- South Korea

- /

- Machinery

- /

- KOSE:A010620

Asian Stocks Trading Below Estimated Value In August 2025

Reviewed by Simply Wall St

As global markets experience shifts driven by inflation data and rate cut speculations, Asian indices have shown resilience, with Japan's stock markets reaching record highs and Chinese stocks advancing amid renewed tariff pauses. In such a fluctuating environment, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on discrepancies between market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥157.16 | CN¥311.16 | 49.5% |

| Nan Juen International (TPEX:6584) | NT$228.00 | NT$453.12 | 49.7% |

| Matsuya R&DLtd (TSE:7317) | ¥717.00 | ¥1427.08 | 49.8% |

| Lotes (TWSE:3533) | NT$1345.00 | NT$2677.95 | 49.8% |

| Kolmar Korea (KOSE:A161890) | ₩79500.00 | ₩155064.18 | 48.7% |

| King Yuan Electronics (TWSE:2449) | NT$141.00 | NT$279.98 | 49.6% |

| Kadokawa (TSE:9468) | ¥3679.00 | ¥7271.24 | 49.4% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$10.19 | HK$20.22 | 49.6% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.81 | NZ$1.60 | 49.3% |

| GCH Technology (SHSE:688625) | CN¥34.60 | CN¥68.17 | 49.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hd Hyundai MipoLtd (KOSE:A010620)

Overview: Hd Hyundai Mipo Co., Ltd. is a South Korean company that specializes in the manufacturing, repair, and remodeling of ships, with a market cap of ₩7.79 trillion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated ₩5.79 billion, after accounting for a connection adjustment of -₩980.25 million.

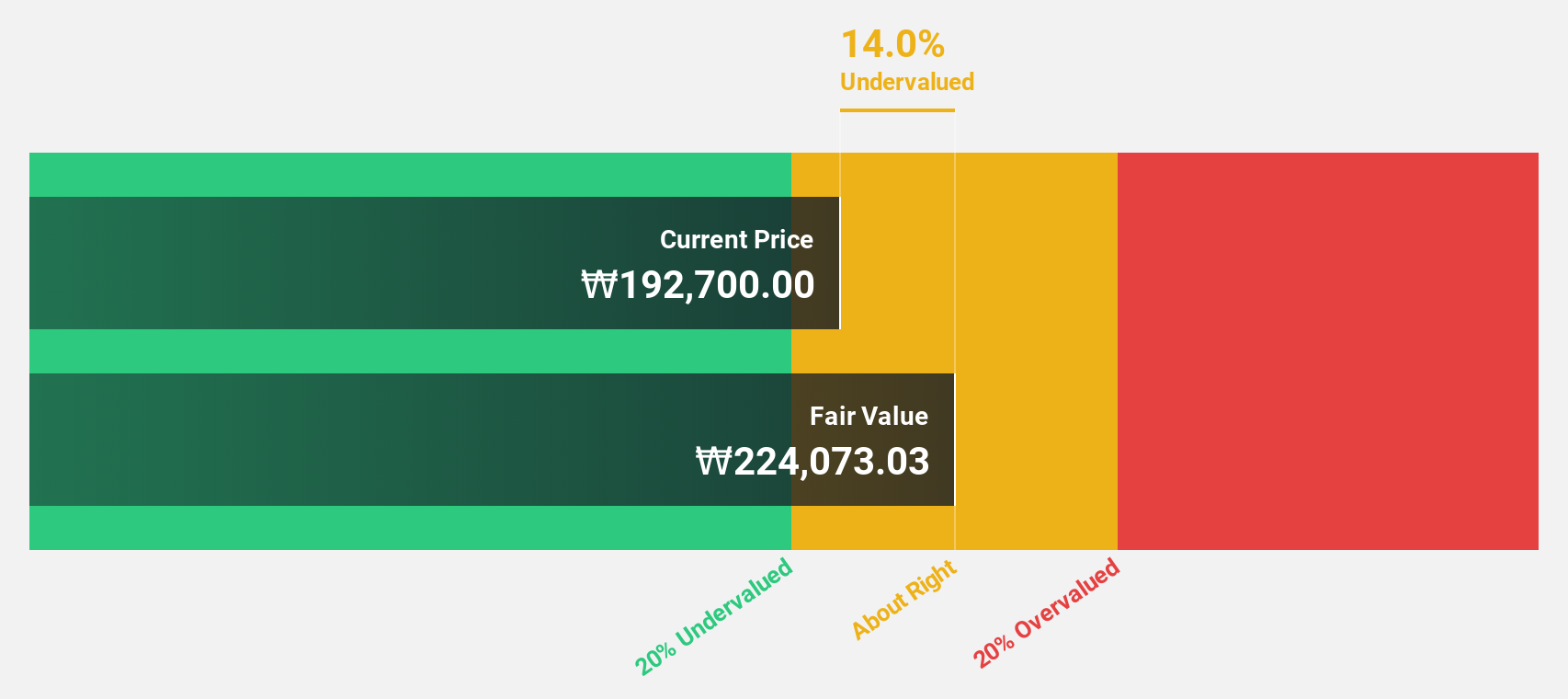

Estimated Discount To Fair Value: 29.4%

Hd Hyundai Mipo Ltd. appears undervalued based on cash flows, trading at ₩195,200—29.4% below its estimated fair value of ₩276,347.9. Recent earnings reveal a significant annual profit growth forecast of 42.5%, surpassing the Korean market's 22.5%. Although revenue growth is slower than 20% per year, it still exceeds the market average of 7.2%. The company recently became profitable and announced a cash dividend of ₩480 in June 2025.

- In light of our recent growth report, it seems possible that Hd Hyundai MipoLtd's financial performance will exceed current levels.

- Click here to discover the nuances of Hd Hyundai MipoLtd with our detailed financial health report.

MicroPort CardioFlow Medtech (SEHK:2160)

Overview: MicroPort CardioFlow Medtech Corporation is a medical device company that focuses on the research, development, and commercialization of transcatheter and surgical solutions for structural heart diseases in China and internationally, with a market cap of HK$3.91 billion.

Operations: The company's revenue is primarily derived from its Surgical & Medical Devices segment, which generated CN¥361.57 million.

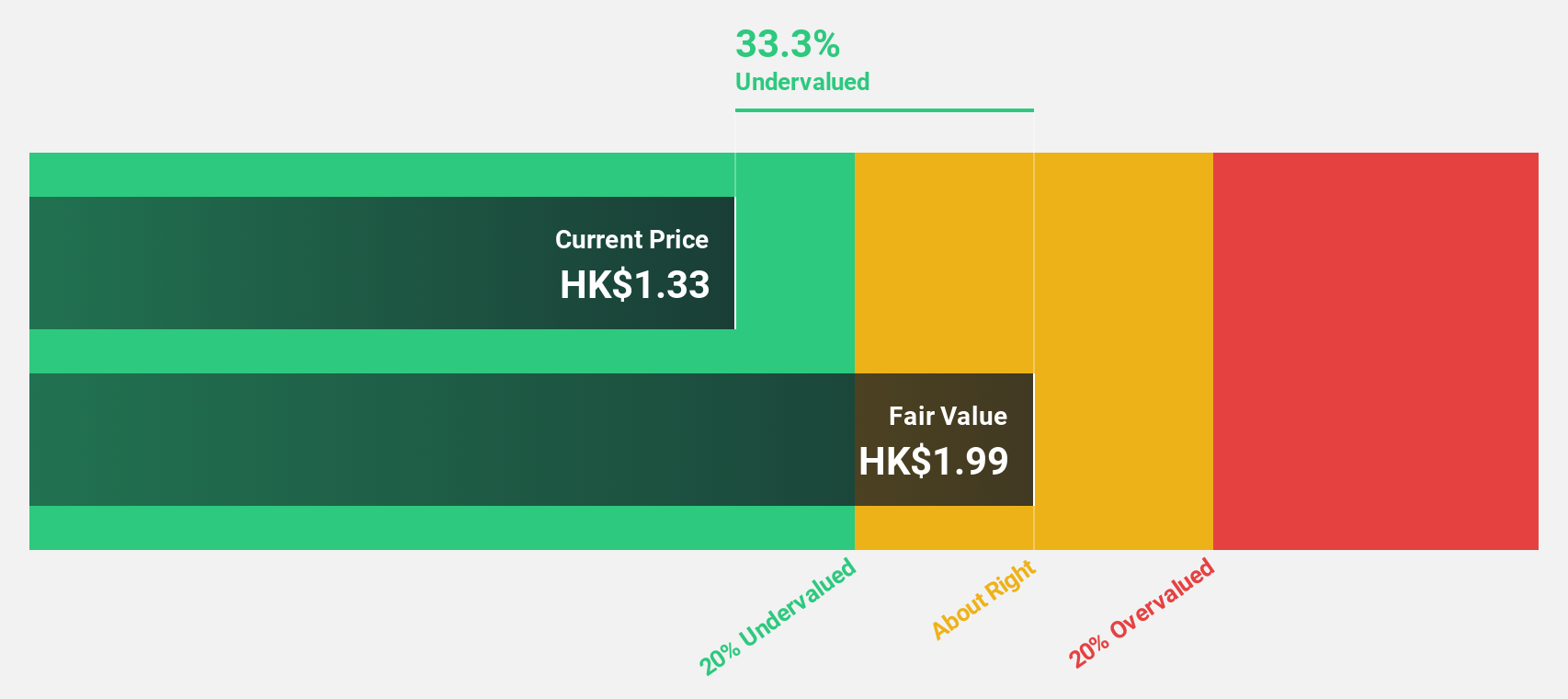

Estimated Discount To Fair Value: 19.5%

MicroPort CardioFlow Medtech is trading at HK$1.62, 19.5% below its estimated fair value of HK$2.01, indicating potential undervaluation based on cash flows. The company projects a significant reduction in net loss for the first half of 2025, driven by strong overseas sales and operational efficiency improvements. Revenue is expected to grow at 23.2% annually, outpacing the Hong Kong market's average growth rate, though profitability remains a future target within three years.

- Insights from our recent growth report point to a promising forecast for MicroPort CardioFlow Medtech's business outlook.

- Dive into the specifics of MicroPort CardioFlow Medtech here with our thorough financial health report.

Kadokawa (TSE:9468)

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market cap of approximately ¥539.15 billion.

Operations: Kadokawa's revenue segments include Publishing at ¥134.75 billion, Film and Video at ¥83.50 billion, Web Services at ¥43.25 billion, and Others at ¥10.60 billion.

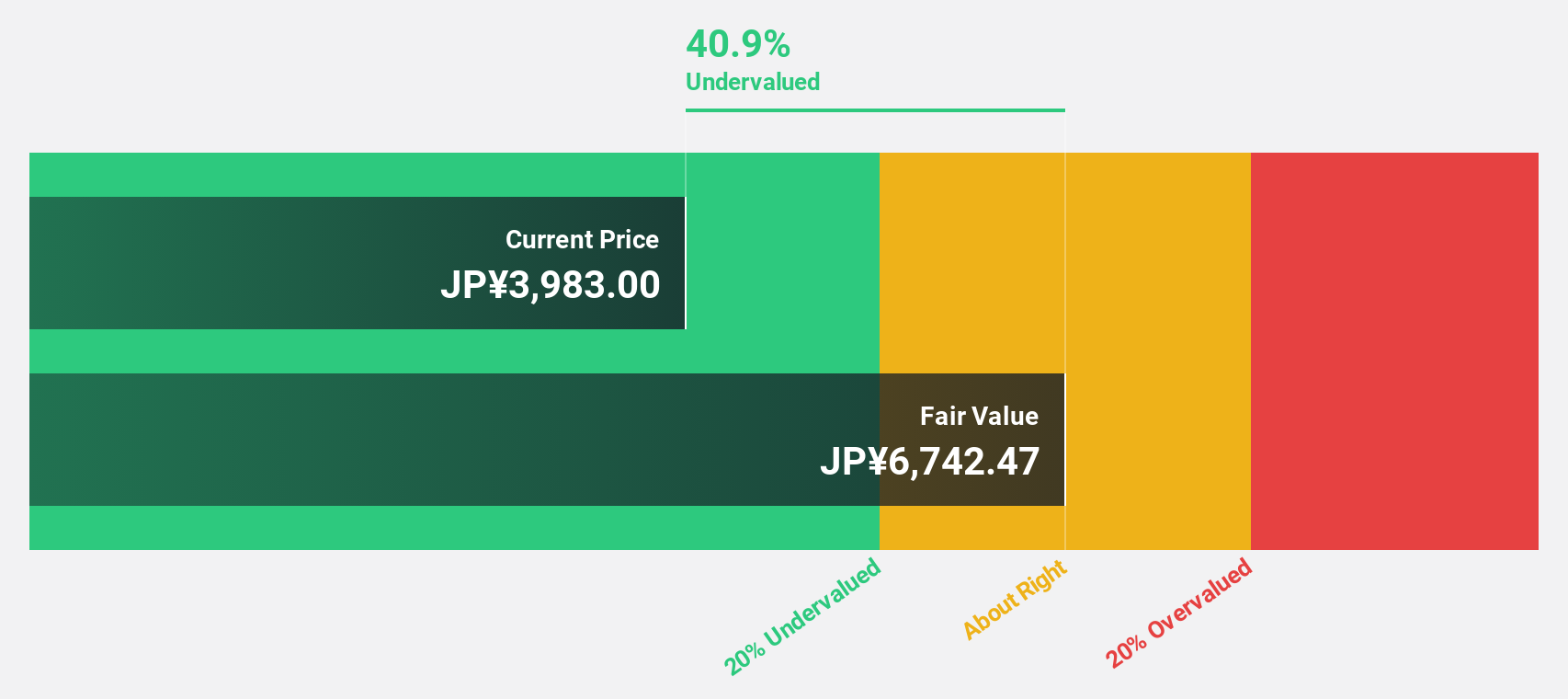

Estimated Discount To Fair Value: 49.4%

Kadokawa is trading at ¥3,679, significantly below its estimated fair value of ¥7,271.24, suggesting potential undervaluation based on cash flows. The company anticipates a robust annual earnings growth rate of 25%, surpassing the Japanese market's average. However, its return on equity forecast remains modest at 8.8%. Recent initiatives include expanding GeeXPlus Inc.'s capabilities to support creators and strategic board changes to enhance governance and oversight.

- According our earnings growth report, there's an indication that Kadokawa might be ready to expand.

- Navigate through the intricacies of Kadokawa with our comprehensive financial health report here.

Key Takeaways

- Delve into our full catalog of 267 Undervalued Asian Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hd Hyundai MipoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010620

Hd Hyundai MipoLtd

Manufactures, repairs, and remodels ships in South Korea.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives