Asian Value Stocks Estimated Below Intrinsic Worth For July 2025

Reviewed by Simply Wall St

As of July 2025, the Asian markets have been experiencing a mix of economic signals, with China's manufacturing sector showing slight improvement while services remain under pressure, and Japan's stock markets facing challenges due to trade negotiations. In such an environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential value below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥37.49 | CN¥74.86 | 49.9% |

| T'Way Air (KOSE:A091810) | ₩2010.00 | ₩3982.45 | 49.5% |

| Taiyo Yuden (TSE:6976) | ¥2573.00 | ¥5104.72 | 49.6% |

| Shanghai Conant Optical (SEHK:2276) | HK$37.15 | HK$73.81 | 49.7% |

| Serko (NZSE:SKO) | NZ$3.16 | NZ$6.27 | 49.6% |

| Lai Yih Footwear (TWSE:6890) | NT$287.50 | NT$571.27 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩41150.00 | ₩81496.10 | 49.5% |

| Hibino (TSE:2469) | ¥2360.00 | ¥4702.31 | 49.8% |

| Darbond Technology (SHSE:688035) | CN¥39.35 | CN¥78.37 | 49.8% |

| APAC Realty (SGX:CLN) | SGD0.475 | SGD0.95 | 49.8% |

Let's review some notable picks from our screened stocks.

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. operates under the 3trees brand, producing and selling paints, coatings, and building materials in China with a market cap of CN¥27.93 billion.

Operations: The company generates revenue through its production and sale of paints, coatings, and building materials under the 3trees brand in China.

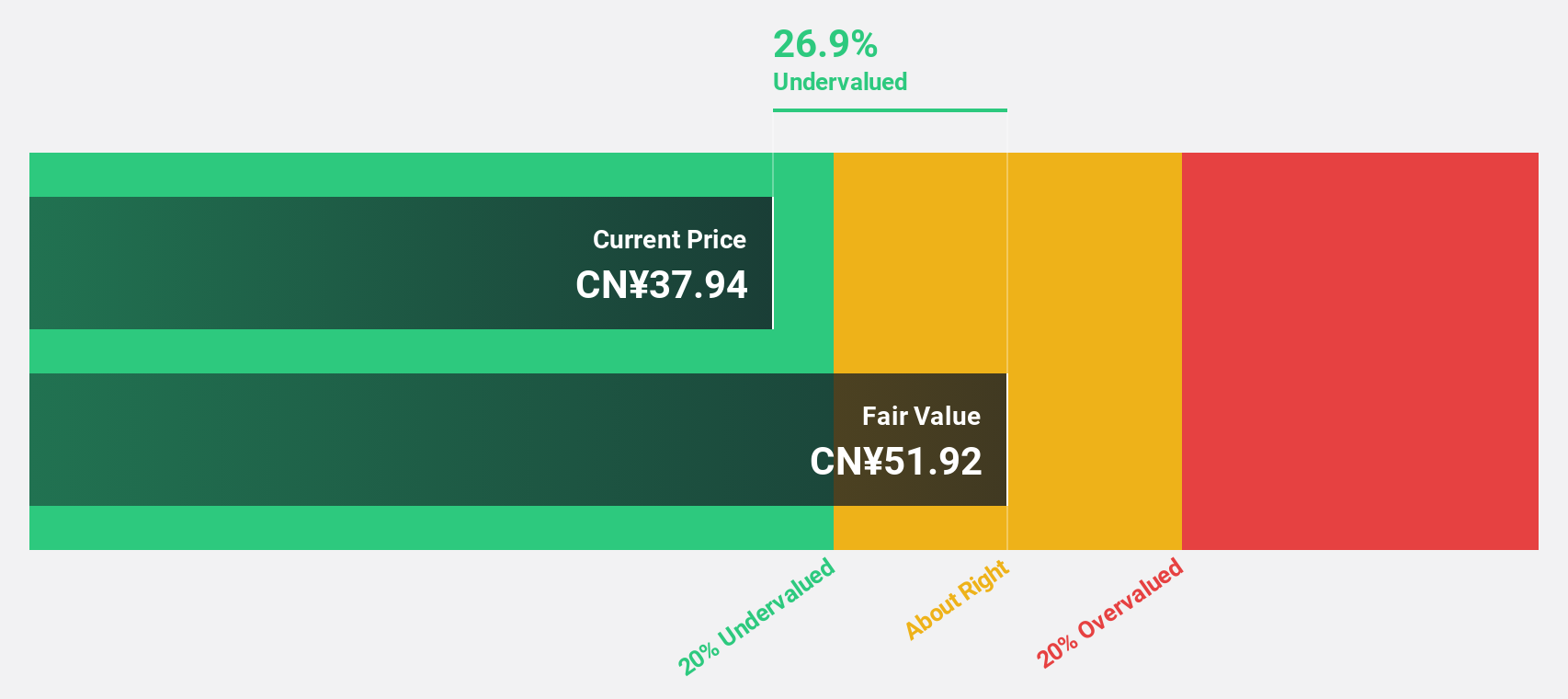

Estimated Discount To Fair Value: 21.2%

SKSHU Paint Ltd. trades at CN¥37.86, significantly below its estimated fair value of CN¥48.03, indicating potential undervaluation based on cash flows. Despite a high debt level and an unstable dividend record, earnings are projected to grow substantially at 31.9% annually, outpacing the broader Chinese market's growth rate of 23.3%. Recent financials show robust performance with net income doubling year-on-year to CNY 105.15 million for Q1 2025.

- Our earnings growth report unveils the potential for significant increases in SKSHU PaintLtd's future results.

- Click to explore a detailed breakdown of our findings in SKSHU PaintLtd's balance sheet health report.

Shengyi Electronics (SHSE:688183)

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of printed circuit boards in China with a market cap of CN¥41.39 billion.

Operations: Shengyi Electronics generates revenue through its research, development, production, and sales of printed circuit boards in China.

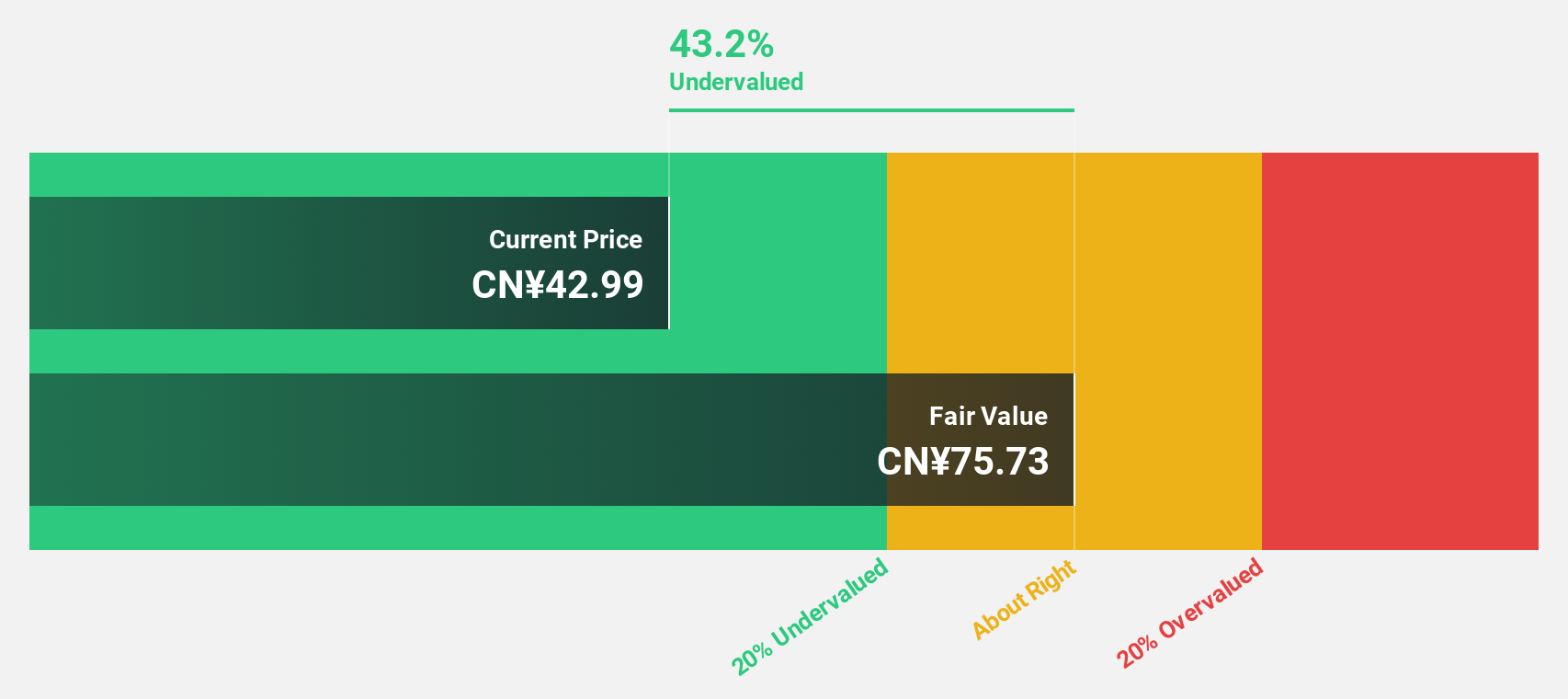

Estimated Discount To Fair Value: 38.6%

Shengyi Electronics Co., Ltd. is trading at approximately CN¥50.7, well below its estimated fair value of CN¥82.64, highlighting potential undervaluation based on cash flows. The company's earnings surged significantly over the past year and are forecast to grow annually by 35.2%, outpacing the Chinese market's growth rate of 23.3%. Recent Q1 2025 results showed a net income increase to CNY 200.18 million from CNY 26.45 million year-on-year, reflecting strong financial performance despite share price volatility.

- According our earnings growth report, there's an indication that Shengyi Electronics might be ready to expand.

- Dive into the specifics of Shengyi Electronics here with our thorough financial health report.

Beijing HyperStrong Technology (SHSE:688411)

Overview: Beijing HyperStrong Technology Co., Ltd. specializes in the design, development, integration, and operation of energy storage power stations across China, Europe, North America, and Australia with a market cap of CN¥15.85 billion.

Operations: Revenue Segments (in millions of CN¥):

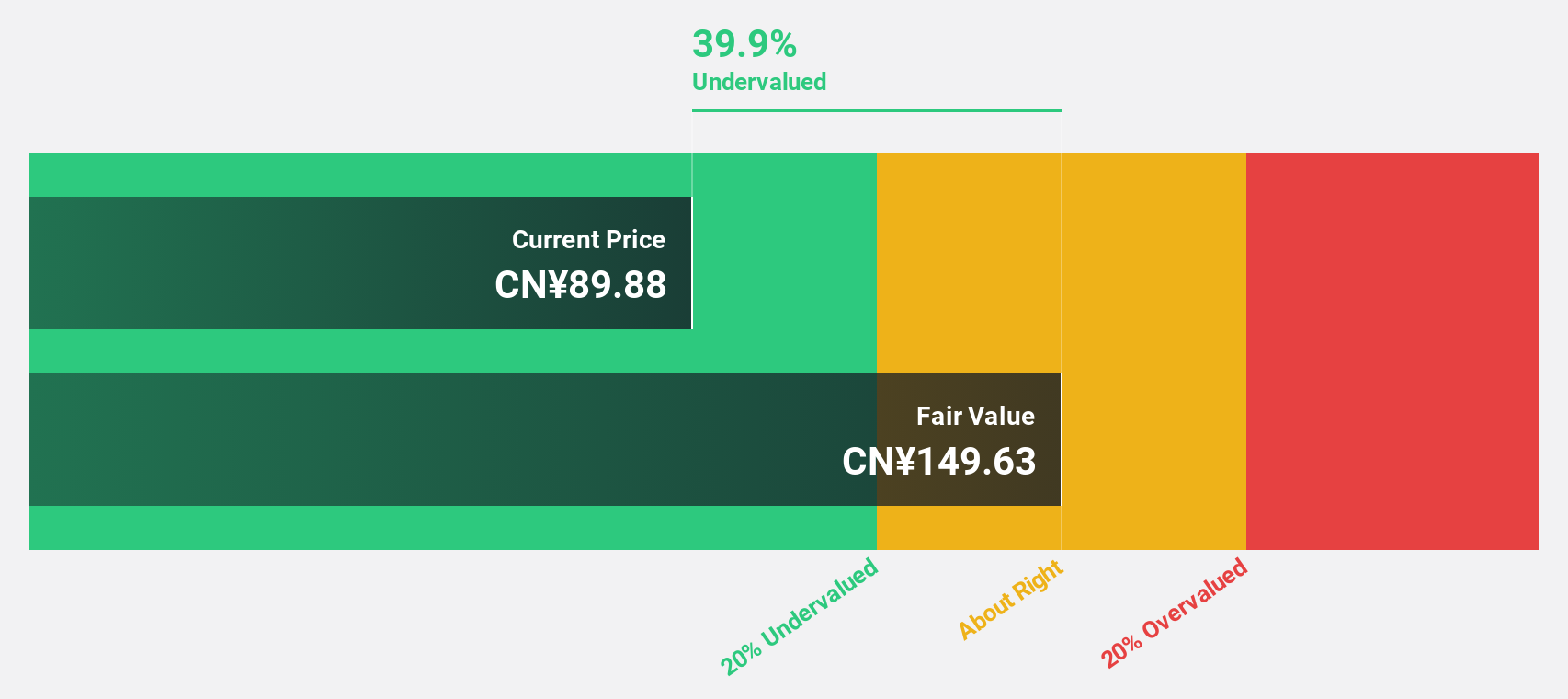

Estimated Discount To Fair Value: 40.9%

Beijing HyperStrong Technology is trading at CN¥88, significantly below its estimated fair value of CN¥148.81, suggesting potential undervaluation based on cash flows. Despite a dividend yield of 1.25% not being well-covered by free cash flow, the company's earnings are forecast to grow 37.1% annually, surpassing the Chinese market's growth rate. The recent launch of HyperBlock M highlights innovation in energy storage solutions, potentially enhancing future revenue streams and supporting robust projected growth in both earnings and revenue.

- Our comprehensive growth report raises the possibility that Beijing HyperStrong Technology is poised for substantial financial growth.

- Take a closer look at Beijing HyperStrong Technology's balance sheet health here in our report.

Make It Happen

- Delve into our full catalog of 268 Undervalued Asian Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603737

SKSHU PaintLtd

Produces and sells paints, coatings, and building materials under the 3trees brand in China.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives