- Hong Kong

- /

- Entertainment

- /

- SEHK:1060

Asian Value Stocks: Damai Entertainment Holdings And 2 Companies That Could Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets experience varied performances, with the U.S. indices reaching record highs and mixed results in Europe and Asia, investors are increasingly attentive to opportunities within undervalued stocks across different regions. In this context, identifying stocks that may be priced below their estimated worth can offer potential value, particularly in Asian markets where economic indicators present a complex picture.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$30.25 | HK$59.90 | 49.5% |

| JRCLtd (TSE:6224) | ¥1160.00 | ¥2305.91 | 49.7% |

| Jiangxi Rimag Group (SEHK:2522) | HK$13.62 | HK$27.23 | 50% |

| Hibino (TSE:2469) | ¥2365.00 | ¥4709.96 | 49.8% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.82 | NZ$1.63 | 49.5% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥42.35 | CN¥84.40 | 49.8% |

| Dive (TSE:151A) | ¥935.00 | ¥1857.63 | 49.7% |

| Darbond Technology (SHSE:688035) | CN¥39.53 | CN¥78.42 | 49.6% |

| cottaLTD (TSE:3359) | ¥430.00 | ¥855.22 | 49.7% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥26.51 | CN¥52.74 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Damai Entertainment Holdings (SEHK:1060)

Overview: Damai Entertainment Holdings Limited is an investment holding company involved in content, technology, and IP merchandising and commercialization in Hong Kong and the People's Republic of China, with a market cap of HK$29.58 billion.

Operations: The company's revenue is primarily derived from its Film Technology and Investment, Production, Promotion and Distribution Platform (CN¥2.71 billion), Damai (CN¥2.06 billion), IP Merchandising and Innovation Initiatives (CN¥1.43 billion), and Drama Series Production (CN¥499.92 million) segments.

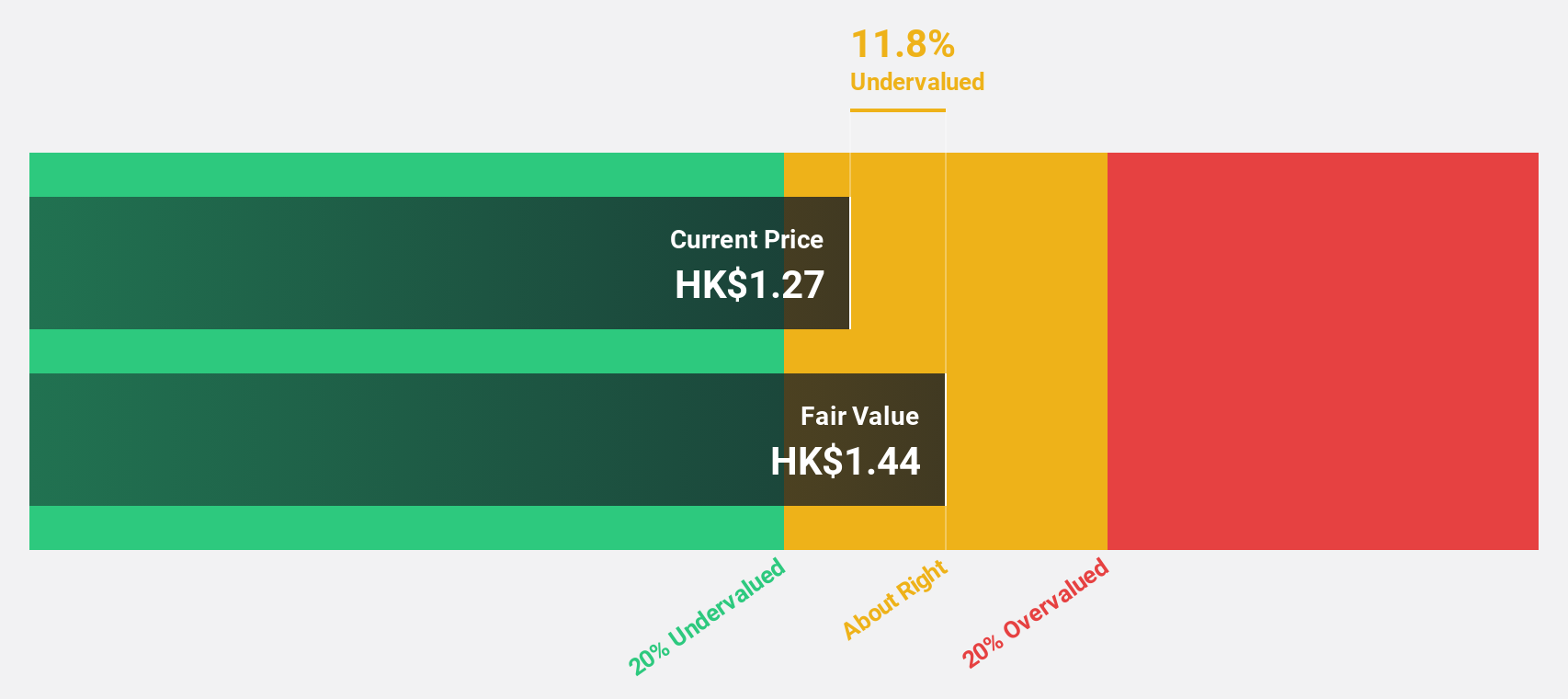

Estimated Discount To Fair Value: 31.1%

Damai Entertainment Holdings, formerly Alibaba Pictures Group, is trading at HK$0.99, significantly below its estimated fair value of HK$1.44, highlighting its undervaluation based on cash flows. Despite recent insider selling and volatility in share price, the company reported increased sales of CNY 6.7 billion and net income growth to CNY 363.58 million for the fiscal year ending March 2025. Earnings are forecasted to grow substantially at over 40% annually, outpacing market averages in Hong Kong.

- The growth report we've compiled suggests that Damai Entertainment Holdings' future prospects could be on the up.

- Take a closer look at Damai Entertainment Holdings' balance sheet health here in our report.

Guming Holdings (SEHK:1364)

Overview: Guming Holdings Limited is an investment holding company that operates as a freshly made beverage company in the People's Republic of China, with a market cap of HK$67.30 billion.

Operations: The company generates revenue from its non-alcoholic beverages segment, amounting to CN¥8.79 billion.

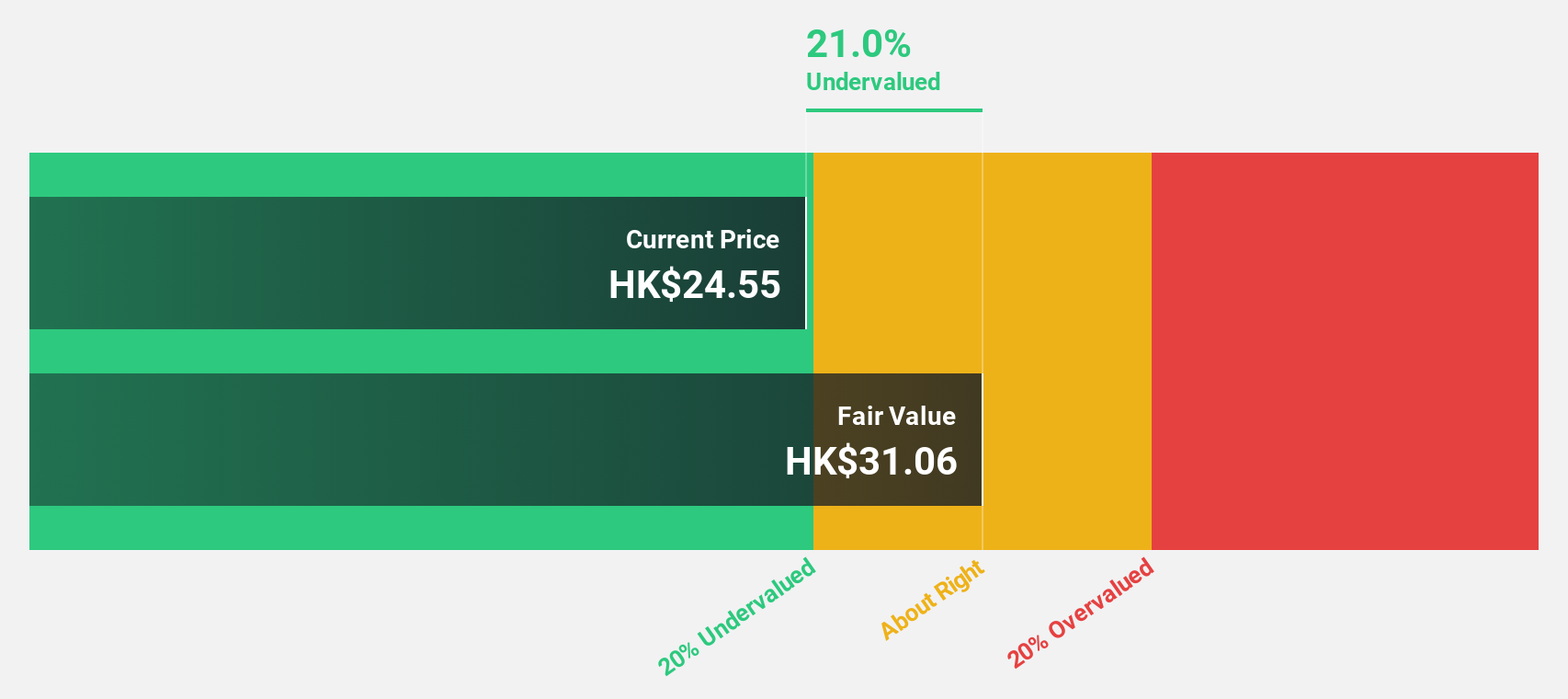

Estimated Discount To Fair Value: 23.6%

Guming Holdings is trading at HK$28.3, below its estimated fair value of HK$37.04, indicating substantial undervaluation based on cash flows. The company was recently added to the S&P Global BMI Index and forecasts suggest earnings will grow significantly at 20.8% annually, surpassing the Hong Kong market average of 10.4%. Despite high non-cash earnings, Guming's revenue growth rate of 17.8% per year remains slower than desired benchmarks but still exceeds market averages.

- Our expertly prepared growth report on Guming Holdings implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Guming Holdings' balance sheet by reading our health report here.

Shenzhen Transsion Holdings (SHSE:688036)

Overview: Shenzhen Transsion Holdings Co., Ltd. manufactures and sells smart devices primarily in Africa and internationally, with a market cap of CN¥88.22 billion.

Operations: Shenzhen Transsion Holdings Co., Ltd. generates revenue through the manufacturing and sale of smart devices across African markets and globally.

Estimated Discount To Fair Value: 30.6%

Shenzhen Transsion Holdings, trading at CN¥77.36, is currently valued below its fair value of CN¥111.43, highlighting significant undervaluation based on cash flows. Despite recent removal from the Shanghai Stock Exchange 180 Value Index and a decline in quarterly earnings to CN¥490.09 million from CN¥1,626.47 million year-on-year, revenue growth is forecasted at 13.2% annually, outpacing the Chinese market average of 12.4%. However, its dividend yield of 3.88% lacks adequate coverage by free cash flows.

- Insights from our recent growth report point to a promising forecast for Shenzhen Transsion Holdings' business outlook.

- Navigate through the intricacies of Shenzhen Transsion Holdings with our comprehensive financial health report here.

Next Steps

- Explore the 277 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1060

Damai Entertainment Holdings

An investment holding company, operates in the content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives