- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3330

Asian Stocks Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets experience fluctuations, with China's stock markets advancing on hopes of government stimulus and Japan's indices facing slight declines amid trade uncertainties, the Asian market landscape presents a mixed picture for investors. In this environment, identifying stocks trading below their estimated fair value can offer potential opportunities for investors seeking to capitalize on undervaluation.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2420.00 | ¥4746.14 | 49% |

| Lucky Harvest (SZSE:002965) | CN¥41.69 | CN¥81.92 | 49.1% |

| Kanto Denka Kogyo (TSE:4047) | ¥843.00 | ¥1678.38 | 49.8% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.78 | NZ$1.56 | 49.9% |

| Good Will Instrument (TWSE:2423) | NT$44.20 | NT$87.29 | 49.4% |

| Fuji (TSE:6134) | ¥2247.50 | ¥4448.27 | 49.5% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.48 | CN¥52.37 | 49.4% |

| Dive (TSE:151A) | ¥924.00 | ¥1813.20 | 49% |

| cottaLTD (TSE:3359) | ¥436.00 | ¥859.36 | 49.3% |

| BalnibarbiLtd (TSE:3418) | ¥1162.00 | ¥2283.94 | 49.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

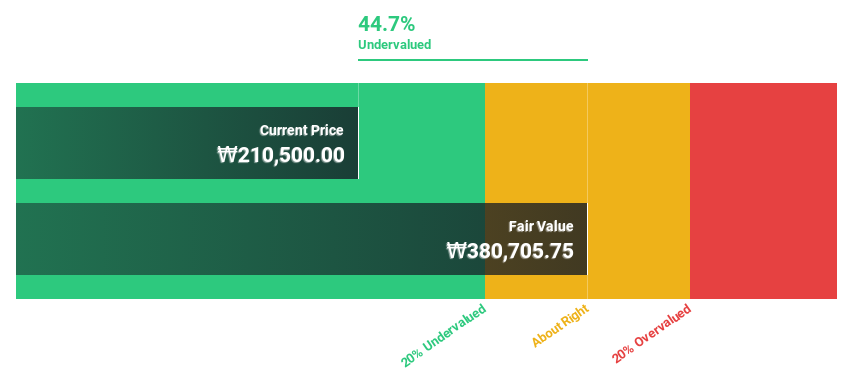

LS ELECTRIC (KOSE:A010120)

Overview: LS ELECTRIC Co., Ltd. offers smart energy solutions both in South Korea and internationally, with a market cap of ₩7.69 trillion.

Operations: The company's revenue is primarily derived from its Power Sector at ₩4.14 billion, followed by the Metal Sector at ₩654.23 million, Automation Division at ₩607.47 million, and IT Sector at ₩122.17 million.

Estimated Discount To Fair Value: 26.5%

LS ELECTRIC is trading at ₩259,000, significantly below its estimated fair value of ₩352,451.35. The company's earnings are expected to grow by 24.92% annually over the next three years, outpacing the Korean market's average growth rate of 20.7%. Although its Return on Equity is forecasted to be low at 18.4%, LS ELECTRIC's revenue growth of 10% per year surpasses the market average of 7%, highlighting solid cash flow potential amidst undervaluation concerns.

- Upon reviewing our latest growth report, LS ELECTRIC's projected financial performance appears quite optimistic.

- Take a closer look at LS ELECTRIC's balance sheet health here in our report.

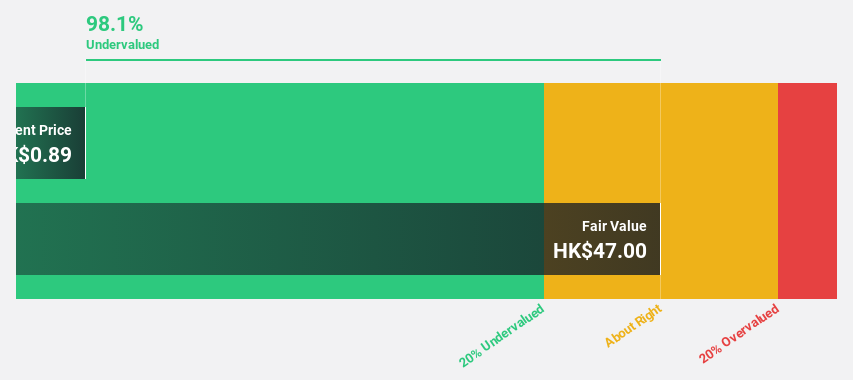

Lingbao Gold Group (SEHK:3330)

Overview: Lingbao Gold Group Company Ltd. and its subsidiaries focus on the mining, processing, smelting, refining, and sale of gold products in China with a market capitalization of approximately HK$15.96 billion.

Operations: The company's revenue is primarily derived from its smelting operations, which account for CN¥12.04 billion, followed by mining activities in the People's Republic of China at CN¥2.31 billion, with additional contributions from retailing at CN¥8.53 million and mining in the Kyrgyz Republic at CN¥257.32 million.

Estimated Discount To Fair Value: 35.6%

Lingbao Gold Group is trading at HK$12.4, significantly below its estimated fair value of HK$19.25, with earnings expected to grow by 37.8% annually over the next three years, surpassing the Hong Kong market's average growth rate of 10.4%. Despite high debt levels and recent share price volatility, Lingbao benefits from robust cash flow driven by increased gold output and improved operational efficiency amid rising gold prices, positioning it as an undervalued opportunity based on cash flows in Asia.

- The analysis detailed in our Lingbao Gold Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Lingbao Gold Group with our comprehensive financial health report here.

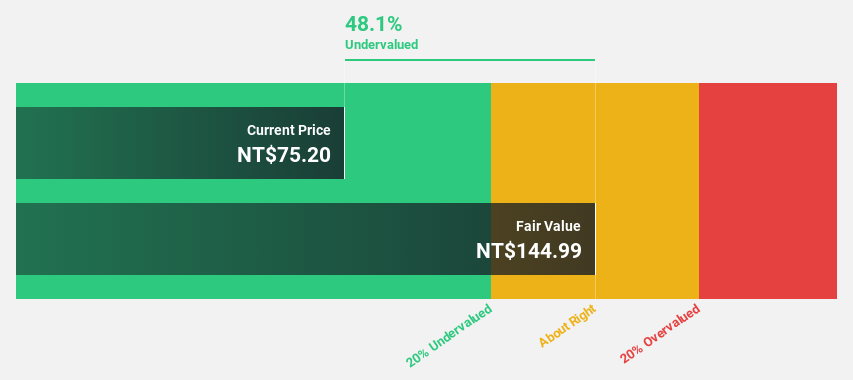

Gold Circuit Electronics (TWSE:2368)

Overview: Gold Circuit Electronics Ltd. is a Taiwan-based company specializing in the design, manufacture, processing, and distribution of printed circuit boards with a market cap of NT$131.65 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of printed circuit boards, totaling NT$41.95 billion.

Estimated Discount To Fair Value: 19.1%

Gold Circuit Electronics, trading at NT$270.5, is undervalued relative to its estimated fair value of NT$334.31. Its earnings are forecast to grow significantly at 22% annually, outpacing the Taiwan market's average growth of 13.7%. Recent Q1 results show robust sales and net income growth year-over-year, although dividend coverage by free cash flow remains inadequate. Despite high non-cash earnings and share price volatility, it presents a compelling case for undervaluation based on cash flows in Asia.

- Our growth report here indicates Gold Circuit Electronics may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Gold Circuit Electronics.

Summing It All Up

- Reveal the 300 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3330

Lingbao Gold Group

Primarily engages in mining, processing, smelting, refining, and sale of gold products in the People’s Republic of China.

Outstanding track record with high growth potential.

Market Insights

Community Narratives