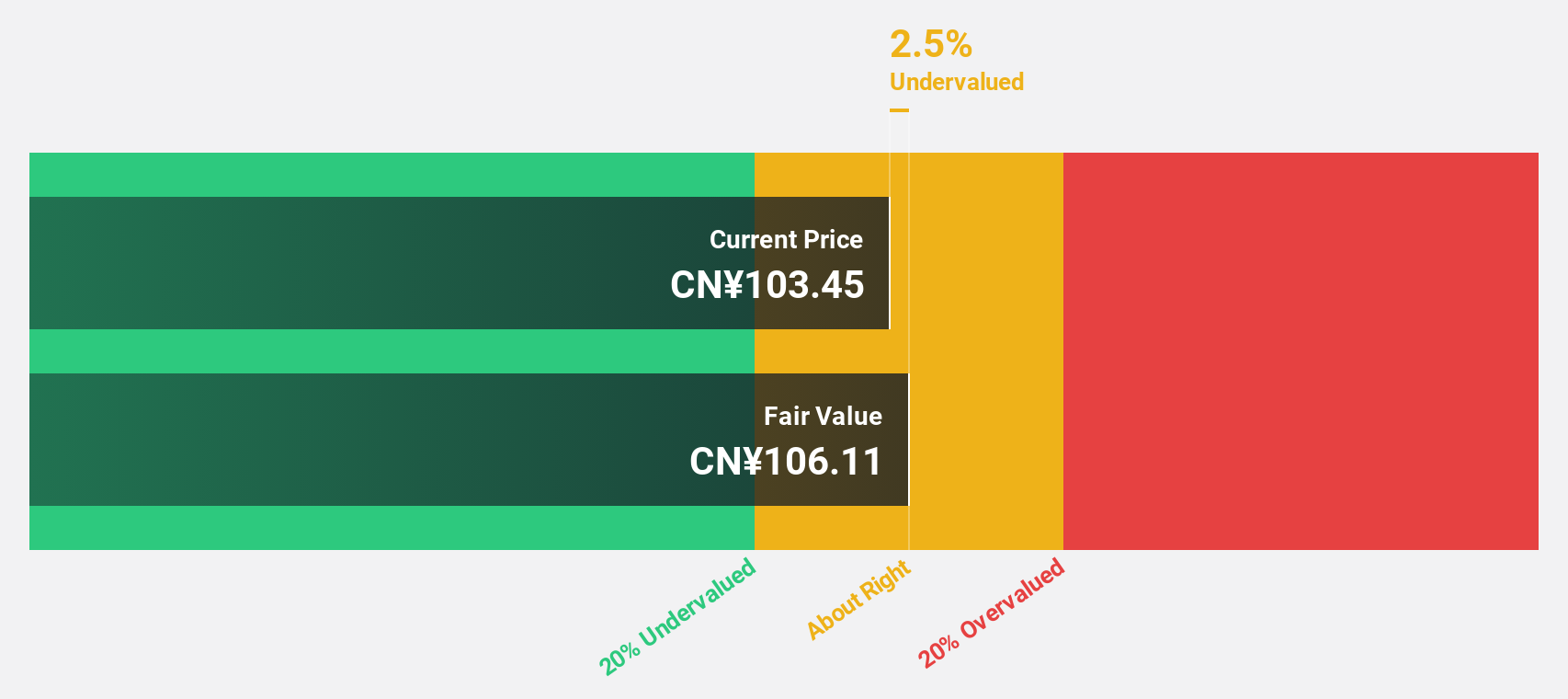

Estimated Discount To Fair Value: 13.7%

Zhongji Innolight is trading at CN¥91.76, below its estimated fair value of CN¥106.29, reflecting an undervaluation based on discounted cash flow analysis. Despite recent share price volatility, the company's earnings have grown by nearly 96% over the past year and are expected to continue growing significantly. Revenue growth is projected to surpass both industry and market averages at 20% annually. Recent dividend increases highlight strong cash flow management amidst robust financial performance in Q1 2025.

- According our earnings growth report, there's an indication that Zhongji Innolight might be ready to expand.

- Take a closer look at Zhongji Innolight's balance sheet health here in our report.

Zhejiang Tianyu Pharmaceutical (SZSE:300702)

Overview: Zhejiang Tianyu Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical intermediates and APIs both in China and internationally, with a market cap of approximately CN¥9.33 billion.

Operations: The company's revenue is primarily derived from its activities in the research, development, manufacture, and sale of pharmaceutical intermediates and active pharmaceutical ingredients (APIs) both domestically and internationally.

Estimated Discount To Fair Value: 16.2%

Zhejiang Tianyu Pharmaceutical's current trading price of CN¥27.14 is below its fair value estimate of CN¥32.38, suggesting it is undervalued based on cash flows. The company has achieved profitability this year, with earnings expected to grow substantially at 42.36% annually, outpacing the market average. Despite recent share price volatility, Q1 2025 results show improved financial performance with net income more than doubling from the previous year, supported by strong revenue growth and a consistent dividend payout strategy.

- Our comprehensive growth report raises the possibility that Zhejiang Tianyu Pharmaceutical is poised for substantial financial growth.

- Navigate through the intricacies of Zhejiang Tianyu Pharmaceutical with our comprehensive financial health report here.

Renesas Electronics (TSE:6723)

Overview: Renesas Electronics Corporation is a global company involved in the research, development, design, manufacturing, sales, and servicing of semiconductors across Japan, China, the rest of Asia, Europe, North America, and other international markets with a market cap of ¥3.17 trillion.

Operations: The company's revenue is primarily derived from its Automotive segment, which accounts for ¥679.96 billion, followed by the Industrial/Infrastructure/IoT segment at ¥615.96 billion.

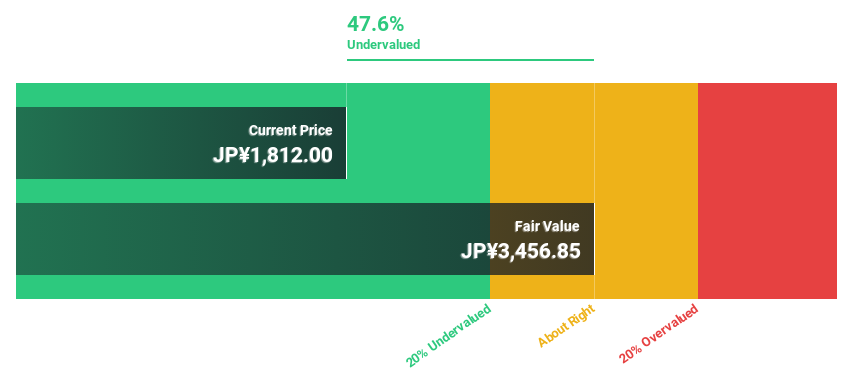

Estimated Discount To Fair Value: 47.3%

Renesas Electronics is trading at ¥1763, significantly below its fair value estimate of ¥3345.4, highlighting its undervaluation based on cash flows. Despite high debt levels and recent share price volatility, the company is poised for substantial earnings growth of 20.3% annually, surpassing market expectations. However, profit margins have decreased from last year’s 21.3% to 12.7%. Recent product innovations and strategic expansions in India may bolster future revenue streams and operational capabilities.

- Our growth report here indicates Renesas Electronics may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Renesas Electronics.

Taking Advantage

- Reveal the 305 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongji Innolight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300308

Zhongji Innolight

Engages in the research and development, production, and sales optical communication transceiver modules and optical devices in China.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives